ValueAnalyst

Closed

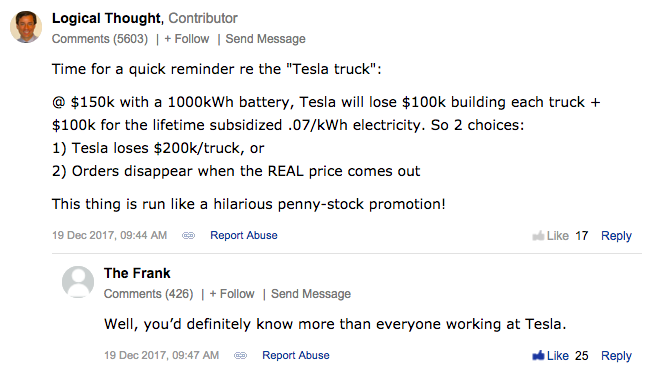

Bears are freaking out over Tesla Semi and throwing the kitchen sink, but retail investors have already wised up:

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Bears are freaking out over Tesla Semi and throwing the kitchen sink, but retail investors have already wised up:

View attachment 267549

Thanks, any information on lease vs purchase?

Thank you, I've been looking for those!

It's a lot choppier than I would have expected. I guess they really like using it for the minute-to-minute balancing, which makes sense.

Not in the website, you should ask directly @nasatech.

Speaking of Norway: I'd like to understand the opinion of the forum about this.

My question is: is Norway a possible future benchmark for other "mature" markets, or the fact that they have great incentives and cheap, idro electricity makes it a total outlier?

If the former, Q4 numbers are huge, bullish news.

We are talking about 21739 Tesla cars (as of now: we'll probably reach 22500 for end of the year) in a country with

5 mil people...

If we count registered voters as "potential car customers" (Wikipedia says 3'765'245) it becomes one Tesla every 167 people.

Tesla is slaying every competition, both EV and premium ICE.

To me, this means: *there is no alternative* to Tesla cars. They are just better. And we'are not even talking about Model 3 numbers!

If (and it's a big if) my argument is correct, this is as close as a laboratory test as we can get. And it's game over.

Already a record quarter for Europe with only Norway counted for December and still rising. 230 so far today and over 7200 for Europe. A normal end of quarter for the rest of Europe would led to 10,000 Europe sales for q4. 7068 was last quarters record. Now we need model 3 production confirmation. If we're at 3.5 billion in revenue and 500 million in new Roadster and semi deposits and bears are going to be very disappointed.And also Norway is still counting

+ 184 and still counting for today(and it is only 15.45)

Makes it 1800 and still counting for the month ..

makes it 3092 and still counting for Q4

I'd also be curious to hear people's thoughts on Model X performance. +30% to Model S registrations YTD. Anything that is driving that other than MX being newer and the fear of the higher taxes on the heavier MX?

And Norway is still rising with post-business hours scraping updates--it's at 231 now, a few minutes after dc_h's post... Norway will likely break its combined S+X monthly record of 2,004 tomorrow. (It's sitting at 1,847 right now, leaving only 157 needed tomorrow to set the record.) Even if you knock out the entire Christmas holiday week, we've still got 3 business days left in the year to keep the new record rising.

Not in the website, you should ask directly @nasatech.

Speaking of Norway: I'd like to understand the opinion of the forum about this.

My question is: is Norway a possible future benchmark for other "mature" markets, or the fact that they have great incentives and cheap, idro electricity makes it a total outlier?

If the former, Q4 numbers are huge, bullish news.

We are talking about 21739 Tesla cars (as of now: we'll probably reach 22500 for end of the year) in a country with

5 mil people...

If we count registered voters as "potential car customers" (Wikipedia says 3'765'245) it becomes one Tesla every 167 people.

Tesla is slaying every competition, both EV and premium ICE.

To me, this means: *there is no alternative* to Tesla cars. They are just better. And we'are not even talking about Model 3 numbers!

If (and it's a big if) my argument is correct, this is as close as a laboratory test as we can get. And it's game over.

I´d answer this with an "absolutely not". Norway is pretty special in green possibilities and ev incentives.My question is: is Norway a possible future benchmark for other "mature" markets,

Let alone Christmas week, I'm pretty sure some here would skip even Christmas dinner to get their Model X.

Agreed, no auto mfr native to Norway and electricity is probably half the avg European price and fewer long term incentives.I´d answer this with an "absolutely not". Norway is pretty special in green possibilities and ev incentives.

It`s downright crazy in comparison to pretty much every other market.

Some quotes:

It's a start-up company that was founded by the founder of a website about cars (yiche.com) about two years ago, major backers include Tencent, among other big names in China. They marketed the car having a range of 500 km when driven at 60 km/h. NEDC rated at 355 km or roughly 200 miles. Where range comes short, they are offering a plan of leasing the battery and battery swap as a way to recharge.A Chinese start-up is taking on Tesla with a car half the price of Model X

Haven't see NIO discussed here, but todays headlines are all filled with this. Could todays SP dip be corelated to this news.

Big picture - Tesla China market has competitor and number of Tesla's that will sell in China will drop or not gain market ...?

having invested in Kandi a while back (all speculation and did make some profits) ... the only company in China in EV space with a reasonable shot so far i though was BYD??

Does that 3.765M people include Children and Elderly who dont drive? One Tesla for every ~100 driving age person in the country. Pretty awesome.