Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TSLA Technical Analysis

- Thread starter Robert.Boston

- Start date

-

- Tags

- TSLA

anthonyj

Stonks

Zhelko Dimic

Careful bull

What's the point of coming into technical analysis thread to tell us how technical analysis doesn't work? Are you trolling? I can't see another reason to do it in this thread.And in the past weeks technical analysts were talking about the patterns that were showing us we were going to have a breakout. Where are they now? In the end all these technical predictions are just utterly useless.

What's the point of saying that in general, anywhere, when it's been said numerous times, and fought thousands of time? Again, everything points to trolling and trying to rile up hornet's nest. I guess your provocation did work...

BTW, should you plan to answer to this post, I'm unlikely to ever see it, I'll let you guess why (saying why used to be frowned upon)...

Zhelko Dimic

Careful bull

Feb '16 TSLA lost around 50% from the top achieved few months beforehand. That 50% loss did coincide and slightly penetrated 200 moving average on weekly, but it recovered the next week. 200 weekly is at 268-269 today, sudden drop would probably take it no lower than 265Anyone have a chart from Feb 2016 for comparison?

Feb '16 TSLA lost around 50% from the top achieved few months beforehand. That 50% loss did coincide and slightly penetrated 200 moving average on weekly, but it recovered the next week. 200 weekly is at 268-269 today, sudden drop would probably take it no lower than 265

Could the 200ma be relied upon even in a severe market downswing? I empathize with your tagline, by the way - "Careful bull".

Zhelko Dimic

Careful bull

No, I don't think it can't be relied upon. Probability that it will arrest the drop is higher than any other random band, but there are no 100% assurances. If market fundamentals didn't turn in Feb '16, we don't know what would have happened.Could the 200ma be relied upon even in a severe market downswing? I empathize with your tagline, by the way - "Careful bull".

I wouldn't be surprised that 200 ma line gets challenged, played with, even lost for few weeks, but I would be surprised it really gets trampled, i.e. price goes under $240 or so. I have been surprised in the past tho, but I was less careful too. I kept looking at TSLA as if it were just another stock. And, btw TSLA loves head-fakes, both up and down. It loves breaking technical levels, even confirming breakdown/breakup, just to reverse in next few days. I've seen it many, many times.

Having said all of that, we're more likely than not, in a period where TSLA will outperform over the next 24 months, and not underperform. So it's all about controlling your personal risk and optimizing exposure while making sure wrong call doesn't obliterate you. The way I think about it now, I'd rather take 5 years to get where I want, rather than make 6 months play, that can decimate me. But I had luck to run number of years with close to 100% gains, so individual situations vary.

EVNow

Well-Known Member

Had to search.Megaphone topping pattern.

Looks like a result of macros - heightened political & economic risk - amplified by TSLA.

Broadening Formation

Broadening Formation

Broadening formations occur when a market is experiencing heightened risk over time. For example, many countries experience broadening formations due to heightened political risk ahead of an upcoming election. Different polling results or candidate policies may cause a market to become very bullish at some points and very bearish at other points. Broadening formations may also occur during earnings season when companies may report differing quarterly financial results that can cause bouts of optimism or pessimism.

…

Broadening formations are generally bearish for most long-term investors and trend traders since they are characterized by rising volatility without a clear move in a single direction. However, they are good news for swing traders and day traders, who attempt to profit from volatility rather than relying on directional movements in a market. These traders rely on technical analysis techniques, such as trendlines or technical indicators, to quickly enter and exit trades that capitalize on short-term movements.

