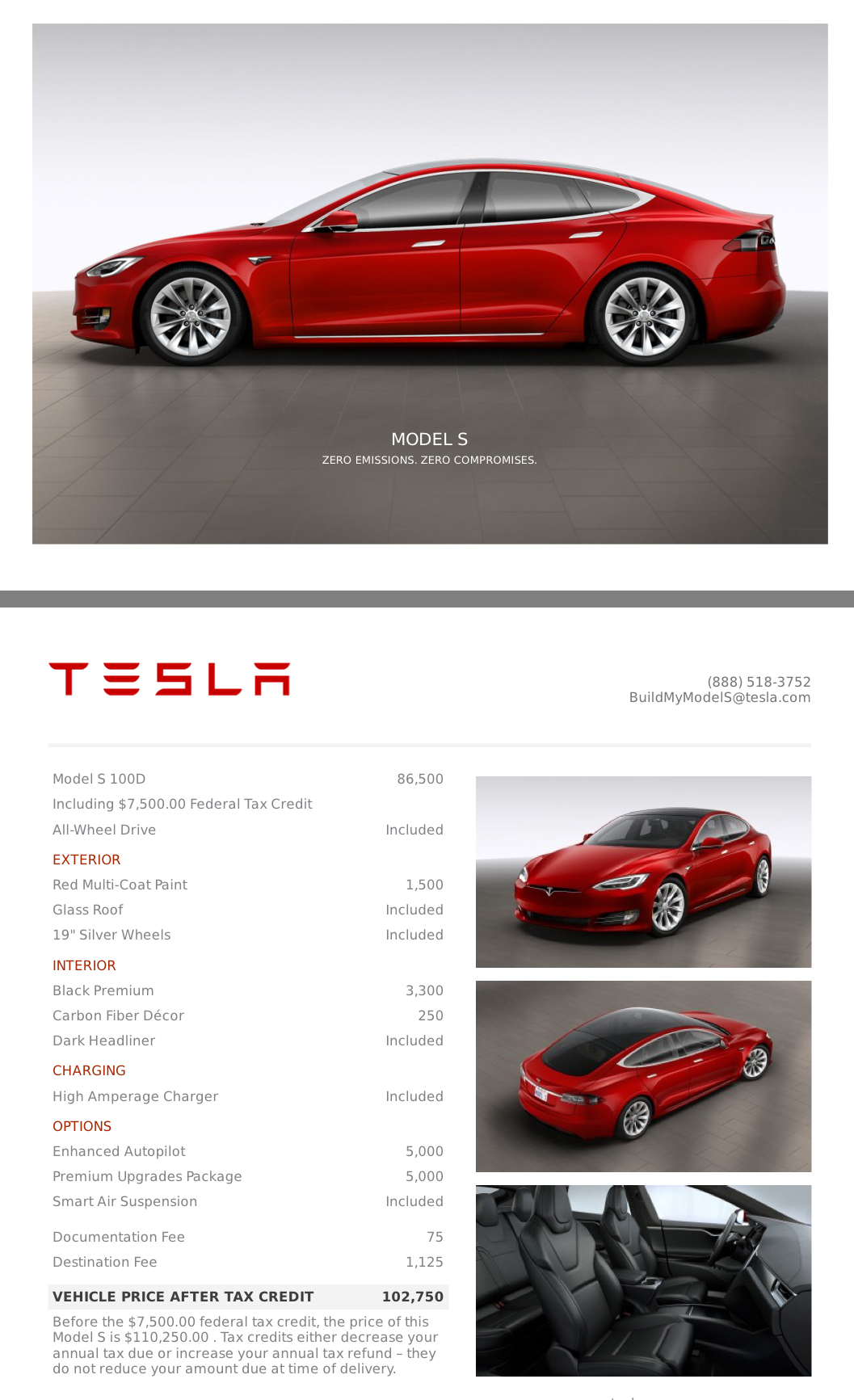

Trying to get a handle on what the trade-in value of this 2018 Model S 100D will be in 3 years to help with my Loan vs Lease decision. Loan has slight 3 year out of pocket advantage (~$1,500) over a 1,5000 mile/yr lease.

Ultimately, it really depends on what the trade-in value will be in 3 years on the Loan side.

Any educated guesses?

Ultimately, it really depends on what the trade-in value will be in 3 years on the Loan side.

Any educated guesses?