Head over to the Iceland Meetup thread (https://teslamotorsclub.com/tmc/threads/tmc-iceland-meetup-2020.181724/page-9-) Karen posts there, maybe better quality than here?

Looks like even the whole Karen thread has been removed

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Head over to the Iceland Meetup thread (https://teslamotorsclub.com/tmc/threads/tmc-iceland-meetup-2020.181724/page-9-) Karen posts there, maybe better quality than here?

Here's next week's chart, but it will change a lot between now and then - although I expect $1000 calls to go up.

View attachment 547689

YTD chart, $TSLA versus $NASDAQ - I don't think we missed out much, quite the opposite...

View attachment 547688

Looks like even the whole Karen thread has been removed

Eh?? The Iceland thread is there, did you mean another one?

When I'm comparing Nasdaq and Tesla's chart, I'm mostly doing it from Q1 Earnings date. And the reason for that is because I still think Q1 earnings were flat out amazing and Tesla deserved a much higher valuation after those earnings. The margins were spectacular and while some people will say it was because of credits, my response would be "And?". Q1 earnings showed us how much credits will helps margins going forward and not only will they stay consistent(with the exception of Q2 because of obvious reasons), they'll actually increase next year and then again the year after that. When Tesla replicates those margins(or slightly higher) in Q3 and Q4 with Q3 and Q4 production rates, Tesla's going to crush earnings in the 2nd half the year. I would think big money would see that.

But yes, if you look at the YTD charts, there's not much to complain about. My complaining is simply because of how great I thought Q1 was.

Is it safe to say that the market has pretty much completed a V-shaped recovery already?

Amazing that we’re at pre-coronavirus levels already. I understand markets are forward looking, but main street isn’t really the same as before.

ETA: Not that I believe the markets ever cared about main street.

I don’t know the post, but I actually recall stealth posting about calls. I missed chasing some cheap calls earlier this year myself. No Nostradamus hereWait so you are saying when I wrote that post a year ago, you were sure that Tsla would be 800 a year later when historically in the past years there were not only signs of cycling of sp, but Tesla just broke down 180 3 months prior? Did you mortgage out your house last year and bet everything because I want the crystal ball you had.

I remember even the bulls who were on the forum for years, and even our mods panic sold when Tesla tanked after reaching 900 just a few months ago. So let's not rewrite history as if people here were full of conviction.

People bought calls because the premiums were dirt cheap because Tesla was such a bear.

Anecdote from my BIL who had a run-of-the-mill Ford F-150 that just came off a 2 year lease in mid-April during the COVID-19 peak: The local dealership was pensive about making any sort of commitment during the turn-in and they were still trying to figure out how to WFH, seemed scared, and clueless. Since my BIL has a second car and neither he or his wife and family are driving anywhere for the foreseeable future, he figured he'd wait until the dealerships started getting desperate to get a new (or 2019) F-150 since he could easily get by for the next few months without it.Barron's - 10 minutes ago: Car Stocks Are Higher Because Sales Were Only Kind of Dreadful. Here’s How Far They Can Run.

Excerpts:

U.S. light-vehicle sales came in better than feared for May -- news that lifted car stocks on Wednesday and raised the prospect of more gains as investors focus on the rate of change...

...Traditional auto makers including Ford Motor (ticker: F) and General Motors (GM) were up almost 5% on Wednesday, on average...

...The sector remains down about 20% year to date, worse than the comparable drops of the Dow Jones Industrial Average and S&P 500 over the same span. The Russell 3000 Auto & Auto Parts Index is actually up 9% year to date, but that is because of Tesla (TSLA)...

USA markets maybe, EU markets not at all. My European stocks are still around 20% from pre Corona levels (february).

The above does not make a lot of sense to me given the fact that the US are not handling covid better than most of EU.

