This is a new personal record for me. (Artifact on an options position from the glitch in options pricing.)

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Financial markets LOVE to over react. Making a hen out of a feather and all that. Fear, uncertainty, and doubt - Wikipedia

And when they do you deploy your dry powder.

strago13

Member

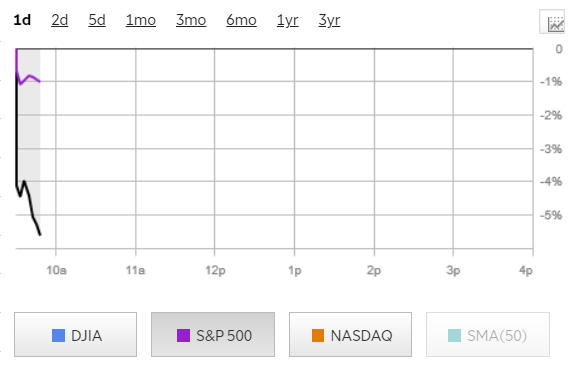

Compared to S&P 500, we're doing great I think. Expected worse myself.

Letting others use the Tesla Superchargers will be a win for Tesla. Can you imagine pulling into a Tesla charging station in a crappy ID3, sitting next to a bunch of beautiful Model 3s, feeling the glare of all the Tesla owners. Likely that VW owner will buy a Tesla next time....

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

And when they do you deploy your dry powder.

I agree with this.

But to give a bit more nuance to the discussion: The market is super near sighted. For example: vaccines were announced and a few people got a shot last week. Markets react like the pandemic is over. Then we get a reminder it isn't - cases increase in the UK (which is true, even though it's probably not because of a "super-strain" of Covid, the same old SARS CoV2 that we've had all along is plenty infectious as it were) and all of a sudden the markets again over react in the other direction.

I know it's not really directly TSLA related, but seeing how concecus seems to be that the downturn is due to "new strain of Covid" in the UK. (I'm an MD and follow this stuff closely, so I think I know what I'm talking about): It's not a new strain, it's a variant. It's called SARS-CoV-2 VUI 202012/01. It is one of many genetic variants of the virus. It's been the main variant spreading in the UK. There is no reason in particular to think it's more infectious or more virulent (disease causing) than other variants, probably through chance it's just the one that spreads a lot currently in the UK. Again - it's NOT a new strain. Strain and variant are not the same. In fact since the start of the pandemic there has been no new strains. This variant most likely is biologically equivalent to all other variants known.

https://www.ecdc.europa.eu/sites/de...le-spike-protein-mutations-United-Kingdom.pdf

Note: Me saying "it's not a new strain, but a new variant" uses the nomeclature of the experts - that I would highly trust - in the podcast TWIW - This Week in Virology, which I've been following every episode of in the last year. They haven't been wrong once on this stuff. If you have time listen to the last episode: TWiV 696: Tear down that SARS-CoV-2 manuscript | This Week in Virology

How does this "Strain" affect the Moderna and Pfizer vaccines? I heard that they have been touting that it doesn't affect it, but can we really be sure this early? Is it possible to be certain without running clinical trials on people especially with only this new strain?

Variant, not strain. The Doctor has spoken earlierthis new strain?

Low volume on the opening cross this morning (520k shares paired), and it occasionally popped up with a sell-side imbalance - further supporting the idea that index funds have all the shares they need.

In terms of the order book, standing orders are skewed to the sell-side, with approximately 730k shares' with of sell orders between current price and $700.

Yes and I imagine the 650-660 level is acting as great support because there are other buyers, namely benchmark?

There was a big trade that happened premarket at 695$ so that explains the spike from the lows this morning. Somebody accumulating enough shares to sell to an index fund at a predetermined price of 695$. Pretty amazing how efficient our markets here

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

How does this "Strain" affect the Moderna and Pfizer vaccines? I heard that they have been touting that it doesn't affect it, but can we really be sure this early? Is it possible to be certain without running clinical trials on people especially with only this new strain?

Scientific concencus is that the vaccines will work well for this variant too. The spike protein is a very "soft target" with many epitopes for the immune system to react to. Think of it this way: if the genome of the virus mutates so much that the spike protein changes a lot, making the vaccines ineffective against that new virus variant, then that variant would also likely no longer be effective in spreading and causing disease - since the spike protein is very important for the virus' infectious mechanism. It's highly conserved.

Knightshade

Well-Known Member

Exactly. Elon's actual words were garbage. Unreality. Fantasy. Simply useless as regards FSD.

