Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Irishjugg

Member

Be careful, Elon did essentially say they would need to be somewhere around 2-3k/ week run rate before margins go positive at all on the 3. Just a reminder not to get excited too soon about profit generation in late quarters this year.As others have already posted, the biggest news for me was that Model3 margins would be similar to Model S and X's (~20%). Confirms previous guidance that Model3 would be cash positive from early in the production ramp. I expect that this Model3 margin guidance alone will propell the stock price higher.

I do wish someone would have asked the same question from a cash flow perspective. Previously Musk had said that they designed the ramp to be a cash generator, so perhaps their supplier tends allow for +cash with -profit.

myusername

Banned

go back and read the 2Q15 transcript.No, what it means is more specific: he'll do a capital raise *if the price is right*. But he won't do a capital raise at disadvantageous prices.

So if the price rises again towards $290 or $300, we might expect stock issuance. If he could issue straight-up bonds at under 5% interest rates, he'd probably do that. But if the stock price crashes to $220 and he can't get decent rates on bonds, then he probably won't do a capital raise and will just conserve money to get through the launch.

EDIT:

here -- let me do it for you:

Aug. 6, 2015 2:05 AM ET

"Elon Reeve Musk - Chairman & Chief Executive Officer

I don't think that there's not a need to raise equity capital. There may be some value in doing so as a risk reduction measure, but to be clear, we – what Deepak is saying is that even in the absence of any additional capital generation activity, we would have on the order of $1 billion through – basically that would be, our minimum cash position."

Aug 13, 2015

Why Tesla is raising $500 million in a stock sale

Last edited:

Irishjugg

Member

Unless of course you are able to buy back later at a lower price before the breakout. Then the returns would be higher than just holding. That's my plan at least, I've been expecting (maybe hoping?) a post ER drop for a few weeks based on how I think the psychology of the market and people who trade TSLA works. Time to see if I'm right or wrong! Such fun.Selling $TSLA here will be an idiotic move IMO

SP is super volatile and will shake out weak longs and embolden naive shorts

Nate the Great

Member

FredTMC

Model S VIN #4925

Tesla Motors's PT raised by Robert W. Baird to $368.00.

Tesla Motors's PT raised by RBC Capital Markets to $314.00.

So far...

Yeah. I'm a buyer here premarket. Can't help it.

This premarket weakness smells like a headfake

Good prices to me

FredTMC

Model S VIN #4925

I expect a push towards max pain by Friday. So I see close on Friday somewhere between $260 and $270. Probably in the neighborhood of $270 more likely. I am still very bullish long-term, but relatively neutral to perhaps slightly bearish for the next couple of weeks. Obviously if we have a strong day Thursday, then you can throw this prediction out the window, but I expect a decent open, maybe $280 to $282 at most, and then move down throughout the day and close around $275 or less. Then move down to $270 or less Friday.

I think max pain has zero influence this week.

I think max pain is only in play in the absence of news.

aznt1217

Active Member

Margins were bad, but hopefully the street was expecting that due to AP software delay.

Yeah. I'm a buyer here premarket. Can't help it.

This premarket weakness smells like a headfake

Good prices to me

I second that Fred. It's 2017, 5 years later and people still don't "get" Tesla. Amazing.

MartinAustin

Active Member

pre-market battling back steadily from $265 to $268. I wonder if pre-market investors (all three of them) wonder if that is a legitimate buying level

Jonathan Hewitt

Active Member

503K shares traded so far. Probably 4 or 5 traders, not 3pre-market battling back steadily from $265 to $268. I wonder if pre-market investors (all three of them) wonder if that is a legitimate buying level

J

jbcarioca

Guest

I just ordered to triple my TSLA holdings at market when the market opens. Somehow I agree with you, although I will not be at all surprised if major upward movement will depend on two things: Model 3 blowing analysts minds around July or so, maybe before and another jump of ~100% in stationary storage MW installs this quarter. I think both of those things will happen. I'm putting money in now to beat the rush come July. I still don't want to view TSLA as anything other than a long term speculative investment, and will not change my posture until there are profits for at least three quarters in a year. I may well miss a big runup, but I'll sleep well knowing I'm taking no risk I cannot afford to lose completely. If I were 40 years younger I'd be playing with derivatives now.Yeah. I'm a buyer here premarket. Can't help it.

