This was an interesting report from a Tesla Intern:

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

TrendTrader007

Active Member

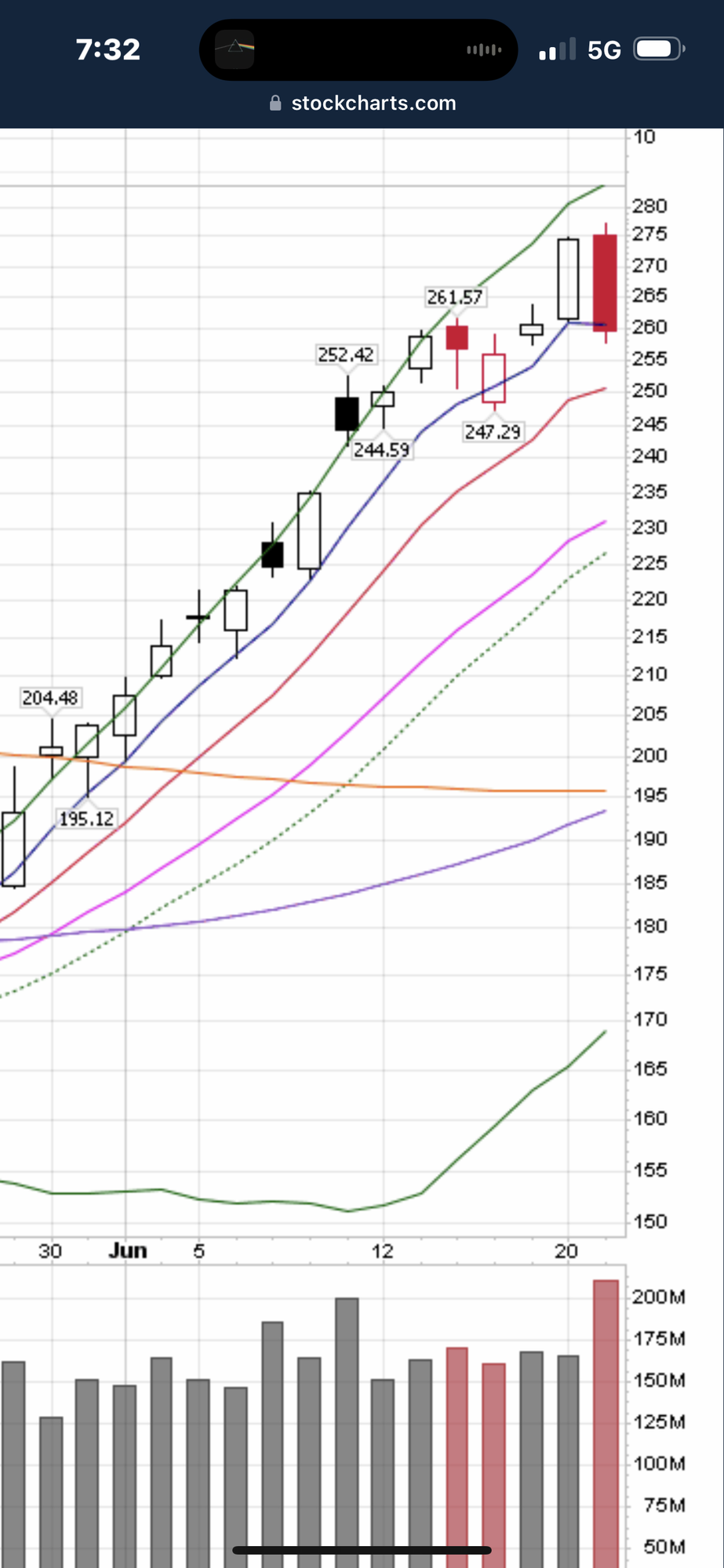

This is current Tesla chart and 50 day simple moving average is about to cross 200 simple day moving average with a gap of 1.22%

Second shot is from November 1, 2019 where the gap between two average is 1.2%.

Second shot is from November 1, 2019 where the gap between two average is 1.2%.