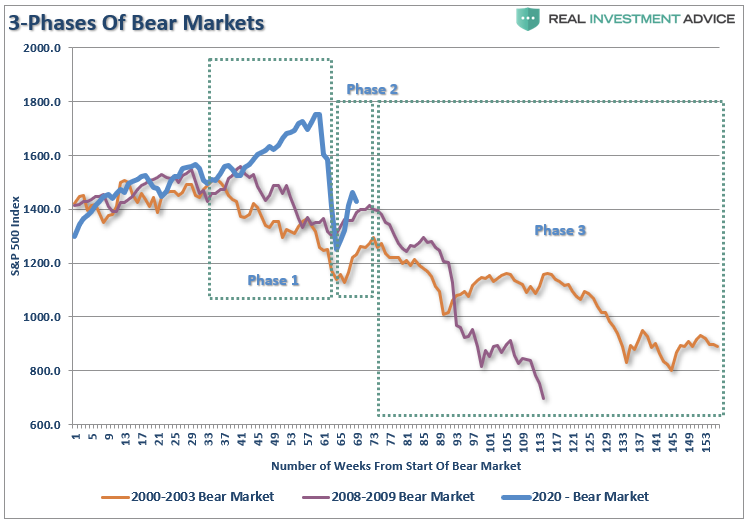

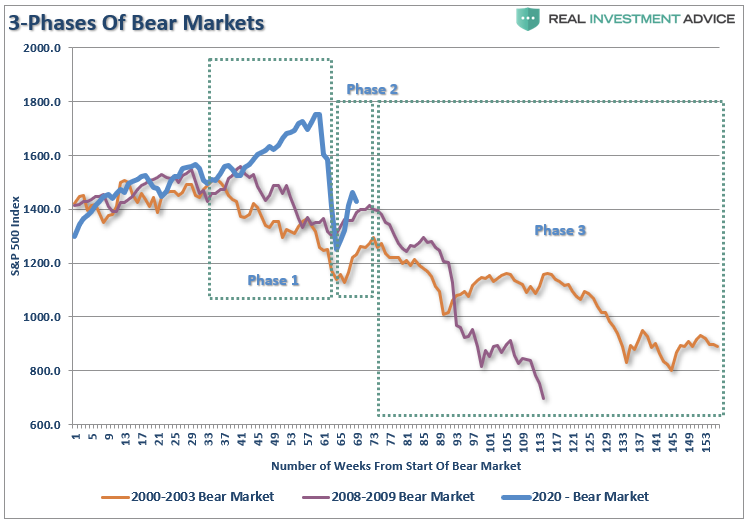

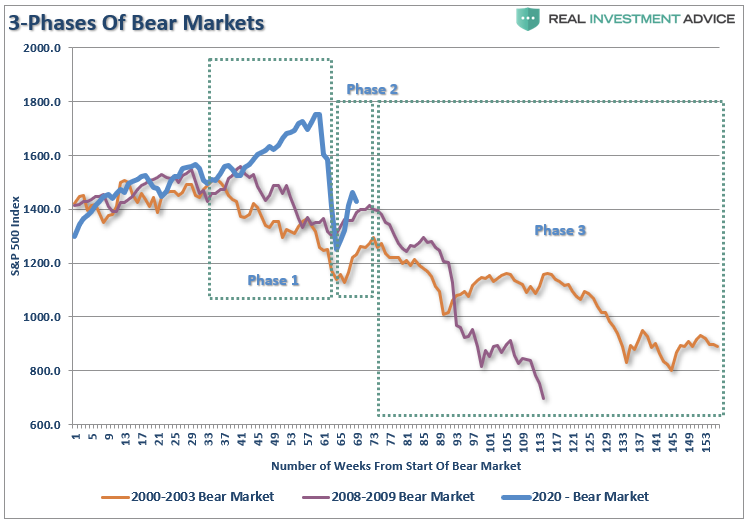

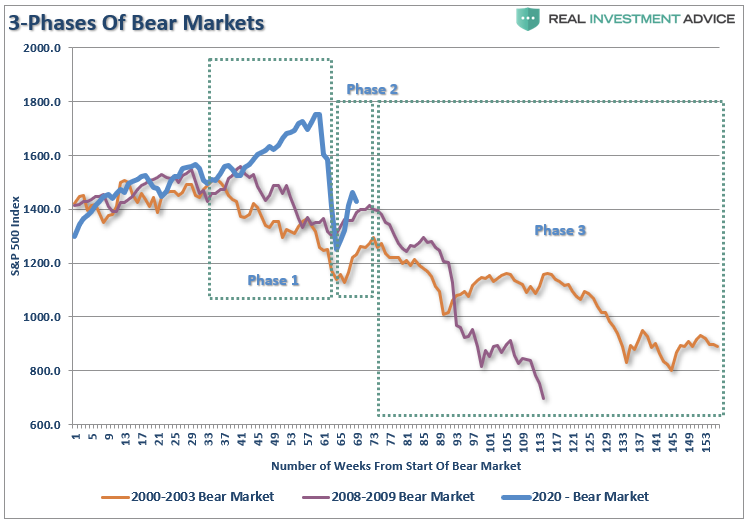

If that's true, this must be true as well.Cant help but think we are in phase 2 of the diagram below ... bear market rally ... I am still long and strong TSLA but i think there is Macro pain ahead .

I think we might see some TSLA buying opportunities in the months ahead ... falling tide impacts all boats... i am prepping for this selling some weak long term positions

Guns and pickup trucks are selling quite well in rural America right now. Very limited supply, so yeah.....it's gonna be 2 months til they have excess pickups.Anecdote from my BIL who had a run-of-the-mill Ford F-150 that just came off a 2 year lease in mid-April during the COVID-19 peak: The local dealership was pensive about making any sort of commitment during the turn-in and they were still trying to figure out how to WFH, seemed scared, and clueless. Since my BIL has a second car and neither he or his wife and family are driving anywhere for the foreseeable future, he figured he'd wait until the dealerships started getting desperate to get a new (or 2019) F-150 since he could easily get by for the next few months without it.

He said there has been a complete reversal over the last ~2 weeks with the various Ford dealerships. Now they won't even return his call or email, they're totally unwilling to budge or deal or negotiate - "The price is what it is. We can do 0% financing for 7 years, but it'll be at full MSRP. We barely have enough in-stock as it is, so this is our best offer." Since he's got nothing to lose, he called their bluff, and so far, they're sticking to it and have not engaged him for over a week.

