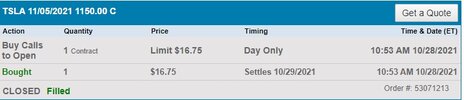

Actually, I would also be interested in this topic as well. For my REQUIRED RRIF withdrawals which began when I retired this year, I'm moving shares to a non-registered account, and only selling the minimum # of shares to cover the withholding tax. Yesterday was my first ever sale of TSLA shares that I've been holding with diamond hands since Jan 2016. It was relatively painless when I looked at what they actually cost me almost 6 years ago.

Currently Island shopping, and taking Flying lessons to keep me occupied in the mean time, hoping to soon join the airborne members (

@OrthoSurg ,

@BornToFly, +?) of this community.

I would also like to add my voice to the chorus of Thanks for the invaluable contributions to this forum by so many intelligent, articulate individuals from such a wide range of back-grounds, experience and geographic locations, which gave me the confidence not only to hold through the tough times, but to go all in during the darkest days of early 2019.

Edit to add: 10 years ago, the situation I'm in today was in-fathomable. Thank-you TSLA! Thank-you TMC!