ibGeek

Member

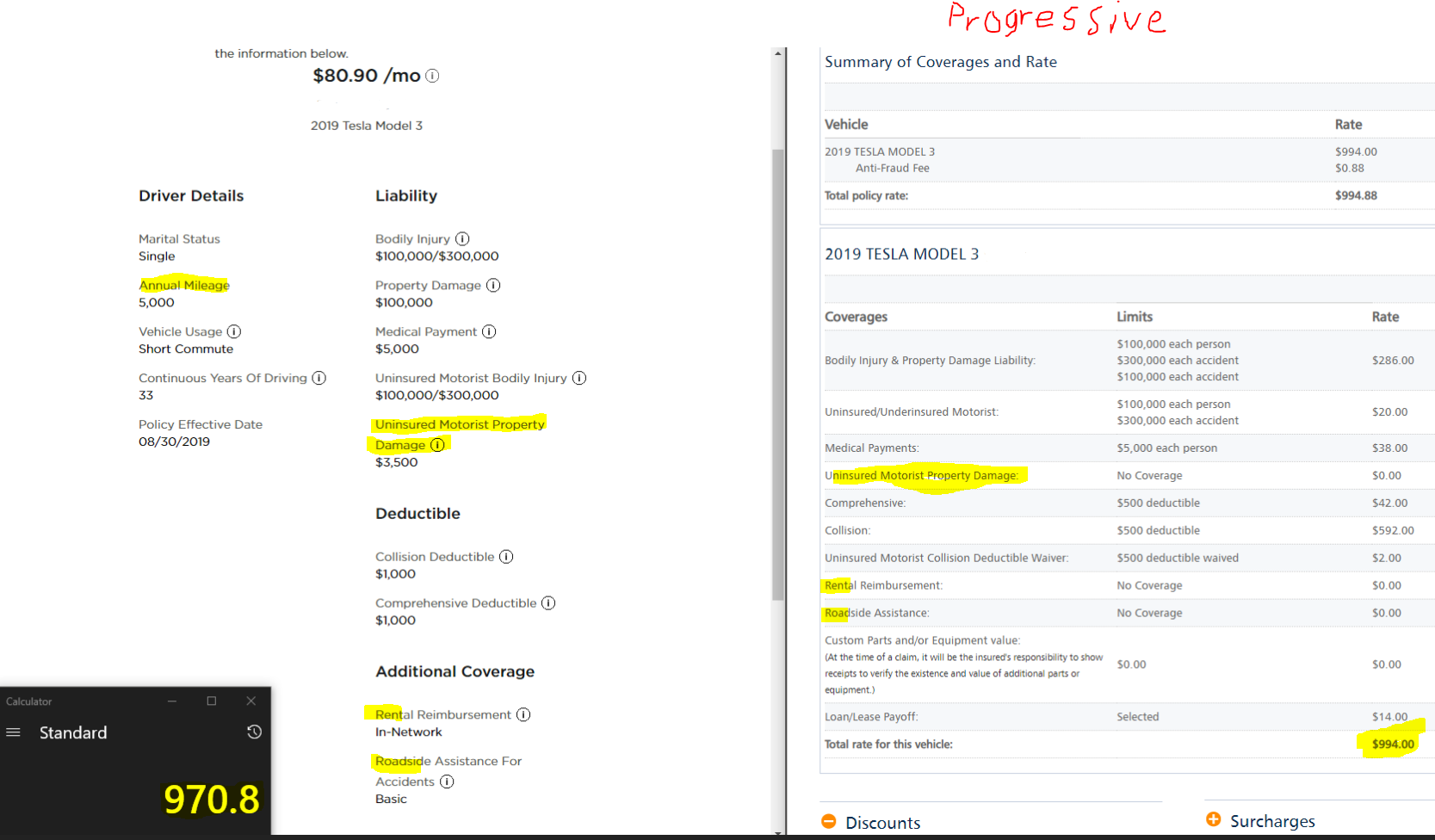

I highlighted the big differences in coverage. Tesla is on the left, my Progressive plan is on the right.

Note that if I change the annual miles to 10,000 the rate goes to $96.79 per month. It's not less than my current plan, but it does offer more features. And changing the deductible to match progressive didn't affect the cost that much. My plan is to wait two or three months, then call them and talk to a rep. I want to see if there or different options not on the website and if the prices the rep give out match the quote.

I'll likely change to them though. Progressive has been jacking up my rates every 6 months since I got my M3, so it wouldn't take long before Tesla was cheaper.

Note that if I change the annual miles to 10,000 the rate goes to $96.79 per month. It's not less than my current plan, but it does offer more features. And changing the deductible to match progressive didn't affect the cost that much. My plan is to wait two or three months, then call them and talk to a rep. I want to see if there or different options not on the website and if the prices the rep give out match the quote.

I'll likely change to them though. Progressive has been jacking up my rates every 6 months since I got my M3, so it wouldn't take long before Tesla was cheaper.