Possible government shutdown perhaps.Anybody know why macros are red, even though the vaccine news sounds great? Sell the news?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

mickificki

Member

Anybody know why macros are red, even though the vaccine news sounds great? Sell the news?

in the wsj they mention a disruptive brexit, things not looking well for a clean break between the uk and the EU.

mickificki

Member

Interesting observation by Fact checking:

https://twitter.com/truth_tesla/status/1337147645635272707?s=21

https://twitter.com/truth_tesla/status/1337147645635272707?s=21

I have a different question. Why do we see new ATH in all markets all the time when most of Europe and the US is in the middle of a severe pandemic?Anybody know why macros are red, even though the vaccine news sounds great? Sell the news?

Besides, macros have recovered quite a bit in the last hours

Krugerrand

Meow

Anybody know why macros are red, even though the vaccine news sounds great? Sell the news?

Unresolved stimulus package. AirBnB IPO value greater than Hilton and Marriott combined. Sanofi and GSK delay their vaccines.

Krugerrand

Meow

in the wsj they mention a disruptive brexit, things not looking well for a clean break between the uk and the EU.

But wasn’t it reported like 2 days ago that everything was worked out and resolved for the separation? I literally just read that.

Tslynk67

Well-Known Member

So, down a couple of % most of the morning, but pre-market volume is really, REALLY low... so no indication of the day's direction whatsoever IMO

UkNorthampton

TSLA - 12+ startups in 1

in the wsj they mention a disruptive brexit, things not looking well for a clean break between the uk and the EU.

Implications to Tesla after 1 Jan 2021: Import taxes to UK from EU, USA, China similar. Berlin does not have an advantage without a deal.

Now - UK ports problems (Felixstowe-containers, not Tesla, Southampton-TESLA & others I can't remember). Felixstowe also affected by bad IT system, PPE (Personal Protective Equipment) that may not meet spec dumped in port storage.

EU ports also affected as more containers offloaded in EU (Zeebrugge etc), can't send to UK ports in timely fashion.

It's possible that some Right-hand Drive (RHD) Teslas can't get to UK this month. Some Tesla ships delayed to UK/EU & some seem to be stationary near Azores.

UK is a big Tesla market, RHD cars can't easily be shifted to other RHD markets as no big ones nearby (Eire/NI are tiny). We might find delivery <> production & days from prod to delivery go up from 14 days. Overall, not a big problem & most can be landed elsewhere & trucked in but does add cost & delay.

edit: typos & noting first Disagree to @Kruggerand - just regarding deal was ok. It's not, it might be soon, but it's still going to cause chaos, even in a best scenario

edit2: link to Floaty McTeslaFace - 2020 Shipping Movements

Last edited:

mickificki

Member

But wasn’t it reported like 2 days ago that everything was worked out and resolved for the separation? I literally just read that.

“We’ve been thinking for a long time that these comments are a negotiating tactic and that it is important for both sides to get a deal,” said Seema Shah, chief strategist at Principal Global Advisors. “But we’ve seen concerns starting to creep in this week that if the gap is too wide between the two sides then maybe it can’t be breached.”

The U.K.’s current commercial and trading ties with the EU expire on Jan 1. Intensive talks are meant to take place this weekend. If a deal can’t be struck, both sides are preparing for significant border disrup-tion affecting trade worth close to $900 billion a year. A hard split between the U.K. and EU could pile on pain to a global economy that has already been reeling this year under the stress of Covid-19.

While negotiations would likely go down to the wire, investors are largely betting on a last-minute compromise, said Altaf Kassam, head of investment strategy at State Street Global Advisors in Europe.“

U.S. Stock Futures Fall Amid Talk of Disruptive Brexit

Not really. A while ago I did sell 900 shares at $500+ to finance a remodeling project next year. When the price went well below $400, I bought 100 shares on the idea that I would sell them when the price reached $650. The other day I sold them at $650. Basically, made a plan and executed it. Now if I had a time machine, I could have gone back and held all 900 till $650, but there was no guarantee that the price would rise to that level by the time I needed the funds, so the risk was that I would have had to sell the shares at low prices. Of course, all my other shares are intact.So yesterday was a psychology experiment. Ask yourself: did you get duped by the big boys and end up losing any of your net position in TSLA yesterday or today? I wouldn't blame you if you did. It's hard, isn't it? This is why the house usually wins.

Interesting observation by Fact checking:

https://twitter.com/truth_tesla/status/1337147645635272707?s=21

If FactChecking had a GoFundMe page....

One of the few people that guided me through the FUD past several years everytime I felt the itch to press the sell-button on my Tesla shares...

Todd Burch

14-Year Member

What I'm seeing in premarket is a steady climb, followed by a "bop" down, followed by a steady climb, rinse and repeat. That screams of an attempt to manipulate on low volume.

