RobStark

Well-Known Member

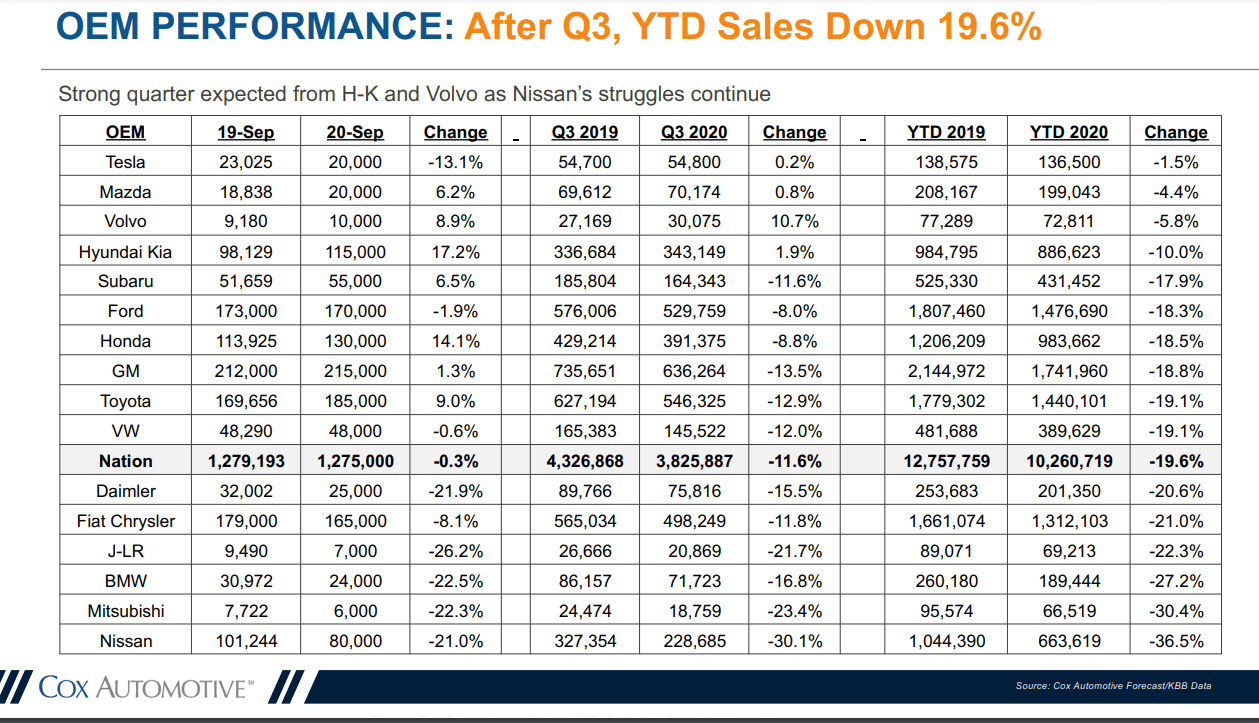

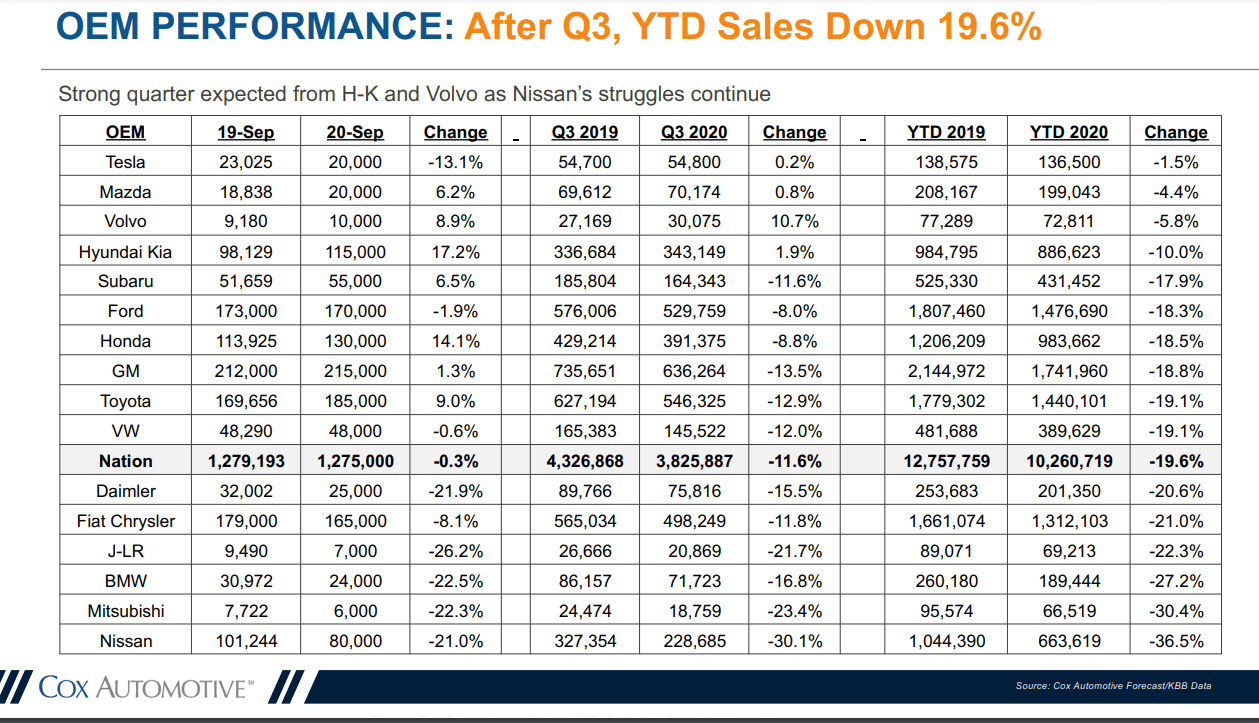

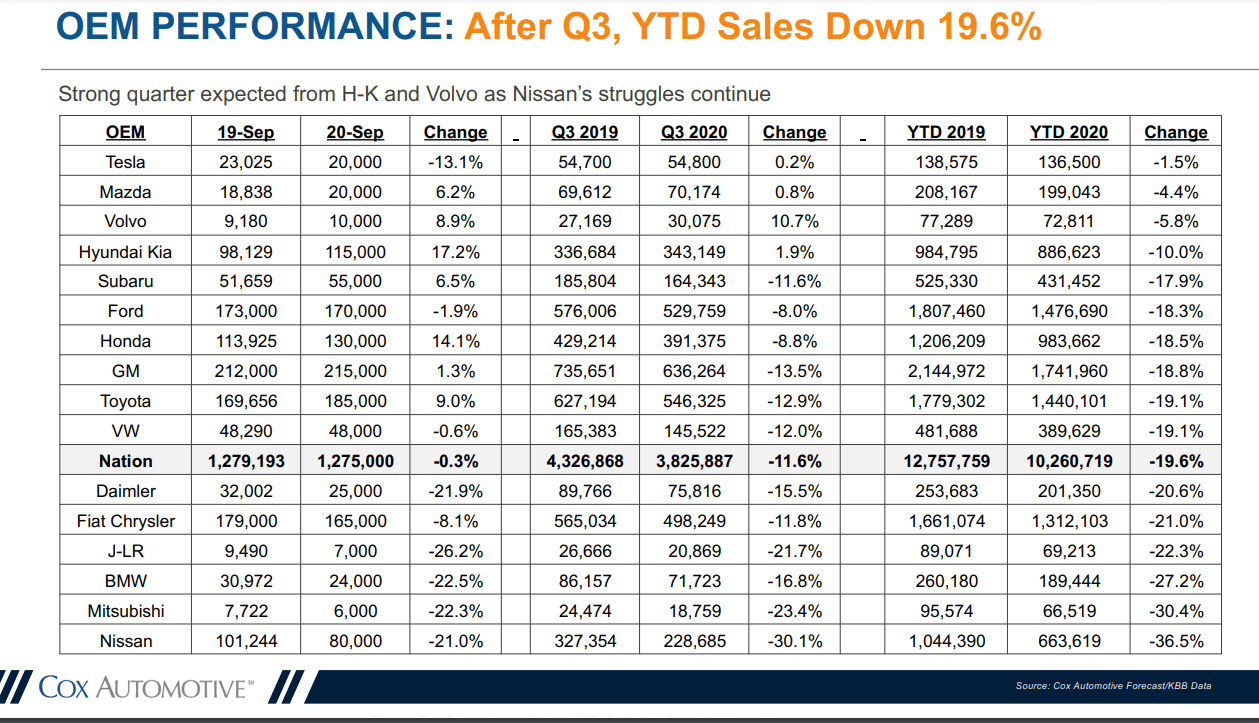

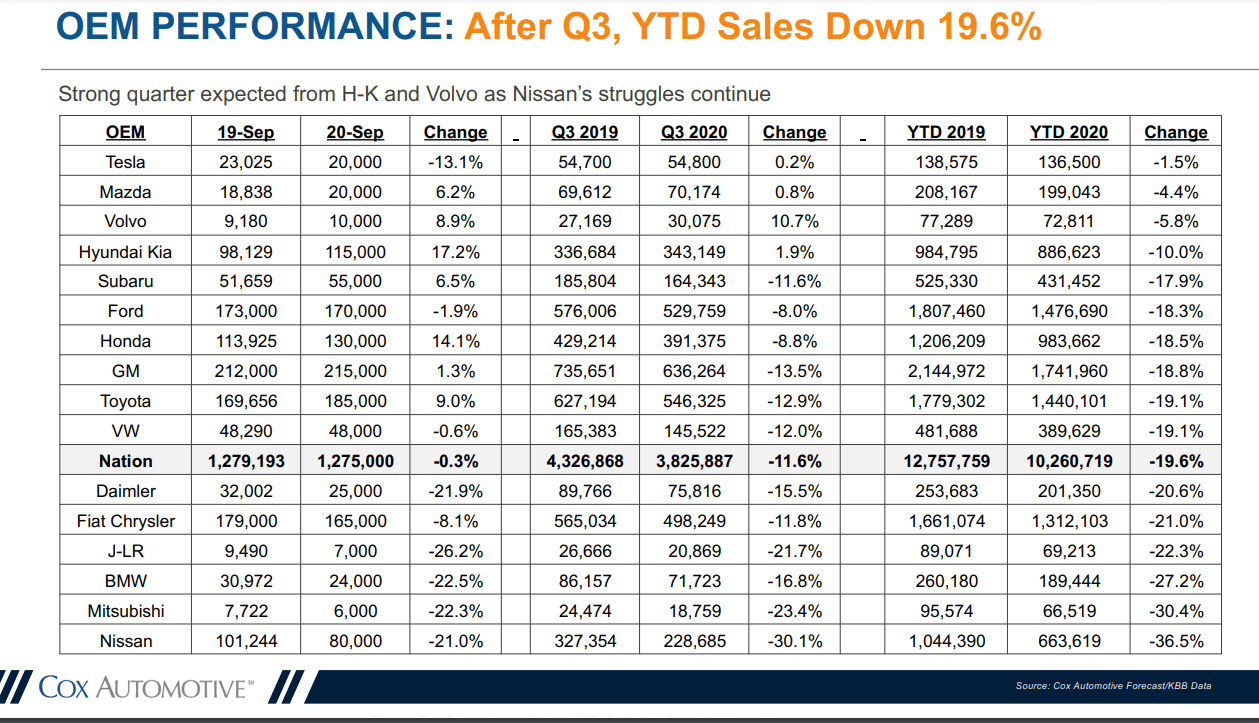

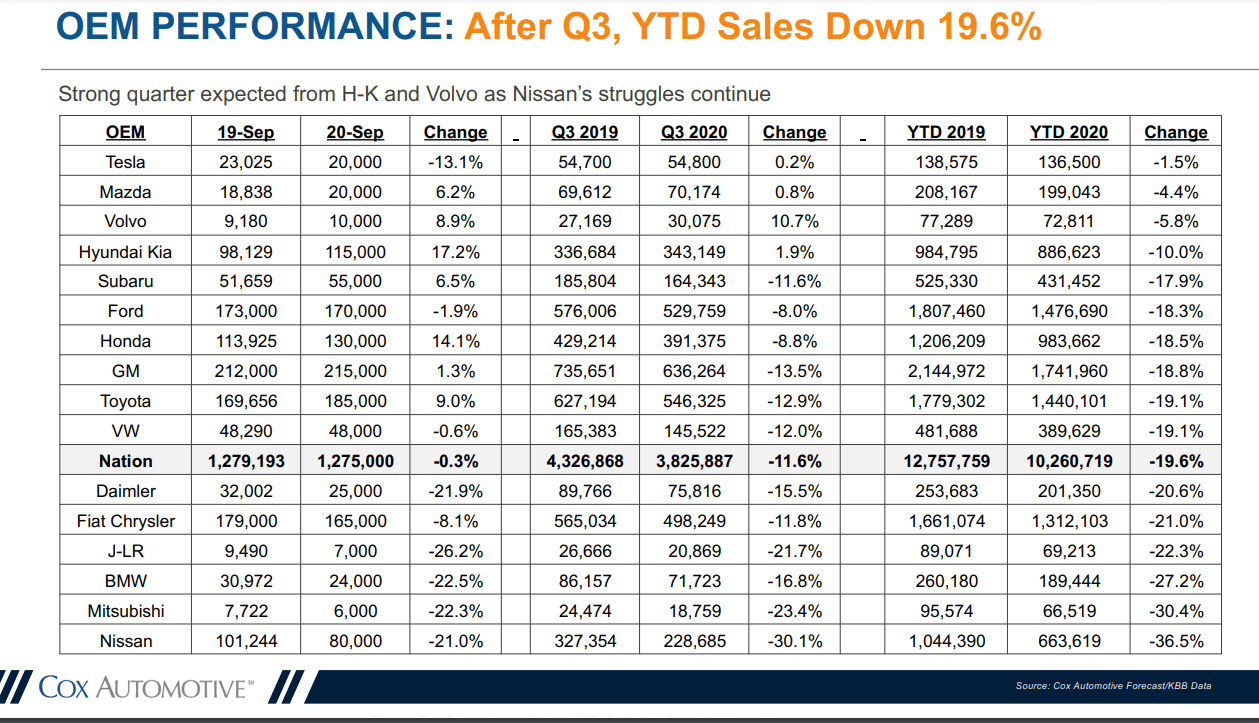

US market according to Cox Automotive

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I know QC issues aren't popular here but reddit has stickied a post where a new MY owner had their entire roof blow off as they were driving down the highway away from picking up the vehicle from the Tesla store. Obviously anecdotal, but quite incredible.

So Tesla’s quality control is really bad. Our brand new model y’s entire roof just fell off : teslamotors

One day I might learn how to disable "spellcheck" that resembles 'lost in translation' . My own typos are so common I almost expect spellcheck to accentuate my mistakes.OT: So...

...

Cheers!

Possible causes and glass roof assembly process posted by another redditor who possibly previously worked in Tesla assembly - points to poor training -- Roof fell off : RealTeslaI know QC issues aren't popular here but reddit has stickied a post where a new MY owner had their entire roof blow off as they were driving down the highway away from picking up the vehicle from the Tesla store. Obviously anecdotal, but quite incredible.

So Tesla’s quality control is really bad. Our brand new model y’s entire roof just fell off : teslamotors

