I think we got a record hereTried it.

Amazing offer, 5200£ for 20k miles.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Insurance UK

- Thread starter hagrid_LDN

- Start date

-

- Tags

- Ireland United Kingdom

Hello fellow Teslans,

I've just purchased Model 3 Long Range recently and awaiting the pickup date. This is going to be soon as yeah, I need an insurance.

I live in London and just learnt this is going to pain...

Anyway, any recommendations for a sane premium for:

I've never had a car in the UK or have dealt with the car insurance market*

Which of the above, are likely base of getting a decline or a high premium? I've learnt so far it's the London postcode and (lack of) NCD. Anything else be aware of?

What are the insurance providers/compare site to try?

So for I've tried Direct Line recommended as InsureMyTesla - decline

And I've got a quote from www.lv.com for about £2100. That's hefty, I must admit but no clue how it relates overall (?) Is that insurer worth a go?

Ironically, I work for an insurance company myself but just do my bit around their software so I don't know much about the whole market.

What I know though, they decline London post codes entirely

I am all ears, folks. Any insight for a 1st-time Tesla driver is welcome too.

I've just purchased Model 3 Long Range recently and awaiting the pickup date. This is going to be soon as yeah, I need an insurance.

I live in London and just learnt this is going to pain...

Anyway, any recommendations for a sane premium for:

- London (SW)

- 40+ yo

- with wife as the 2nd driver

- no kids, car is (at least for now) going to be parked on a public road

- company registered car (used as employee benefit though, not for business/commute)

- no NCD (first car in the UK)

- EU driver licences

- if it's a reliable insurer that wouldn't hurt either

I've never had a car in the UK or have dealt with the car insurance market*

Which of the above, are likely base of getting a decline or a high premium? I've learnt so far it's the London postcode and (lack of) NCD. Anything else be aware of?

What are the insurance providers/compare site to try?

So for I've tried Direct Line recommended as InsureMyTesla - decline

And I've got a quote from www.lv.com for about £2100. That's hefty, I must admit but no clue how it relates overall (?) Is that insurer worth a go?

Ironically, I work for an insurance company myself but just do my bit around their software so I don't know much about the whole market.

What I know though, they decline London post codes entirely

I am all ears, folks. Any insight for a 1st-time Tesla driver is welcome too.

Tony Hoyle

Active Member

And I've got a quote from www.lv.com for about £2100. That's hefty, I must admit but no clue how it relates overall (?) Is that insurer worth a go?

Given your situation I would say £2k is a 'bargain', I suspect LV will want a black box with that policy? If not you have done well. I doubt you will get a cheaper price with anyone else, the fact DL declined you tells you how unattractive you are as a customer.

greenbottle123

Member

Have you tried Novo?Hello fellow Teslans,

I've just purchased Model 3 Long Range recently and awaiting the pickup date. This is going to be soon as yeah, I need an insurance.

I live in London and just learnt this is going to pain...

Anyway, any recommendations for a sane premium for:

I should perhaps read some of the recent pages of that thread, and will, promise. I'd appreciate some insight though.

- London (SW)

- 40+ yo

- with wife as the 2nd driver

- no kids, car is (at least for now) going to be parked on a public road

- company registered car (used as employee benefit though, not for business/commute)

- no NCD (first car in the UK)

- EU driver licences

- if it's a reliable insurer that wouldn't hurt either

I've never had a car in the UK or have dealt with the car insurance market*

Which of the above, are likely base of getting a decline or a high premium? I've learnt so far it's the London postcode and (lack of) NCD. Anything else be aware of?

What are the insurance providers/compare site to try?

So for I've tried Direct Line recommended as InsureMyTesla - decline

And I've got a quote from www.lv.com for about £2100. That's hefty, I must admit but no clue how it relates overall (?) Is that insurer worth a go?

Ironically, I work for an insurance company myself but just do my bit around their software so I don't know much about the whole market.

What I know though, they decline London post codes entirely

I am all ears, folks. Any insight for a 1st-time Tesla driver is welcome too.

guicane

Member

I'm looking to insure a Model X 100D in London and thought the quoted £1200 was a lot but after seeing some of your messages here I guess it's actually decent...

LuckyLukeUK

Member

You really need to shop around and try different comparison websites. U found compare the market .com the cheapest and gocompare .con quotes the most expensive. Also try different profession that is similar to yours as that can make a difference, i.e. rather than manager our office worker, administration. I live in London too and we are paying premium prices here. My cheapest quote came £800 with quote me happy and aviva. There are some insurance companies that are not on comparison websites like direct line so be sure to check those too! Good luck.I'm looking to insure a Model X 100D in London and thought the quoted £1200 was a lot but after seeing some of your messages here I guess it's actually decent...

