Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Morning Cindy in Shanghai:

MORNING CINDY Current position (Vehicles Carrier, IMO 9633185) - VesselFinder

CSCC Europe entering the English Channel:

CSCC EUROPE Current position (Vehicles Carrier, IMO 9391593) - VesselFinder

MORNING CINDY Current position (Vehicles Carrier, IMO 9633185) - VesselFinder

CSCC Europe entering the English Channel:

CSCC EUROPE Current position (Vehicles Carrier, IMO 9391593) - VesselFinder

StarFoxisDown!

Well-Known Member

On a more happy note.

If the model Y unveiling is soon. IE the display of one.

How much advance notice ?

How much advance notice did the model 3 have ?

Is March still in the cards ?

I for one hope they announce the event the day before....in fact I hope they announce the event in after hours the day before the event. In fact, I hope they do the event early in the morning the next day too, just to make sure there's as little of notice as possible for wall st

RobStark

Well-Known Member

The CR report is from data of last year.

I promise to you if I win on loto I buying this CR mag and close it immediatly after !

How can they compile reliability data from this year?

Owners must own the car a minimum of 90 days.

Fact Checking

Well-Known Member

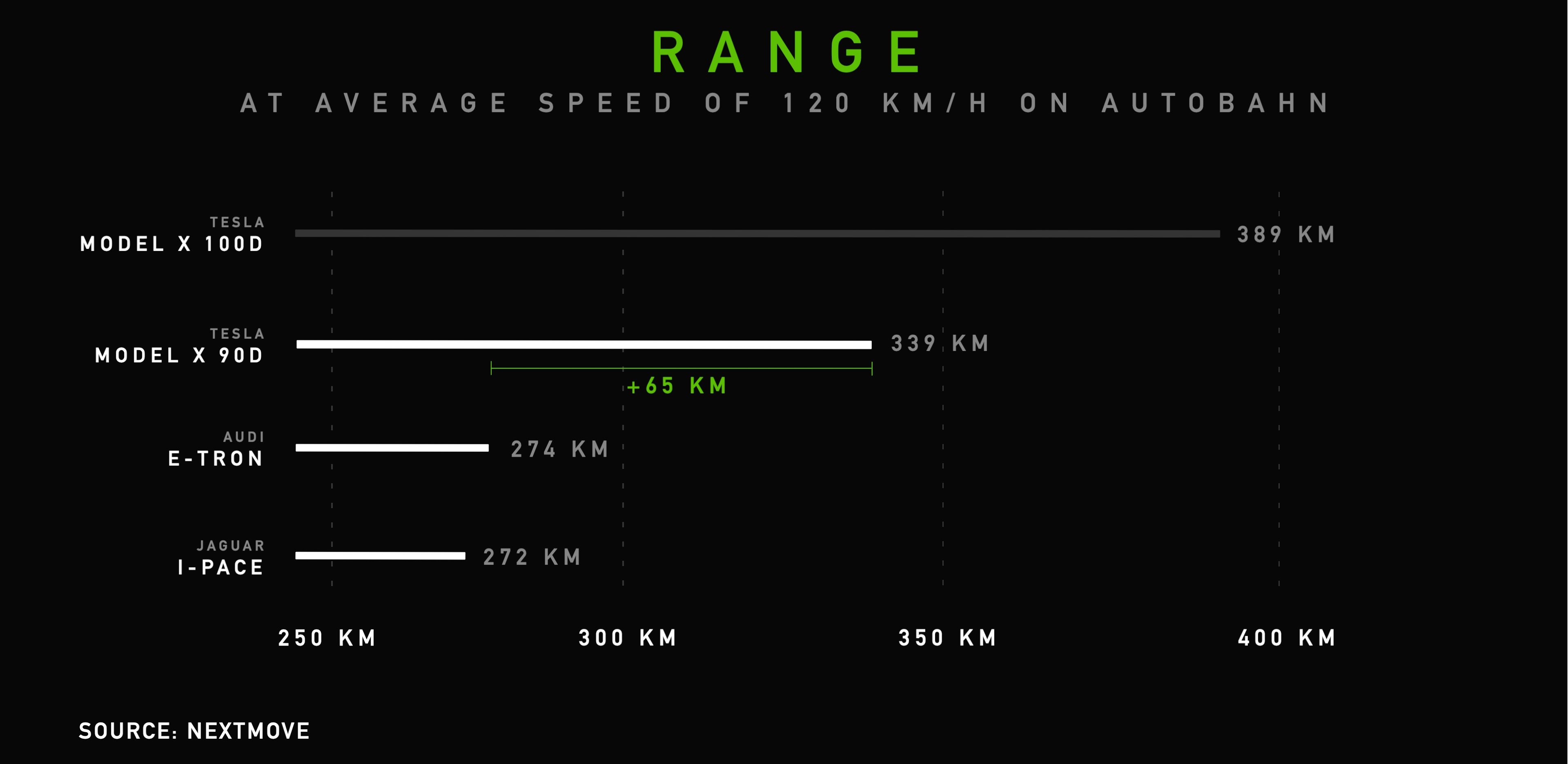

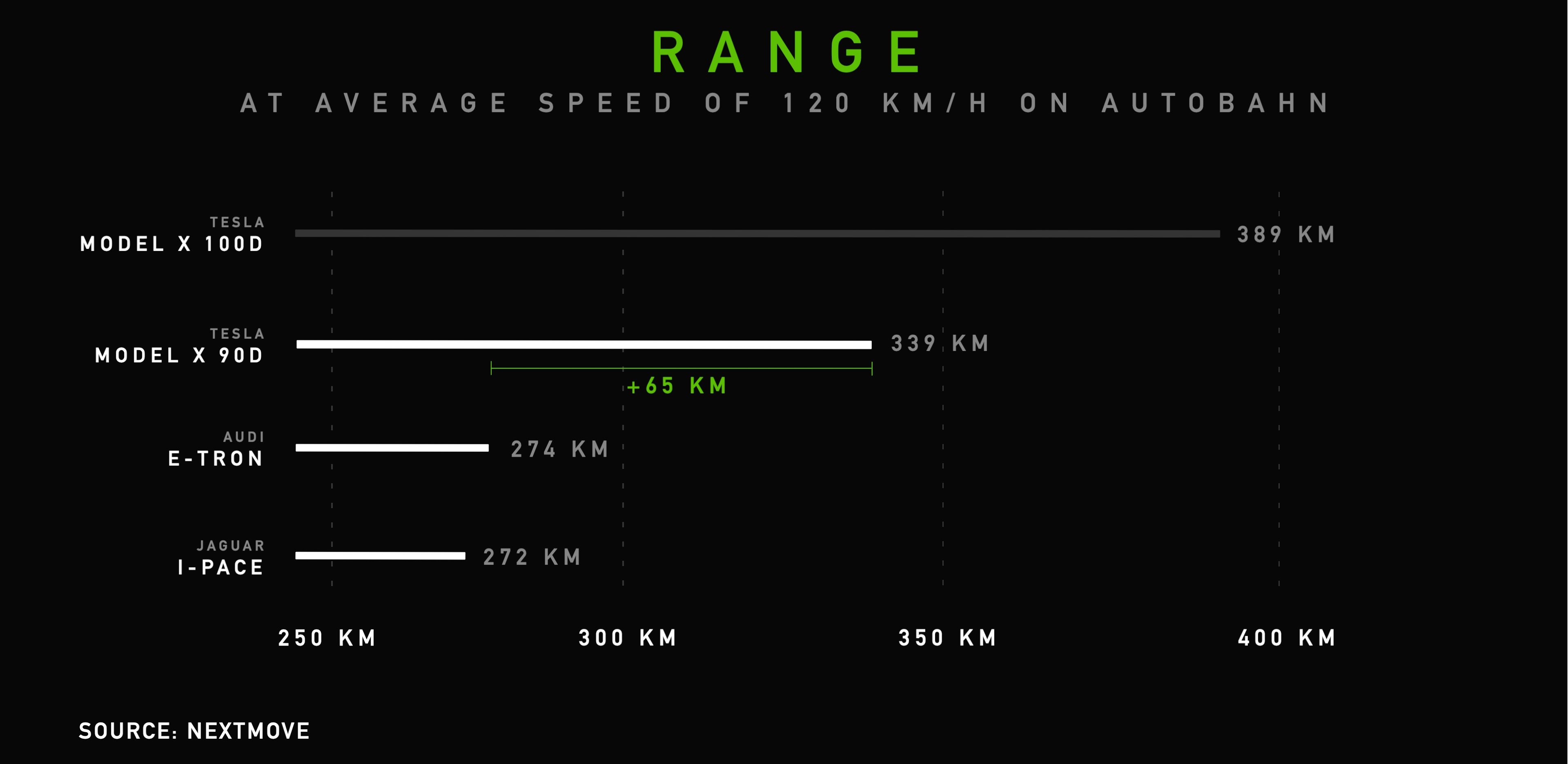

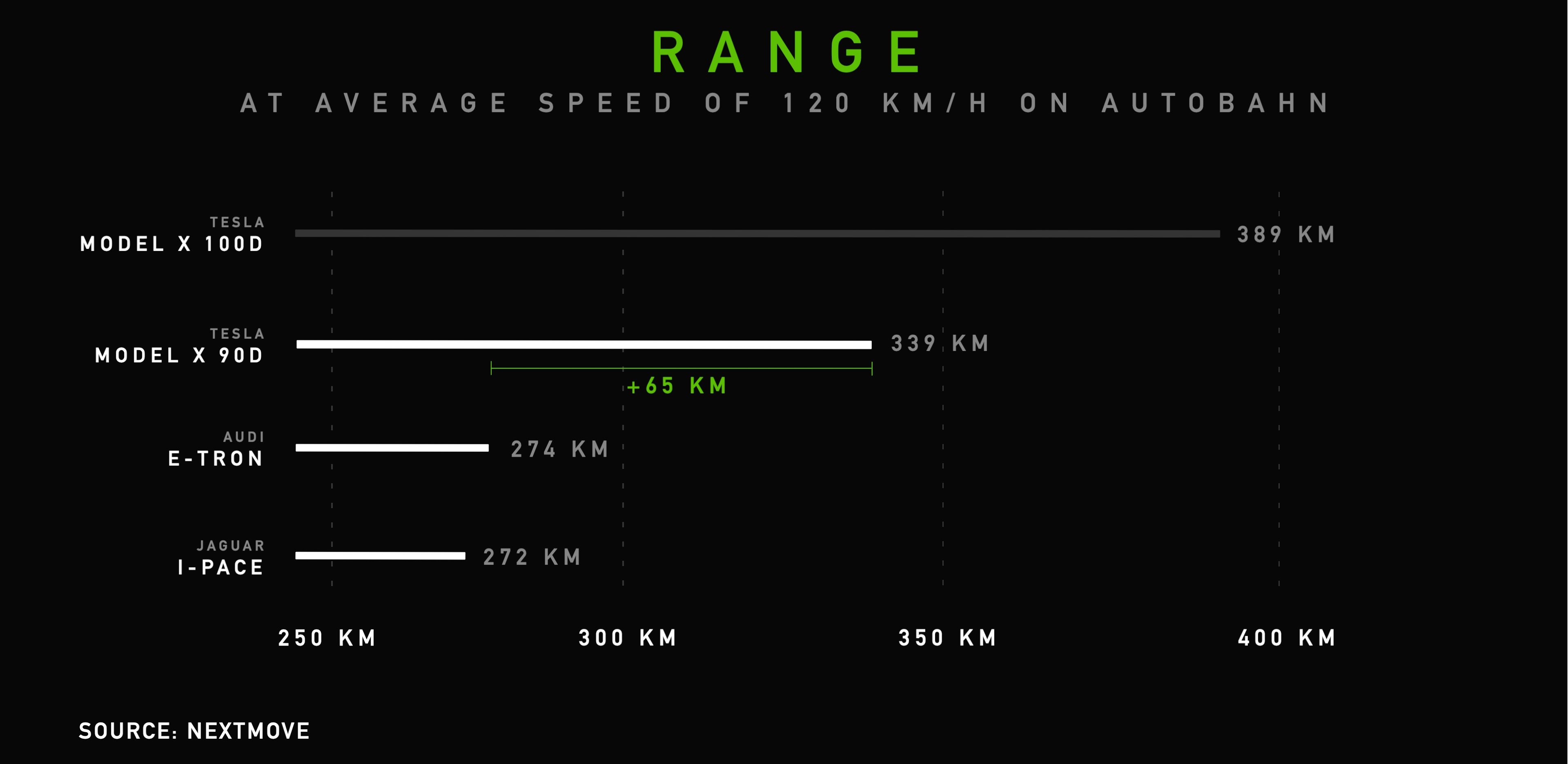

New Electrek article about Tesla's efficiency and range lead over competitors, via efficiency testing conducted by a third party:

Last edited:

