myusername

Banned

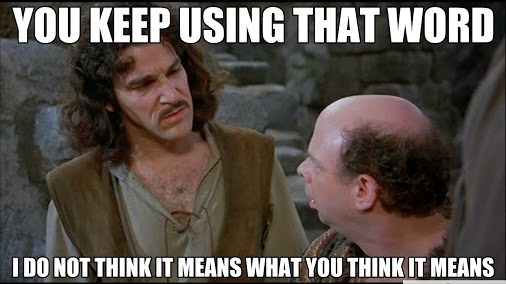

like I said the other day... Elon will provide some tidbit in the report to allow you to hang onto the story. there's a handful of them in there...It could also mean they had enough parts to run continuously for some number of days at a 1,000 /week rate. 200/day or 142/day depending...

Did not make 1k in a week, but could have (assuming all raw material movement operations also kept up)

"In the last seven working days of the quarter, we made 793 Model 3's, and in the last few days, we hit a production rate on each of our manufacturing lines that extrapolates to over 1,000 Model 3's per week"

this statement neither provides guidance or data that would qualify as scientific analysis... so why is it being referenced at all?... to keep the story going... and that's why it's in there.