Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla EV Tax Credits coming back?

- Thread starter hnguy054

- Start date

Several things may happen then, for example:I feel like if this gets passed and and it only starts with purchases 1/01/22 and after no one will be purchasing a Tesla in December of this year

1) Europe will get a boatload of new Teslas

2) The price maybe lowered significantly for those buying in 2021.

Fluffhead

Member

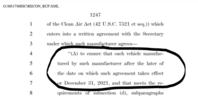

Line 4, page 1247This has been brought up before, and nobody can find any proof of this. We should stop pushing this rumor.

65 pages of reading comments is long. lol

is the general consensus that the EV credit will NOT be valid for those vehicles (2022's) purchased before the new year? i can't seem to find any hard evidence that this may apply retroactively to cars purchased or delivered in say...November...?

is the general consensus that the EV credit will NOT be valid for those vehicles (2022's) purchased before the new year? i can't seem to find any hard evidence that this may apply retroactively to cars purchased or delivered in say...November...?

pgcoco

Member

It would be nice if the credit is for 2022 vehicles then it should start after Nov 1 of this year since Tesla is giving 2022 cars starting Nov 1, 2021

Consumers will be very happy if this happens but who knows what is going to happen.

Plus, if this doesn't happen, consumers are going to put their orders on hold until January of next year and then who knows how long of a wait it will be? To be honest its hard to say No to $8k

Consumers will be very happy if this happens but who knows what is going to happen.

Plus, if this doesn't happen, consumers are going to put their orders on hold until January of next year and then who knows how long of a wait it will be? To be honest its hard to say No to $8k

voxel

Active Member

Line 4, page 1247

So people don't have to search

Attachments

Spidey616

Member

The May 2021 retroactive piece was in senate legislation months ago. It has been replaced with what came from the House Ways and Means Committee and there has been no mention of retroactive credits in any of the updated legislation. I'd be shocked if that got inserted into the existing legislation that has been published for review and vote.

That's the oddly worded 2022 text I referred to. So, the manufacturers must agree to something for cars made starting in 2022. How exactly this connects to who gets the tax credit isn't jumping out to me. A 2022 VIN? A car purchased in 2022? A car made in 2022 (or later) that is purchased?So people don't have to search

It'd be a shame to hold an order to find a November 2021 with a 2022 VIN would qualify. I'd be worse to hold, get the car in January, and find out you don't qualify because the car was made in December.

No retroactive credits.65 pages of reading comments is long. lol

is the general consensus that the EV credit will NOT be valid for those vehicles (2022's) purchased before the new year? i can't seem to find any hard evidence that this may apply retroactively to cars purchased or delivered in say...November...?

voxel

Active Member

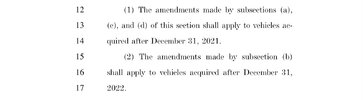

So later on in the law it says acquired after so I think I was wrong (at least for the tax credit portion we care about).That's the oddly worded 2022 text I referred to. So, the manufacturers must agree to something for cars made starting in 2022. How exactly this connects to who gets the tax credit isn't jumping out to me. A 2022 VIN? A car purchased in 2022? A car made in 2022 (or later) that is purchased?

It'd be a shame to hold an order to find a November 2021 with a 2022 VIN would qualify. I'd be worse to hold, get the car in January, and find out you don't qualify because the car was made in December.

Attachments

t.e.s.l.a_dude

Member

Gem!ni

Member

Yes, it means purchase date.

No this is wrong. The language being used is either the car has to be manufactured in 2022 or "acquired" during 2022.

There's no version of the bill that mentions purchase date.

t.e.s.l.a_dude

Member

I assumed the below but I might be wrong:No this is wrong. The language being used is either the car has to be manufactured in 2022 or "acquired" during 2022.

There's no version of the bill that mentions purchase date.

acquired = purchased

currently looks like the incentives will both be refundable. If you take ownership in 2022 when you file taxes for 2022 you will receive your money back. If you purchase in 2023, it will be a point of sale rebate.do we know yet whether it will be at the point of sale or refunded when you file the 2022 taxes?

Jgbaggins

Member

ok, thank you for that.currently looks like the incentives will both be refundable. If you take ownership in 2022 when you file taxes for 2022 you will receive your money back. If you purchase in 2023, it will be a point of sale rebate.

Similar threads

- Replies

- 51

- Views

- 6K

- Sticky

- Replies

- 387

- Views

- 21K

- Replies

- 1

- Views

- 544

- Replies

- 0

- Views

- 105

- Replies

- 9

- Views

- 859