I have a different question. Why do we see new ATH in all markets all the time when most of Europe and the US is in the middle of a severe pandemic?

Besides, macros have recovered quite a bit in the last hours

Interesting questions. When the pandemic happens, the market could be said to have priced in a huge black swan event which removes risk and the market floats higher from the lows. It is rare when the markets get to see and price in such a huge global black swan event.

When the vaccine comes into play, well it is back to normal in a sense and the market seems high and has to price in the uncertainty of the recovery from a black swan event of this magnitude. Lots of uncertainty and moving bets to digest over the next 6 months.

Then there is the S&P inclusion and I have to wonder if there is not downward pressure. Selling and buying are likely to be less traumatic in a lower market (perhaps as a percentage). It seems to me fluidity and instability foster liquidity increases and that will play out favorably for the inclusion. Remember the market is also digesting the evaporation of a stable carbon fuels segment as well as digital currencies and some non-trivial degree of political mischief.

https://twitter.com/Erdayastronaut/status/1337402741723901953

Tesla motors were spotted on Starship. How cool is that!

Tesla motors were spotted on Starship. How cool is that!

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

Interesting observation by Fact checking:

https://twitter.com/truth_tesla/status/1337147645635272707?s=21

So basically the market gulped up $5 billion worth of new shares in two days and the stock took an almost 1% dilution without much more than a flinch. That's good stuff.

Artful Dodger

"Neko no me"

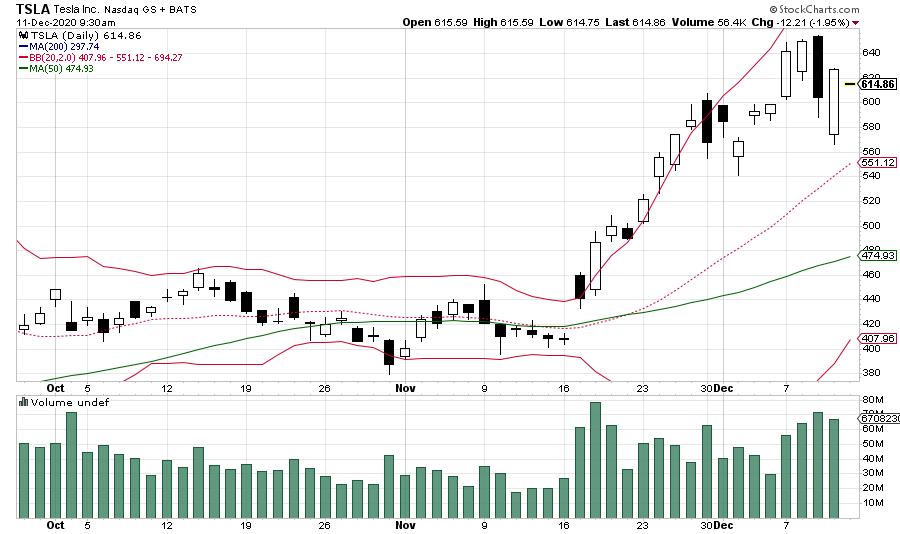

Here is today's TSLA Tech chart as of 09:30 EST:

(Note: Upper-BB at Market Opening was $694.27)

Cheers!

(Note: Upper-BB at Market Opening was $694.27)

Cheers!

bkp_duke

Well-Known Member

Shook the cushions on the "infamous" sofa. Only managed 1 share today at 617.47.

Todd Burch

14-Year Member

Yep. This MMD gonna fail. The attempt to make TSLA look like it's gonna crash is getting old. We're onto the games, guys. Just give it up. Y'can't fool me!

I seem to recall some speculation about SpaceX buying parts from Tesla. I guess this is a confirmation.https://twitter.com/Erdayastronaut/status/1337402741723901953

Tesla motors were spotted on Starship. How cool is that!

Sorry, but your calendar has crashed. It seems to have recovered since. Today is FRI Dec 11.TSLA mkt cap will depend upon the number of shares that Tesla issue on Monday for the $5B cap raise.

If we just take the VWAP for Dec 8/9 of $628.04 then the $5B cap raise would result in approx. 7.961M shares being issued on Mon, Dec 11.

So, if SP stays at today's Closing price, then TSLA's Mkt Cap goes up by $5 Billion on Monday.

Cheers!

P.S. Estimated total shares of TSLA would be 947,900,733 + 7,961,297 = 955,862,030 shares.

P.P.S. Bet that Yahoo Finance doesn't update TSLA's mkt cap until after the 10-K comes out? Even so, S&P DJI is SUPPOSED to change the no. of shares and IWF due to corporate events during the rebalaning 'freeze' period, so we'll see if we get a sniff from them.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M