Zhelko Dimic

Careful bull

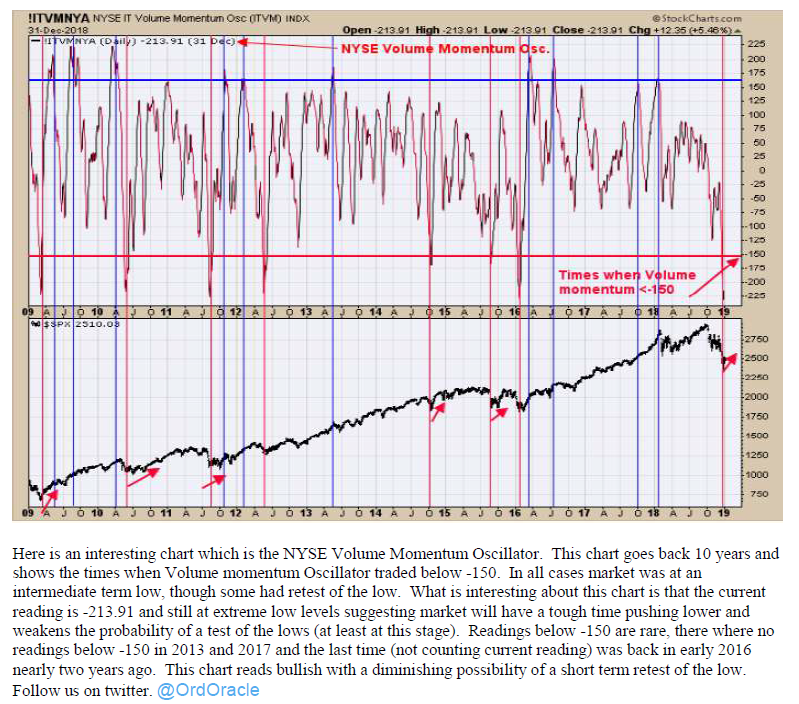

Technical analyst Tim Ord was a regular guest on my TV show. This is what he distributed a half hour ago regarding the NYSE Momentum Oscillator relative to the S&P 500 ETF (SPX).

Website: Ord Oracle - Home

Website: Ord Oracle - Home

Last edited:

TradingInvest

Active Member

William O'Neil has an investment/trading system called "CAN SLIM", which is used to identify stocks that will have huge rally after a breakout. I think his approach makes sense. You can google or read his book called "How to make money in stocks" for more about CAN SLIM. William O'Neil is a smart investor/trader in my view.

The current TSLA set up might trigger the CAN SLIM system. Most of the requirement are already met, we still need a good Q4 and good market direction. When a cup-and-handle breakout happens and those criteria are met, the stock has a high chance to gain a lot.

Don't fix your mind that certain things will happen for sure, instead, keep in mind what MIGHT happen, estimate the probability, prepare for it, observe facts and make rational decisions when facts are presented.

Also keep in mind, a cup-and-handle break out frequently re-test the breakout level to make sure. It doesn't always re-test. If the breakout fails, the pullback could be very strong.

The current TSLA set up might trigger the CAN SLIM system. Most of the requirement are already met, we still need a good Q4 and good market direction. When a cup-and-handle breakout happens and those criteria are met, the stock has a high chance to gain a lot.

Don't fix your mind that certain things will happen for sure, instead, keep in mind what MIGHT happen, estimate the probability, prepare for it, observe facts and make rational decisions when facts are presented.

Also keep in mind, a cup-and-handle break out frequently re-test the breakout level to make sure. It doesn't always re-test. If the breakout fails, the pullback could be very strong.