They do, but it's how they get their numbers and the weight they give to each category. CR is very big on industry standards, so the closer something comes to matching the industry standard (including industry standard testing), the better it is, according to CR. What this means in practice is that they usually, but not always, recommend the lowest common denominator item, rather than the item that might be vastly superior but doesn't match the industry standard all that well or needs a bit of training to use. Note that industry standards are created by those who make the products, not an independent body.I don't want to be an apologist for CR, but they do it by their numbers. They also anonymously buy the cars in their long-term test fleet. If someone had bought 250 subscriptions so they could downgrade Tesla, why would the buyer satisfaction numbers be so high? But you just gave them the idea of how to bias the next survey.

Just saying.

Carl Raymond

Active Member

March, May, what's the difference....

April

I think it's not sensible that the quality of a new production car would get worse over time...I think that they follow their own established rules. I think that it is not sensible to say that they’re only right when they come to a conclusion that suits you.

TradingInvest

Active Member

That the Model 3 is the most loved car by CR subscribers is a simple fact.

That CR 'unrecommends' the Model 3, based on problems whose "vast majority" Tesla says are already fixed, and which car owners are the most satisfied with despite teething problems of a brand new product, is breathtakingly bad logic by CR that should be called out...

In the past 20 years, every time I bought something based on CR's recommendation, the result was terrible. The final straw was when they recommended Hoover vacuum, instead of Dyson bagless. After the weekly bag cost is considered for Hoover, and how much longer the Dyson lasts, the Dyson is actually cheaper than the Hoover, but performs better, the exhaust air is much cleaner. There is no way the CR team doesn't understand the difference. Seems to me their recommendation was influenced by outside forces. Which brand do they recommend can make a substantial financial difference for those brands.

All animals ultimately care about their own benefits, including their families. Nothing wrong about it, this is in every animals' DNA. It's the result of natural selection. Because of this reason, most people are corruptible, it all depends on the risk and how much they can get. Those who think they are not corruptible that's only because they have not been put to the test yet.

Tslynk67

Well-Known Member

the Netherlands too.

That's unclear. Looking at the Netherlands data, not many have gone there. They are delivering at maybe 30-40% of the rate of Norway.

Got a link?

Huskyf

Member

Post this on Bloomberg and CNBC siteNew Electrek article about Tesla's efficiency and range lead over competitors, via efficiency testing conducted by a third party:

TradingInvest

Active Member

In short CR's finding can be summerized as:

CR does not recommend people to buy a car that would make them most satisfied!

They are better off buying less satisfying products from the dinosaur industry...

Among all brands, Tesla has the highest number of buyers say they would do it all over again. So CR does not recommend this kind of product that people love, in stead they would recommend people to buy those brands with higher percentage of buyers who regret their purchase.

schonelucht

Well-Known Member

Got a link?

(Assuming you understand Dutch well enough given your location)

https://opendata.rdw.nl/Voertuigen/Open-Data-RDW-Gekentekende_voertuigen/m9d7-ebf2

It updates every day.

My bull thesis is Tesla’s brand value should already be up there in top 5, which means the brand alone worth much more than current market cap.If you have 30 seconds, the below Twitter post gives a fascinating view of the top 15 global brands from 2000-2019. Hoping to see a 2020-2030 version that sees Tesla somewhere on here.

Jack Kosakowski on Twitter

Only need some time for it to be recognized, shouldn’t be too long.

myt-e-s-l-a

Member

I know this thread is hard to keep up with...but really? This has been the discussion for the past 3 pages...

Yep, I cant keep up!, even though many have speculated that it was a nonevent.

A Nothingburger

shrspeedblade

Rideshare Monkey

Wow, now Lora Kolodny releasing a hit piece on CNBC a few minutes ago about problems with returns and refunds!

On the attack today....

Just added 3 to my Roth IRA at 291.25

On the attack today....

Just added 3 to my Roth IRA at 291.25

myt-e-s-l-a

Member

You will do better closing the PUT and buying the stock.Not to worry... Just roll them forward and get a net credit in the process.

Just before the major downturn in January with the stock at about $350, I sold the weekly $340 Put for a $2.28 premium. Clearly a mistake in hindsight.

Since then I have rolled it five times and reduced my break-even point to a share price of $325 (expiring March 15). I'll keep this up until I get healthy.

Tslynk67

Well-Known Member

anthonyj

Stonks

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M