This premarket weakness smells like a headfake

Good prices to me

We should have the next M3 reveal end of March.

You missed the memo yesterday: Tesla Model 3: Elon Musk says final reveal could come after production in July, when they open online configurator

Ssampling of select sellside analysts reactions (TSLA has 8 buys, 10 holds, 6 sells with average price target $242) to the company's earnings report:

MORGAN STANLEY (Adam Jonas)

OPPENHEIMER (Colin Rusch)

MORGAN STANLEY (Adam Jonas)

- The reiteration of the outlook for the Model 3 launch and volume production may be the most important factor from the release, as the company had every chance to use the opportunity to introduce any level of execution risk

- Estimates Tesla has spent as much as $10 billion in combined/aggregate R&D and capex from the beginning of 2014 through the first half of 2017, an extreme figure in both absolute and relative terms

- "We’re about to find out where this invested capital is going. The launch of a single product could multiply revenues by 4x to 5x."

- Rated overweight, price target $305

- Tesla reported a "phantom beat" as Street estimates for EPS and revenue excluded the SolarCity acquisition

- Cash needs are mounting as the "shopping list has grown considerably" since 3Q; estimates ~$25 billion in cash needed over the next 3-5 years

- Timelines "look aggressive" and hopes to gain greater insight into 2H 2017 and Model 3 ramp on 1Q call in the Spring, though expects management to "punt" until July

- Rated underperform, PT $155

- Remains buyers of shares even given the more than 40% rally over the past three months and potential for a pause until a capital raise

- CFO transition news a surprise, though Deepak Ahuja as a replacement is the best possible outcome, as he will bring his financial and company expertise back to Tesla during a critical time for the company

- Bull arguments outweigh the bears, specifically the continued Model 3 execution, the better-than- feared integration of the SolarCity acquisition, the ~$2 billion capital raise as a positive catalyst and Tesla Energy’s potential

- Rated outperform, raises price target to $368 from $338

OPPENHEIMER (Colin Rusch)

- Clarity on the capital plan and completion of a capital raise would be a positive catalyst for shares

- Forecast of 250k annual production runrate by 4Q is above Street expectations and comes with significant execution risk

- Expects bears to focus on earnings power of the business by 2020 as the company works towards "lofty" manufacturing efficiency goals

- Rated perform

- Earnings were broadly in-line; Motors gross margin miss (22.2% vs Deutsche estimate 25.1%) was largely due to temporary factors such as deferred revenue for Autopilot and foreign exchange

- Remains cautious on shares due to valuation, particularly given significant risks and uncertainties about the capital and cost plans

- Rated hold, price target $215

- Fourth quarter results and 2017 update indicate Model 3 production is on track, yet a bevy of initiatives still requires heavy investment and possibly another dilutive capital raise

- Capital spending in fourth quarter was ~$500m below consensus as Tesla limited its cash burn to $448m

neroden

Model S Owner and Frustrated Tesla Fan

Not in a taxable account.Unless of course you are able to buy back later at a lower price before the breakout. Then the returns would be higher than just holding.

myusername

Banned

go back and read the 2Q15 transcript.

EDIT:

here -- let me do it for you:

Aug. 6, 2015 2:05 AM ET

"Elon Reeve Musk - Chairman & Chief Executive Officer

I don't think that there's not a need to raise equity capital. There may be some value in doing so as a risk reduction measure, but to be clear, we – what Deepak is saying is that even in the absence of any additional capital generation activity, we would have on the order of $1 billion through – basically that would be, our minimum cash position."

Aug 13, 2015

Why Tesla is raising $500 million in a stock sale

sorry... you can't "disagree" with the above... it is fact that Elon said they don't need to (when everyone knew they did) but might for "risk reduction"... and then 5 trading days later... they had all the details laid out along with buyers that closed early in the next week. it is very possible that they already have everything lined up for another raise next week.

neroden

Model S Owner and Frustrated Tesla Fan

This is a sign of a really excessive backlog. When asked about the backlog, Musk and (some other exec) said "it's fine", and then they went into a discussion of how they're anti-selling the 3 and they "don't want to make the line longer".