My SAY question was precisely this, but didn't get answered - was the raise for operations, or to implement battery day technology.Buying ATW, adding more land in Austin, potential nickel deal with Indonesia, R&D and maybe GF in Karnataka, Lithium Hydroxide refinery in Texas, massive deal with Piedmont. Tesla has been busy since Battery Day... Maybe that is what those $5B are going to. When they did the $5B raise they had a list of things needed to be done to get to 3TWh in 2030 and came up with a figure that should cover it and raise it. Not for the hell of it or because they could, no because that was the correct figure that they needed. This quarter should add $800M to their war chest, I expect Musk to keep spending and maybe raising so expect many new announcements and acquisitions over the next years...

US market according to Cox Automotive

Sure. Long Term Capital management did it too, Nobel Prize winners included. Every one of these has outsized success until they become large enough to move a market or unusual events happen, either one. Every statistical model including every AI application has 'boundary conditions' beyond which the models do not work. James Simons has learned enough to limit growth objectives when that happens. When the economy is in uncharted territory (e.g. COVID-19, large scale environmental catastrophe, sudden protectionist measure in major economies) almost no models can be assured of applicability. But...Most people who trade the market do have terrible returns, but some very smart people in fact did figure out the market, and they did it over 30 years ago. but no one has successfully managed to copy them consistently.

... James Simons is regarded as the best money manager ever. They created successful mathematical models for trading - using a roster of exceptional scientists, but it only scales to a certain size before their trading size starts to impact their returns negatively, so they limit there trading to a level where they "only" make billions a year in their closed funds, rather than hundreds of billions.

I'm continually shocked as to why they aren't more well known...

Possible causes and glass roof assembly process posted by another redditor who possibly previously worked in Tesla assembly - points to poor training -- Roof fell off : RealTesla

Nice to see the rear view mirror getting more populated. Volvo, Mitsubishi and Jaguar-Land Rover all behind us now. 2021 should see Tesla pass BMW, Mazda and Daimler in the USA. VW and Subaru at around 400,000 cars are not likely to be caught until 2022. When Austin starts cranking out Model Y’s, I’d expect Model 3 and Y to have some price cuts that will expand the market demand by another 50%. Market share will also continue to expand based on consumer knowledge of Tesla, perceived quality improvements, retained value and tech leadership. The Apple like brand image of Tesla versus everyone else.US market according to Cox Automotive

Just received the message below from my UK broker about a mini-tender from Ponos Industries LLC, who want to buy up to 500k TSLA shares at $420 (I'm not making this up!). I'm not selling any shares, but would be interested to know if anyone knows anything more about this.

It says that Ponos will only go ahead with the purchase if the SP is above $420 when the offer completes. Who would agree to sell their shares for less than the market price?!

View attachment 595520

This sort of offer verges on a scam. Best advice is to ignore.I got one from HL as well. Not sure that such a contract would be legal in UK. Sales of Goods Act, Distance Selling regulations etc.

Seems a VERY BAD offer, very odd, presumably taking advantage of people who aren't following Tesla closely.

Some really nice aerial shots of Giga Berlin from today, courtesy of @gigafactory_4.

The rate of progress has honestly really surprised me; way beyond what I would have expected in Germany.

See this and this google photos album for regular updates - highly recommended!

View attachment 595052 View attachment 595054 View attachment 595055