TrendTrader007

Active Member

TrendTrader007

Active Member

Subsequent resolution of November 1, 2019 through February 4, 2020

It does not mean it will happen exactly the same or if it will even follow similar script but just something to think about

whatever the resolution, in my personal highly biased TA opinion, the fun is just begun. once 50 day SMA crosses 200 day, that's the start of games.

until then, just conversation. and, for me, chance to pick up more TSLA on cheap

Not investment advice

It does not mean it will happen exactly the same or if it will even follow similar script but just something to think about

whatever the resolution, in my personal highly biased TA opinion, the fun is just begun. once 50 day SMA crosses 200 day, that's the start of games.

until then, just conversation. and, for me, chance to pick up more TSLA on cheap

Not investment advice

Last edited:

jkirkwood001

Active Member

Your spelling's improved since your recent 'resurrection', I'll say that!As one here claims to be Lord Vetenari, the patrician himself, said person only declares the Good Corporal to be almost human. You, my Lord, might well, based on the preponderance of evidence and your visual, auditory and written verbal exchanges declare me to be 100% verifiably human.

That would be of inestimable value in diminishing the doubts of some valued correspondents.

Although you, my Lord, have not reached the official Elder status as have I, though with time your Patrician self might achieve that.

Please, if you are so inclined indicate that my peripatetic mannerisms, habits and speech are not evidence of my lack of being "real" whether or not they provide evidence of my 'humanity'. Anyway I'm much taller than the corporal seems to be.

Marc_K_inNJ

Member

When do you estimate the crossover will happen at this rate?Subsequent resolution of November 1, 2019 through February 4, 2020

It does not mean it will happen exactly the same or if it will even follow similar script but just something to think about

whatever the resolution, in my personal highly biased TA opinion, the fun is just begun. once 50 day SMA crosses 200 day, that's the start of games.

until then, just conversation. and, for me, chance to pick up more TSLA on cheap

Not investment advice

FFS Elon. Why would you go and pander to those TMC nerds quibbling about auto wipers for the entire Juneteenth holiday weekend!

Maybe they couldn’t qualify for a decent fixed rate would be my guessWhy would would anyone get an ARM when fed rates are basically 0% and mortgage rates are 2%?

Do you have any data to support that "tons of people" have ARM's starting in 2020?

I have zero data to back this up, just common sense, but I would think there would be less ARM's starting in 2020.

Captkerosene

Member

A good update on DOJO from Rob:

Tesla is an AI company.

Tesla is an AI company.

”Claims”? I have a certificate.As one here claims to be Lord Vetenari, the patrician himself...

Jalopnik - Wednesday:

Were You A Conscientious Tesla Buyer? We Want To Hear From You

Were You A Conscientious Tesla Buyer? We Want To Hear From You

Optimus dining hall.

Or a cafe? I still think the robots can plug themselves in, no need for wireless.

2 engineers did this in a couple of weeks.

Have you seen the SPF 1000 glop he wears while recreating outside? Zero chance he's willing to get smashed in the face. Ditto for Musk.Mmm, Zuck has been training for years. He would absolutely want to do it.

petit_bateau

Active Member

The next 2-3 cpi prints have extremely favorable comps and we’ve seen a ton of anecdotal data/evidence that points to a rapidly changing situation on the MoM inflation data. The PPI is already foretelling what’s coming. The real time inflation data tracker is actively in the 2% range. Housing and rent data are not just showing slight drops but actually trending to bigger drops. The YoY number that the media loves to quote, even though MoM is far more important, will show big drops which further weakens the Fed’s words and integrity. We also have student loan payments restarting after 3 years of no one having to make a payment. We’re staring down deflation in the 2nd half of this year, not sticky inflation. All the data points to that. Not sure what data you’re looking at

As for liquidity, not sure how you’re coming to that conclusion. The VC and private market is bone dry still since Nov 2021 with AI just starting to get private money flowing in.

Housing movements can be very localized, but my area has been relatively flat for a long time and is just now starting to pick up.