anthonyj

Stonks

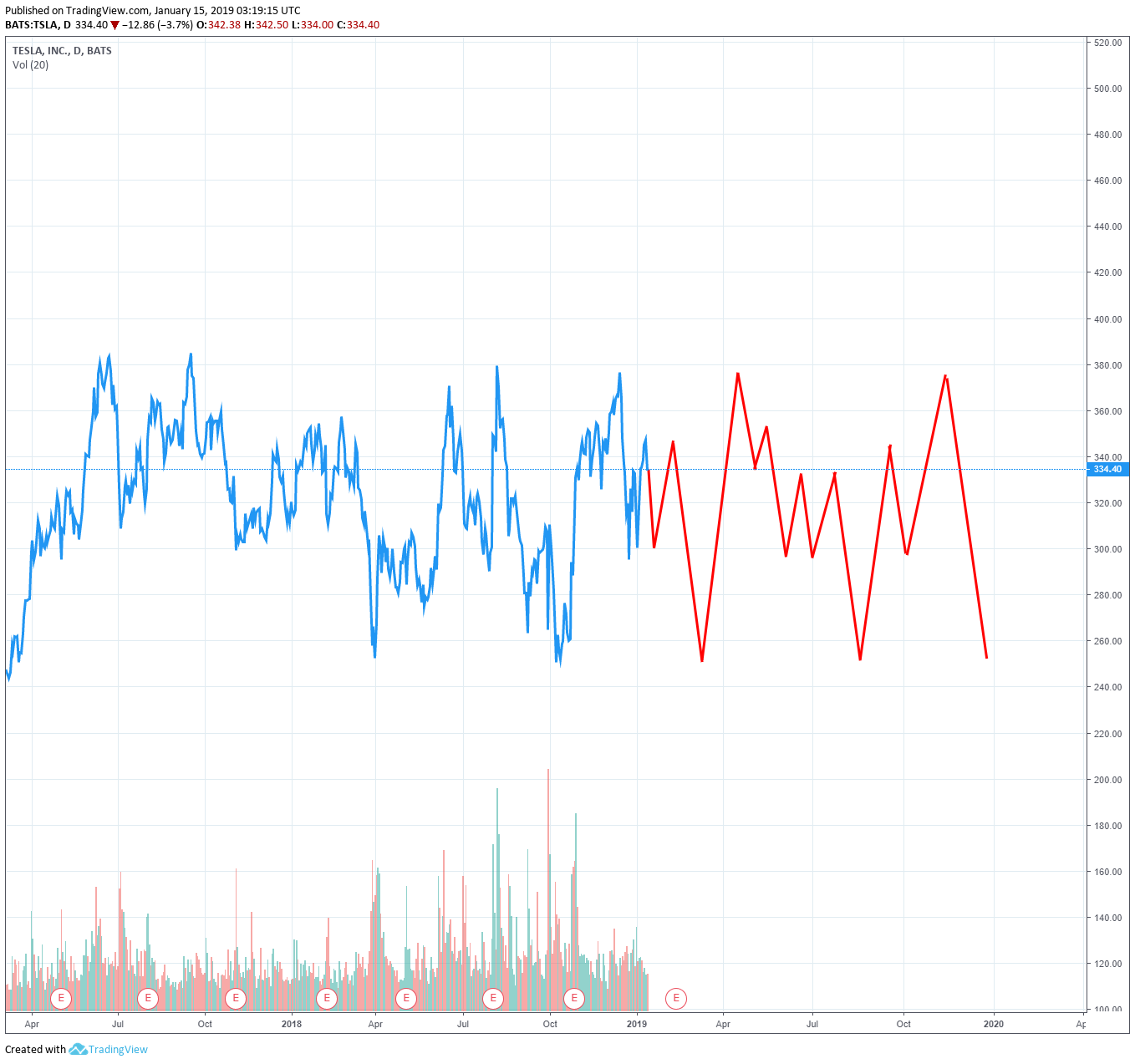

I've attached my expert technical analysis for 2019

TrendTrader007

Active Member

Will it be 2019 or 2020- I’m positioned accordingly

TrendTrader007

Active Member

Either ways it’s all good in favor of bulls

dmvevguy

Member

View attachment 369262 $tsla is overdue for a year similar to 2013- big white candle like in 2013

Will it be 2019 or 2020- I’m positioned accordingly

I think it will be this year...just too much bullish news esp with China / Model Y / S&P 500 inclusion and if they can prove FSD demo coast to coast trip internal testing this year...it's a done deal.

anthonyj

Stonks

This was supposed to be a joke...

jeewee3000

Active Member

TSLA touching the lower Bollinger Band on hourly chart in pre-market trading. (and approaching the lower BB on daily chart)

Could provide support (approximately $292 and $289 respectively). If those levels hold, the stock could hike IMO.

Could provide support (approximately $292 and $289 respectively). If those levels hold, the stock could hike IMO.

OOPS!I think in another week or two the TSLA chart will resemble the recent bullish action in TREE

Technical analyst Tim Ord was a regular guest on my TV show. After today's market close he issued the comment posted below in regard to the NYSE McClellan Summation Index. BTW Sherm McClellan and his son Tom were also among my regulars.

When this index reaches above +500 (today’s close was +554), it is implied the market has reached “escape velocity” and a new uptrend has started. There can be corrections that follow but overall higher prices are expected and an intermediate term bullish sign.

Website: Ord Oracle - Home

When this index reaches above +500 (today’s close was +554), it is implied the market has reached “escape velocity” and a new uptrend has started. There can be corrections that follow but overall higher prices are expected and an intermediate term bullish sign.

Website: Ord Oracle - Home

Similar threads

- Replies

- 21

- Views

- 6K

- Replies

- 3

- Views

- 915

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 23

- Views

- 814