Apologies if this has already been posted but this is the funniest thing I've seen in quite awhile:

David Einhorn on Twitter

David Einhorn on Twitter

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

But we know that tweet wasn't exactly true because the board hasn't approved the deal yet. So it not only depends on shareholder approval, but board approval as well.

If shareholders approve and the board doesn't, well, the board may find itself replaced. Or at least outvoted when it goes to an actual shareholder vote. They matter, but they don't have a final say necessarily.

Yeah, it would take a lot longer to happen. But if the major shareholders (not us small fry who makes up the 12% retail) are interested, and I'm sure they'll let the board know, the board will know they may be only delaying the process and getting themselves tossed out to boot.Well it can't go to shareholders for a vote until it gets approved by the board, right? (With the exception of the vote could be added to the next yearly shareholders meeting.)

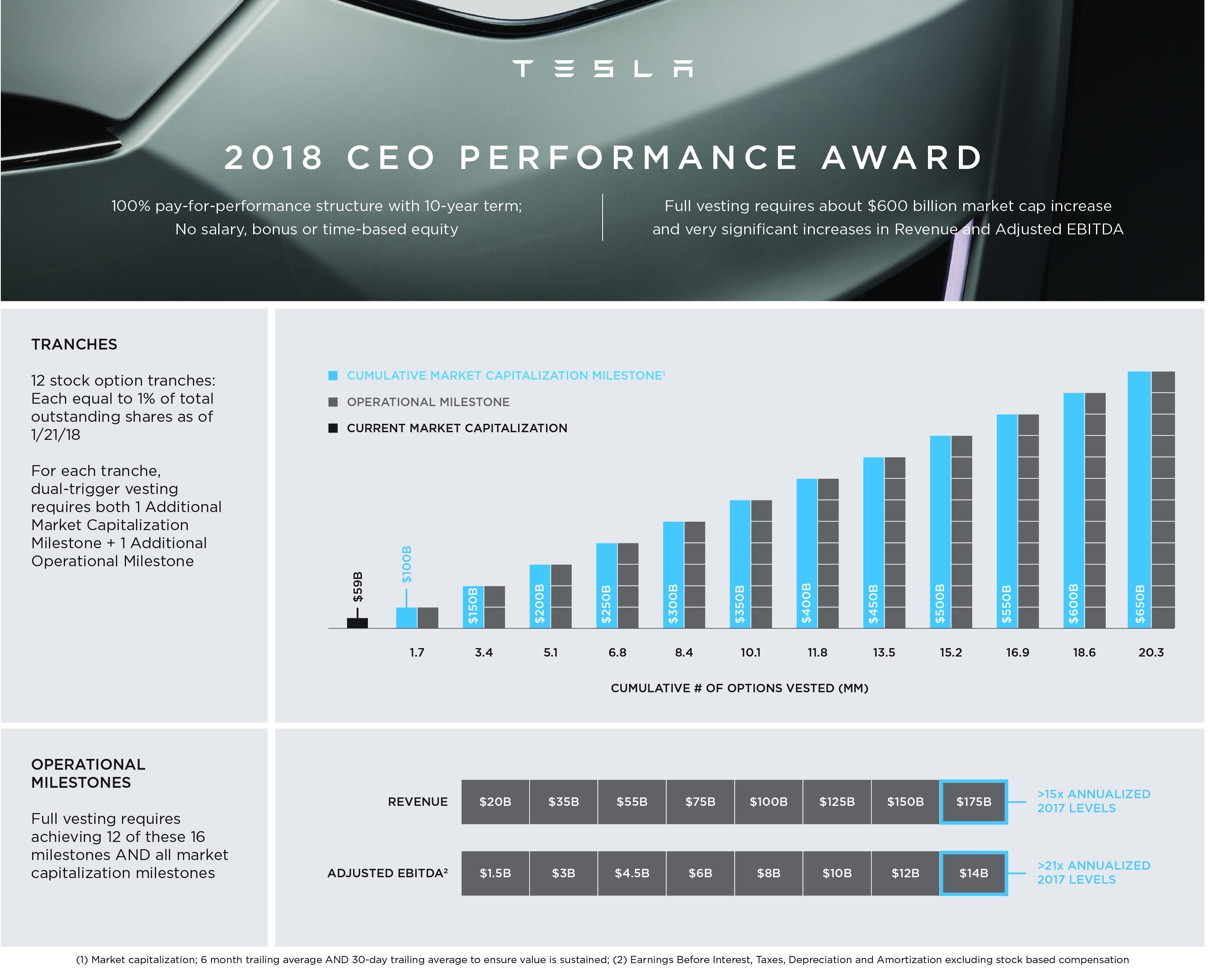

Won't Elon's compensation plan kick in if there is an epic squeeze?

I get the feeling we're seeing a chess game playing out.

"He hates these conference calls, he hates answering to analysts. He just wants to do his thing".CNBC - today:

CNBC - today:

That caption on the screen is exactly the opposite of what Elon said, that he DOES NOT want to combine the companies.CNBC - today:

It is a hacker conference for anyone interested in the field. Nothing nefarious.Did elon's twitter just get hacked? it's saying:

@defcon. hqr sz wut.

and apparently defcon is a hacker group.