RichardTheKing

Member

Hello,

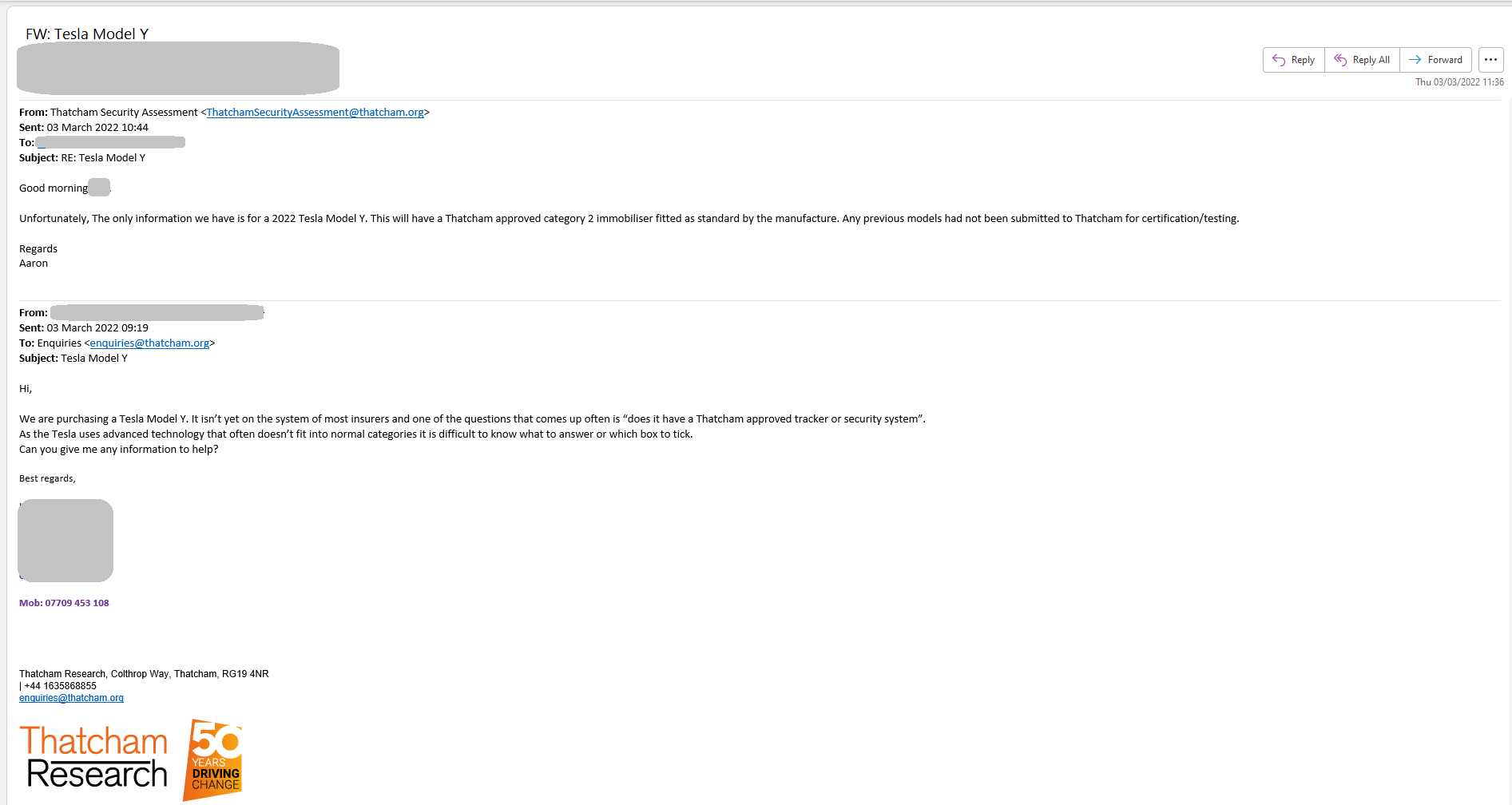

I have just received back today an email from "Thatcham Security Assessment ":

The model Y 2022 is a Thatcham approved category 2 immobiliser fitted

I have just received back today an email from "Thatcham Security Assessment ":

The model Y 2022 is a Thatcham approved category 2 immobiliser fitted

Tony Hoyle

Active Member

It's a computer controlled car.. the 'immobiliser' just that it isn't practical (if indeed possible) to bypass that to drive the car. I'd be *very* surprised if Tesla were installing extra bits of hardware to get a certification.

RichardTheKing

Member

Just received another email from "Thatcham Security Assessment ":Hello,

I have just received back today an email from "Thatcham Security Assessment ":

The model Y 2022 is a Thatcham approved category 2 immobiliser fitted

View attachment 776160

"Apologies, you are correct. The Model Y is the latest vehicle. We are currently working with them to hopefully get their vehicles up to a category 1 security standard."