We talked about it a bit and can't totally make sense of it, but there are articles that indicate the traditional auto dealers (or at least pickup trucks) are actually doing pretty good right now. It may have been the case that production dipped in concert with demand and both are on a rebound right now, with demand briefly outstripping supply, causing dealers to DGAF right now.

How this pertains to Tesla?

I think this is yet another check-mark in the "incredibly bullish" column. I realize light/medium-duty trucks are not cross-shopped with S/3/X/Y, but I think this bodes extremely well for the remainder of the year.

Cant help but think we are in phase 2 of the diagram below ... bear market rally ... I am still long and strong TSLA but i think there is Macro pain ahead .

I think we might see some TSLA buying opportunities in the months ahead ... falling tide impacts all boats... i am prepping for this selling some weak long term positions

So why growth in 30%-40% range now and not 50% or more? It looks like Tesla has been throttling capex to get to positive FCF. See Q1 2020 investor letter. Why?Oh the path over the next 5 years for at least 30-40% annual growth is very clear. 30-40% growth would give Tesla a very high P/E. I think over the next 12 months, the growth is going to be 100% on a quarterly run rate. From Q2 2021 to Q2 2022, I could see the growth rate still being 60-70% based on what we know of the roadmap for Tesla's production. After that, it becomes more unclear because of many variables, all to the upside. So I think baseline 30-40% growth in Year 3, 4, and 5. The not so visible part are things like Tesla Energy growth and FSD/Robotaxi. Those have the potential to take Year 3,4, and 5 growth from 30-40% to anywhere from 50% to 100%.

Cant help but think we are in phase 2 of the diagram below ... bear market rally ... I am still long and strong TSLA but i think there is Macro pain ahead .

I think we might see some TSLA buying opportunities in the months ahead ... falling tide impacts all boats... i am prepping for this selling some weak long term positions