Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

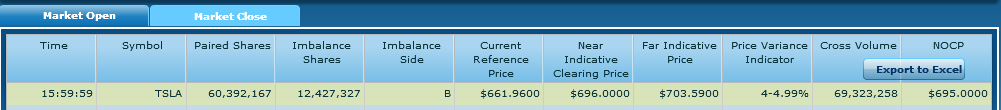

So is TSLA in the S&P based on $658.34 or $665 or $695 or what?

Indexes bought at 695.

jkirkwood001

Active Member

Going to need some tissues and a short break to recover...

That's nothing. I'm going to have to change my pants.

Fascinating! Pop a huge buy order at fixed, escalation SP, and grab all available sell orders in the last 10 seconds so nobody has time to react by raising their sell order prices (pardon me if I got the stock parlance wrong). Somebody just gained a lot of shares with controlled risk. Can't wait to read @Papafox ' analysis on THAT one.

StealthP3D

Well-Known Member

Well, that sure was a bit disorderly! A big difference between the closing auction price and the instant market price.

Don't think we even know if the buyers got their 12.4 million shares that they asked for in the imbalance.

I think they still have a deficit of the shares they need (based on all the unfilled buy orders during the closing cross). The question is, is the deficit bigger or smaller than the shares speculators are still looking to unload? And that is still unanswerable!

TheTalkingMule

Distributed Energy Enthusiast

Seems the cross was ~60M shares?17 mln shares traded AH already. 192 mln for the day (it was 175 mln after the closing cross). I think most funds will finish buying today if it continues at this speed.

AH ~17M shares?

That's not 120M+. Am I looking at this even remotely correctly?

Process the 20-40M share remainder at an opening cross Monday and be done with it? That would be ideal for my covered call selling plan next week.

Could someone explain what just happened like I'm 5?

2daMoon

Mostly Harmless

Everyone who wants to waive the weekend and go straight to Monday raise their hands.

P.S. The best part for me was when Fidelity updated the final price.

P.S. The best part for me was when Fidelity updated the final price.

It's still screwy. I have a limit sell in IBKR for 800 that I wanted to cancel and change to 700 (just a handful of play shares) but it won't let me. The order is stuck in "pending cancel".

CLK350

Member

Usual manipulations let's see what happens Monday morning AH Schwab 4:15 PM Bid 682.55 Ask 683.00 High 684.75 Low 628.54 Volume 180,032,273

No way to trade in last 5 minutes either...

Schwab also corrected the closing price

No way to trade in last 5 minutes either...

Schwab also corrected the closing price

on the other hand, volume thus far is 196M.... subtract our "daily" 50M and not only indexers but also some benchmarkers are in at ~146MThat's not 120M+. Am I looking at this even remotely correctly?

Everyone who wants to waive the weekend and go straight to Monday raise their hands.

Absolutely. TSLA is such a strong drug, the withdrawal symptoms over the weekend are real.

ETrade DITM LEAPS pricing at the close is definitely wrong. I assume they'll fix it Monday at the open.

View attachment 618991

View attachment 618993

Yeah, the BID prices are all showing as $0. But there is an ASK price. But they are still pricing them in the middle of the spread, or half of the ASK... It will probably get fixed after open on Monday.

Last edited:

adiggs

Well-Known Member

I think none of the above. It'll be based on the Opening Cross, Monday morning.

That'll be the indexes next chance to get the shares they need.

For the disagrees, here's what I found for how the opening price is determined on NASDAQ:

How NASDAQ's Opening and Closing Cross Works

The brief read here is that it is the same process used to determine the closing price; It just happens in the morning in the last 10 minutes of premarket trading, along with all of the orders that accumulate over night, in order to find the price that maximizes the order book at that moment.

S&P has indicated that the official start of trading for the index that includes TSLA is the opening price on Monday.

Any information to the contrary, I'm eager to see. I don't have knowledge about this beyond what I've been reading and learning these last couple of weeks.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M