Not sure what to tell you about the other items, I'm surely not the only one here who is aware of big labour agreements coming through that will be jacking up people's wages for years to come.

Wages are what actually feed into the core inflation metrics, housing, services, etc. The decline in headline inflation to date is all about energy, core inflation excluding food and energy has barely budged and are what some would argue will only be driven down by higher unemployment and moderating wage growth.

We're still in the early innings of this IMO

Tesla is a global business, wth global clients. Whilst the shareholder base is hugely US-skewed and so hugely US-markets and US-economy biased, there are non-trivial non-US shareholders and not all of them are in Canada.

US inflation may be about to fall sharply, but outside of USA inflation is by no means over. The UK is perhaps an outlier as inflation is still rising (and a recession cannot be ruled out; and UK has some particular gunshot wounds of its own making), but wider Eurozone inflation is not yet dead (and some key countries have flirted with technical recessions).

I appreciate that some around here are into political messaging with all the talk about "Darth Powell" (which is imho both childish and unwarranted) and seeking to make a direct connection between US Fed interest rate decisions and TSLA share price. Hence the focus on inflation data. Whilst in the short term there may well be such a share price connection, in the medium term the much more important driver of shareprice is business performance. That in turn is quite heavily influenced by overall economic performance of the key Tesla markets, and a good economic performance cannot be taken for granted at this point. I appreciate that a weak economic performance may relatively damage Tesla's competitors more than it does damage to Tesla, but in absolute terms that would still be bad for Tesla in the short and medium term (though perhaps not in the longer term).

Anyway ..... my underlying point is : keep an eye on what goes on outside USA as well as inside USA. The soft patch is by no means over yet. Don't over-fixate on the Fed.

Economic Experts Survey: Inflation Remains High Worldwide (Q1 2023)

How are economists’ expectations for future price developments evolving worldwide? Are the central banks’ sizeable interest rate hikes having an impact, and can we observe a decline in inflation expectations? The latest wave of the Economic Expert Survey (EES) conducted by the ifo Institute and...

Global Inflation Tracker Q2 2023: Inflation Trends Down but…

Stay informed about global inflation trends in Q2 2023. Discover…

Inflation Peaking amid Low Growth

The World Economic Outlook Update will be released in Singapore at 9:30 am on January 31, 2023 (January 30 at 8:30 pm Washington D.C. time)

www.imf.org

Jeremy Hunt expresses concern about cost of living crisis after OECD forecast

Chancellor responds to news UK likely to avoid recession but will have one of highest inflation rates among G20

UkNorthampton

TSLA - 12+ startups in 1

Recruiting Artificial Intelligence experts. Mentioning compute/person ratio - probably a sore point for many experts that feel scarcity is slowing down their progress.

2 engineers did this in a couple of weeks.

Buckminster

Well-Known Member

Rob is really really worth watching today:

Covers several topics including:

Project Dojo - the SaaS Product? - NVDA = $1T therefore TSLA addition is $1T in 2025?

Gigafactory locations and products India plus Texas expansion

Wiferio for Tesla Home Wireless Charger and/or

Tesla Optimus Sub-Prime Robot

Tesla Stationary Storage Investors Thread Tesla Ai selling excess energy from Powerwalls at $5.52 while buying at $0.11 per kWh

Plus several other topics.

Project Dojo - the SaaS Product? - NVDA = $1T therefore TSLA addition is $1T in 2025?

Gigafactory locations and products India plus Texas expansion

Wiferio for Tesla Home Wireless Charger and/or

Tesla Optimus Sub-Prime Robot

Tesla Stationary Storage Investors Thread Tesla Ai selling excess energy from Powerwalls at $5.52 while buying at $0.11 per kWh

Plus several other topics.

Last edited:

Why stock go down?

Actually: why stock went up?

Much of the market is going down due to what Powell said yesterday, it's got the market scared again.

Mike Smith

Active Member

Why stock go down?

Actually: why stock went up?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M