Artful Dodger

"Neko no me"

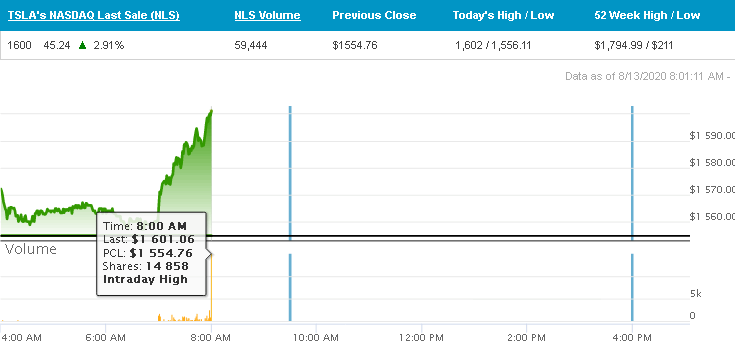

08:00 a.m. Whistle: Thu, 13 Aug 2020

Comment: "Pre-Market Volume is High"

Cheers!

- TSLA share price: $1,600.99 +46.23 +2.97%

- NASDAQ Pre-market Volume: 235,005

- NASDAQ-100 Futures: +26.00 +0.25% 08:08:54 ET

Comment: "Pre-Market Volume is High"

Cheers!