So why do you keep castigating people for not believing Elon's actual words? That's what I asked. And you either misinterpreted or ignored. Don't you pay attention to yourself and your own arguments? I'm objecting to your inconsistency.

It's not inconsistent at all, you're simply ignoring the 60 minutes quote.

Elon is telling you ignore him when he's giving you a timeframe for finishing something he's never done before and is not actually done yet.

He's admitting he's guessing.

It's an informed guess, but always a very very very optimistic one, and very often a wrong one.

Which explains all the missed FSD deadlines (and various other ones the first time he tries to do something).

That doesn't mean ignore everything he says- just the bit about when it'll be finished (or how hard it'll be to get there).

Ummm...probably because FSD revenues already have a huge impact on Tesla's profitability and this will only grow as the technology matures.

In other words because it's highly relevant to an investment in TSLA.

Exactly... actual "solved" FSD is at least one 0 added to the end of the share price... possibly more depending on the details.

It's not priced into the stock yet beyond very fractionally as a bet on Tesla delivering it as a general solution (far more scalable than what most others are working on with LIDAR and HD mapping)

The good news for investors is if you win that bet, massive massive upside... and if you don't, it's not like there isn't plenty of existing upside to look forward to in lots of other places in the company.

lafrisbee

Active Member

Dear Elon,

Release the new renditions of the cybertrck on Christmas Eve. Consider the fact I was a very good boy this year. Go ahead check your list ( The Mods are LIARS, do not believe them). And I deserve a big present.

Releasing the new rendition will support the SP, or give it a nudge up so it is Investor related.

But even if it wasn't, a significant percentage of the investors are invested in getting a cybertrck(notatruck).

Release the new renditions of the cybertrck on Christmas Eve. Consider the fact I was a very good boy this year. Go ahead check your list ( The Mods are LIARS, do not believe them). And I deserve a big present.

Releasing the new rendition will support the SP, or give it a nudge up so it is Investor related.

But even if it wasn't, a significant percentage of the investors are invested in getting a cybertrck(notatruck).

JRP3

Hyperactive Member

Can you imagine pulling into a Supercharger in your beautiful Model 3 and having to wait for a crappy ID3 to finish charging?Can you imagine pulling into a Tesla charging station in a crappy ID3, sitting next to a bunch of beautiful Model 3s, feeling the glare of all the Tesla owners.

OK, now I'm diversified?

Not really, but ARK Genome might hedge some of the covid fears.

Not really, but ARK Genome might hedge some of the covid fears.

Ms. Woods recently said she saw more upside in genomics than TSLA.OK, now I'm diversified?

Not really, but ARK Genome might hedge some of the covid fears.

View attachment 619721

Can you imagine pulling into a Supercharger in your beautiful Model 3 and having to wait for a crappy ID3 to finish charging?

But not if they're paying Tesla for ENERGY.

I can imagine more stalls paid for by ID3s. Hopefully spaced at shorter distances to accommodate their range. Come on Henryetta, OK! Don’t make me buy that chademo adapter.Can you imagine pulling into a Supercharger in your beautiful Model 3 and having to wait for a crappy ID3 to finish charging?

From the UK Daily Telegraph.

Investors have begun ditching electric car giant Tesla as it becomes a member of the S&P 500 index with a 1.7pc weighting from today.

<snip>

Mr Whiston added that if chief executive and founder Elon Musk left the company, shares could plummet as Tesla's fate is closely linked to Musk’s actions. “We see immense key-man risk for the stock,” he said.

William de Gale, a technology specialist at investment manager BlueBox, said Tesla the S&P inclusion played in to the hype around the company but would no longer spur its share price higher.

“Its inclusion was a one-off event and now it’s done. It is time to take some profits and use the cash for something concrete, such as paying off part of a mortgage. Tesla is changing the world, but I would rather invest in boring companies companies which are less volatile and more profitable.”

Investors have begun ditching electric car giant Tesla as it becomes a member of the S&P 500 index with a 1.7pc weighting from today.

<snip>

Mr Whiston added that if chief executive and founder Elon Musk left the company, shares could plummet as Tesla's fate is closely linked to Musk’s actions. “We see immense key-man risk for the stock,” he said.

William de Gale, a technology specialist at investment manager BlueBox, said Tesla the S&P inclusion played in to the hype around the company but would no longer spur its share price higher.

“Its inclusion was a one-off event and now it’s done. It is time to take some profits and use the cash for something concrete, such as paying off part of a mortgage. Tesla is changing the world, but I would rather invest in boring companies companies which are less volatile and more profitable.”

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M