On the Thatcham website found this doc and it has M3 under the cat 1 listing and MY under cat 2 listingJust received another email from "Thatcham Security Assessment ":

"Apologies, you are correct. The Model Y is the latest vehicle. We are currently working with them to hopefully get their vehicles up to a category 1 security standard."

View attachment 776219

JupiterMan

Active Member

in case it helps anyone, I've just renewed my car insurance for my model 3. I have been with Churchill the last 2 years, but this year hiked my premium by 50% at this renewal, despite clean licence and 9 yr + no claims (so no idea why!)

meerkat and direct line yielded similar premiums.... however I am a vitality member, and have been able to insure through them at a slight discount to my previous years premium.

YMMV but worth adding them to the mix when your insurance comes up.

meerkat and direct line yielded similar premiums.... however I am a vitality member, and have been able to insure through them at a slight discount to my previous years premium.

YMMV but worth adding them to the mix when your insurance comes up.

Neilman

Member

in case it helps anyone, I've just renewed my car insurance for my model 3. I have been with Churchill the last 2 years, but this year hiked my premium by 50% at this renewal, despite clean licence and 9 yr + no claims (so no idea why!)

meerkat and direct line yielded similar premiums.... however I am a vitality member, and have been able to insure through them at a slight discount to my previous years premium.

YMMV but worth adding them to the mix when your insurance comes up.

My next (3rd) Churchill insurance premium will be due early September. The first two were £450 each.

I've had a windscreen replacement (done by Tesla not Autoglass) a few months ago and in spite of "won't affect your premium" it still might be more expensive this year if everyone is getting a 50% boost in premium.

I did find shopping around premiums, even from Churchill, £600+ last year so was pleasantly surprised when Churchill only charged "same as first year" renewal premium. I expect to be disappointed this year though.

Jason71

Well-Known Member

They have me my cheapest quote this year £100 less than I paid last year so they can still be competitive. I am not a current customer.My next (3rd) Churchill insurance premium will be due early September. The first two were £450 each.

I've had a windscreen replacement (done by Tesla not Autoglass) a few months ago and in spite of "won't affect your premium" it still might be more expensive this year if everyone is getting a 50% boost in premium.

I did find shopping around premiums, even from Churchill, £600+ last year so was pleasantly surprised when Churchill only charged "same as first year" renewal premium. I expect to be disappointed this year though.

greenbottle123

Member

try a new customer quote for churchill and be wary that vitality do not offer a tesla loan car or approved tesla repairerin case it helps anyone, I've just renewed my car insurance for my model 3. I have been with Churchill the last 2 years, but this year hiked my premium by 50% at this renewal, despite clean licence and 9 yr + no claims (so no idea why!)

meerkat and direct line yielded similar premiums.... however I am a vitality member, and have been able to insure through them at a slight discount to my previous years premium.

YMMV but worth adding them to the mix when your insurance comes up.

Still waiting on a renewal quote from Admiral for mine that is due up mid August, was £525 last year, just done a compare the market and got a quote of £367 for this year from Churchill, quite amazed i actually found it cheaper to be honest.

Thats for me 34Yrold, 11Yrs No Claims just outside Edinburgh

I wonder as mine as it's a new build estate (3 years old anyway) now my address actually shows up has caused it to go down a bit

Thats for me 34Yrold, 11Yrs No Claims just outside Edinburgh

I wonder as mine as it's a new build estate (3 years old anyway) now my address actually shows up has caused it to go down a bit

curmudgeon

Member

Alistairuk

Member

That's good to know - Im pretty much same 36, 11 years no claims, just a bit further from Edinburgh and it went down £100 last year with Churchill over what they charged the first year, so hopefully it stays same or doesn't vary too much when it's due end of August.Still waiting on a renewal quote from Admiral for mine that is due up mid August, was £525 last year, just done a compare the market and got a quote of £367 for this year from Churchill, quite amazed i actually found it cheaper to be honest.

Thats for me 34Yrold, 11Yrs No Claims just outside Edinburgh

I wonder as mine as it's a new build estate (3 years old anyway) now my address actually shows up has caused it to go down a bit

Looks like LV= will now insure cars that are company owned i.e. the registered keeper is a company and not an individual. Previously they wouldn't do this. Just did a quick quote and looks to be roughly the same price wise as Admiral (it was the only insurer at the time who would insure a car that has a registered keeper as a company and not charge more than £1k+). They may have changed policy due to them launching their own EV leasing service ElectriX.

Also worth noting Marks and Spencers also do EV/Hybrid car insurance Electric & Hybrid Car Insurance – Get A Quote | M&S Bank

Also worth noting Marks and Spencers also do EV/Hybrid car insurance Electric & Hybrid Car Insurance – Get A Quote | M&S Bank

Last edited:

Similar threads

- Replies

- 5

- Views

- 464

- Replies

- 9

- Views

- 599

- Replies

- 2

- Views

- 369