I believe the original plan was to do a second reveal to boost reservations, but now they don't *want* to boost reservations, so they're not going to do a reveal.

The online configurator will apparently open for employees first. At the projected production rates which were sent to parts suppliers, and with the number of employees they had back when Model 3 was first revealed, they'll be producing nothing but employee cars for all of July and August, most likely. The "final reveal" will probably come in, I dunno, September?

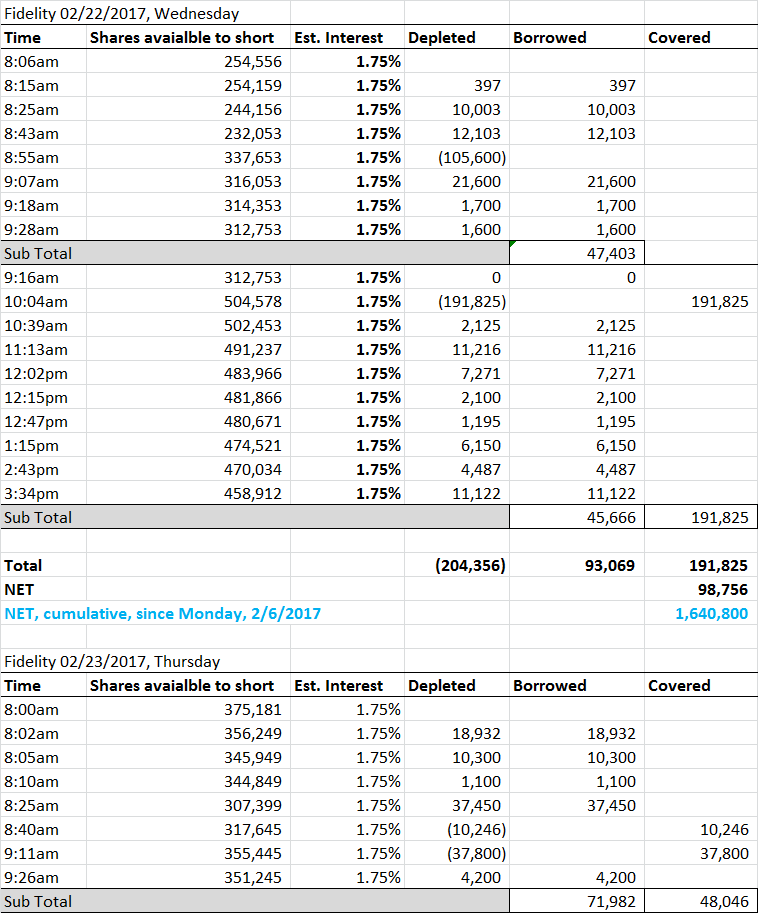

There were 375k shares available for borrowing at Fidelity, total of 72k were borrowed and looks like 48k shares covered. It looks like we are in for a choppy ride as Market grapples for an integral "narrative"

Tslynk67

Well-Known Member

racer26

Active Member

Nah. I suspect we get the 'delivery event' alluded to in mid July, and they'll deliver the first few (dozen? hundred? I dunno) cars to employees at the event.This is a sign of a really excessive backlog. When asked about the backlog, Musk and (some other exec) said "it's fine", and then they went into a discussion of how they're anti-selling the 3 and they "don't want to make the line longer".

I believe the original plan was to do a second reveal to boost reservations, but now they don't *want* to boost reservations, so they're not going to do a reveal.

The online configurator will apparently open for employees first. At the projected production rates which were sent to parts suppliers, and with the number of employees they had back when Model 3 was first revealed, they'll be producing nothing but employee cars for all of July and August, most likely. The "final reveal" will probably come in, I dunno, September?

That'll serve as the final 'here's Model 3' type event. From that point, they'll likely open general public configurator, and people start getting their cars in September.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 870