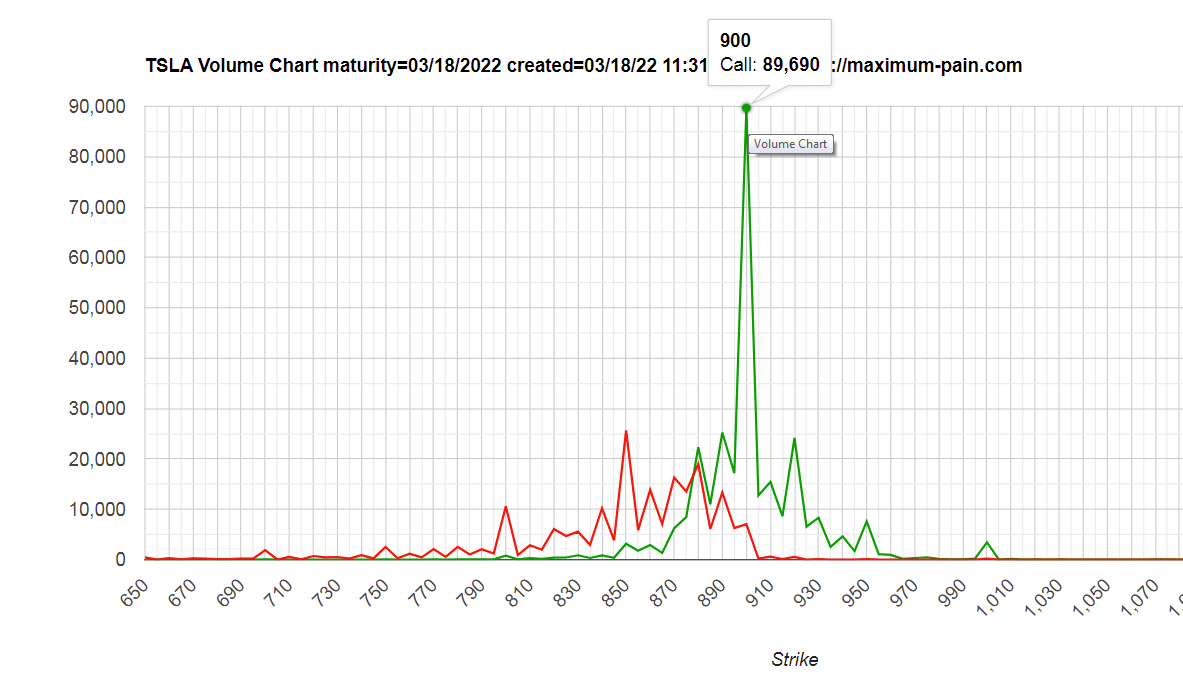

Check out Call Options at 900. That's the main event for sure.

Getting some popcorn kernels for the battle near close today.

Getting some popcorn kernels for the battle near close today.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Max pain is 840 as of open today, probably higher with all the call buying. I dont think this gets held under 900.Volume is fading a bit. I'd be VERY impressed if these guys can do an 850 close. Would probably lever up at 3:55 selling shares for LEAPs.

I do, today anyway for an 899.99 close. Monday though, hoping for 900+Max pain is 840 as of open today, probably higher with all the call buying. I dont think this gets held under 900.

Nobody knows everything. You have to mix them together. Sandy understands exoskeleton applications and production scale paint shop costs that are critical to CT. Seems to me a good investor is looking for as much input from varied sources as can be had.

When is Tesla going to start testing cars without drivers in them?

Videos like this are going to take over the FSD conversation, where there's literally no one in the driver's seat

When is Tesla going to start testing cars without drivers in them?

Videos like this are going to take over the FSD conversation, where there's literally no one in the driver's seat

Far as I'm concerned, they can take their time until they know we've got it right so there are no incidents for a very, very long time after this starts.When is Tesla going to start testing cars without drivers in them?

Videos like this are going to take over the FSD conversation, where there's literally no one in the driver's seat

£682.89$900

Ahh, it is so good to see the good old Mid-Morning-Dip returning

/s

ps: I'm sure MMs are hard at work on it, though...

It would probably be best to understand the different levels of autonomy first.When is Tesla going to start testing cars without drivers in them?

Videos like this are going to take over the FSD conversation, where there's literally no one in the driver's seat

Merit please, great advice!More information is not always better. Particularly if it's from a source that, on the surface, should be trusted. It's difficult to ignore information presented in an authoritative manner.

I attribute my success as an investor over the years by actually sharply limiting the amount of input from specific places. In particular, everything on TV. Especially brokerage analysts and talking heads. I particularly avoid listening to any predictions of share price movements and over/under valuation talk. I've found it's counter-productive to my portfolio performance unless I'm able to use them as contrarian indicators. When I am exposed to those sources, I generally do the mental equivalent of this:

Remember, dead people can't hear, and they have better portfolio performance than people who are alive.

It's not that I don't want to hear something unpleasant, it's that there is too much bad and misleading information to parse for investment purposes and that by limiting it to fewer sources, it can lead to better performance. It's important that you don't filter information based upon what confirms or conflicts with your personal beliefs but that you filter information in a wholesale manner. Sure, I miss plenty of accurate information, but the overall effect on my performance is worth it. We are bombarded with low-quality, misleading and short-term info. It's easy to over-complicate investing or to over-look simple but relevant factors. Simplifying can generally bring a better, more accurate perspective to complex scenarios.

Munro has a ton of expertise, but he often opines outside his areas of expertise. I will generally listen to what Munro has to say but discount it heavily or entirely if he's outside his area of expertise or it doesn't make any sense (as in the case of the woven carbon fiber rotor wrap). Sometimes you actually know more than the 'experts'. Artificial intelligence using neural nets is well outside Munro's area of expertise. The problem here is the nature of the human brain is that it's difficult to discount something you have already heard. Not hearing things, to your advantage, is a learned skill.

650 guineas. All but 2 of my family's trades are positive now. Last two were in a weird account that isn't very flexible and total 3 shares.£682.89

I took a look at your post history because of the reply to your post. So, my question to you, is when can I look forward to a constructive post from you - that I could learn something from? /s. I can look at SA to get the above.When is Tesla going to start testing cars without drivers in them?

Videos like this are going to take over the FSD conversation, where there's literally no one in the driver's seat

Big.

I see ~36k stocks there (all i see up to ~1000 is 120k in total). Nothing that can't be broken, though.

What i compare most is what i see on "both sides". Up to 901 there are 60k in total. 60k on total on the bid side go down to 832. So from a L2-viewpoint 901 and 832 are "equal distant". Now look at the SP: 890 (as i write this). Maybe selling 905c is safe todayBut im not gonna play with THAT fire