Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

X Fan

Active Member

dc_h

Active Member

How much capacity can the old systems build? I thought they maxed out at 3000 a week, which would be great for now. It would seem they are also using those somewhere offsite near the plant, but not onsite. The statement about producing locally didn’t address volume, so it could be early pilot production. We also don’t have any information on cells from CATL or LG. If anyone has any insight into local cell, please post.Battery pack production began in December. But they still need battery cells from somewhere else to put in those packs.

And if the rumors are true the pack production is using the old, slow, equipment that used to be at GF1.

ZachF

Active Member

humbaba

sleeping until $7000

Never fear, the sand is deep and they can't hear, much less see, what is going on.I love the smell of capitulation in the morning.

View attachment 497919

China allowing Tesla to not have a partnership apparently places them under de facto CCP control?

@connerben said:If Tesla is now under de facto CCP control, numbers will simply be made up

There is still confusion about EV credits (hint: Tesla doesn't sell EV credits) and magical claims about fraudulent accounting.

@KingPickleRick1 said:What part has turned around? The end of the day is that Tesla cannot make money selling cars. Whatever profits they make are usually 60-70% from selling EV credits coupled with accounting musical chairs. Period. That’s the bear case. Tesla can’t make money to sustain themselves.

There you have it, that's the bear case, a fantasy wherein the Shortseller Enrichment Commission has failed them and cost some their homes. But if that doesn't float your boat, for some inexplicable reason the Chinese government is paying the bills because Tesla can't make money and is losing it faster than ever.

@DieselGuy696 said:Their business is structurally the worst it's ever been and nothing new legitimately in the pipeline. CCP financing is holding it all together until a Trump v Musk blowout or he falls out of favor. Until then it's just going to keep incinerating cash.

But if you just want to see blind optimism where massive losses are instead massive profits...

bolding mine. I've been puzzling over it because it seems so far fetched its got to be a parody, right? But he seems to be serious. And then people are confused about the distinction between Musk's personal wealth and that of his companies.@BongripCapital said:If you could point to financial & operating data to back that hunch up I’d be happy to listen. Even if the mortal sin is underestimating demand for the story from Elonians, show me another stock that makes as compelling a short vs long positions.

I have some schadenfreude on this one... I gotta admit, I'm rooting for him to hang in there.@MyTsla said:Tesla "could" raise and should, but Musk is probably the richest he's ever been and feeling totally giddy. I doubt he will raise.

@CSecured said:Not covering a share til SCTY litigation outcome in March. After reading the deposition, I can’t unsee it. Naively believe it’s so egregious, something will shake loss & veil removed, on top of ongoing long term brand destruction. Lotto calls used to offset some losses. LFG.

But you do get occasional moments of lucidity:

@vannapalooza said:...snip...

Investing is hard.

My 1000 shares just became a 2-bagger

Just three more doublings to go.

Just three more doublings to go.

MartinAustin

Active Member

I don't have that kind of intestinal fortitude.Could the best strategy really just be as simple as gambling massive amounts of money on deep OTM weeklies?

Wait, you guys have been able to work? All I can do is hit watch the pretty green numbers.Heck, if this continues for another few months I might quit my job and be a full time TSLA stock watcher.

Pezpunk

Active Member

The way things have gone lately, maybe by the end of the day.

the end of the day? pessimist.

I really want to share my excitement with people I know but don't want to come off as gloating. TSLA problems these days...

Causalien

Prime 8 ball Oracle

Fark.

Have to quickly login to place limit sell orders for $900 in case VoltsWagen style squeeze really happen.

It happened within only a few days and about a $400 rise near the end. Not a good time to be flying. But if I recall correctly, I am always greeted with a positive stock price when I pand.

Have to quickly login to place limit sell orders for $900 in case VoltsWagen style squeeze really happen.

It happened within only a few days and about a $400 rise near the end. Not a good time to be flying. But if I recall correctly, I am always greeted with a positive stock price when I pand.

StealthP3D

Well-Known Member

I like how this thread has gotten numb to new ATH's.

That's funny, because @mact3333 was just protesting that we were being too euphoric.

Which is it?

Personally, I believe it's 100% normal for investors to cheer recent gains. Of course, people who sold because they doubted it could continue to rise are probably not feeling as much love. Don't worry, that's normal too! It's all good.

I will point out that when I only have a "buy and hold" long position, gains have a more subdued effect because I know that at some point the stock will correct before we can move higher. The thing to remember is that no one knows where that will be and how much it will correct (and if your position is "buy and hold" it really doesn't matter).

In this case, I have a bunch of options that expire next week so the gains create an extra warmth!

Cheers!

Is the current price really that high?

Looking at the charts, TSLA went as high as $383 in June 2017 which is 2.5 years ago. Model 3 ramp derailed that momentum, but there is a lot more visible growth in the next two years compared to even 2017. We're going from one auto factory to three along with new vehicles on the way. There are many other things in play like solar and battery storage. Most analysts don't even count any of those extras including FSD in their valuations.

I'm not saying we won't correct or try to predict where this will go, but why is $488 silly?

Looking at the charts, TSLA went as high as $383 in June 2017 which is 2.5 years ago. Model 3 ramp derailed that momentum, but there is a lot more visible growth in the next two years compared to even 2017. We're going from one auto factory to three along with new vehicles on the way. There are many other things in play like solar and battery storage. Most analysts don't even count any of those extras including FSD in their valuations.

I'm not saying we won't correct or try to predict where this will go, but why is $488 silly?

Last edited:

Congo Line

(not the dance)

I suspect that with the publicity in China around MIC M3 and start of deliveries, it has caught the attention of Chinese investors. Those who purchase M3s will realize what a great product Tesla is producing and the huge potential for this company to go far. There's a whole new set of eyes watching this stock and buying.

ZachF

Active Member

I really want to share my excitement with people I know but don't want to come off as gloating. TSLA problems these days...

Hey, hows that Tesla doing?

jkirkwood001

Active Member

They did it.

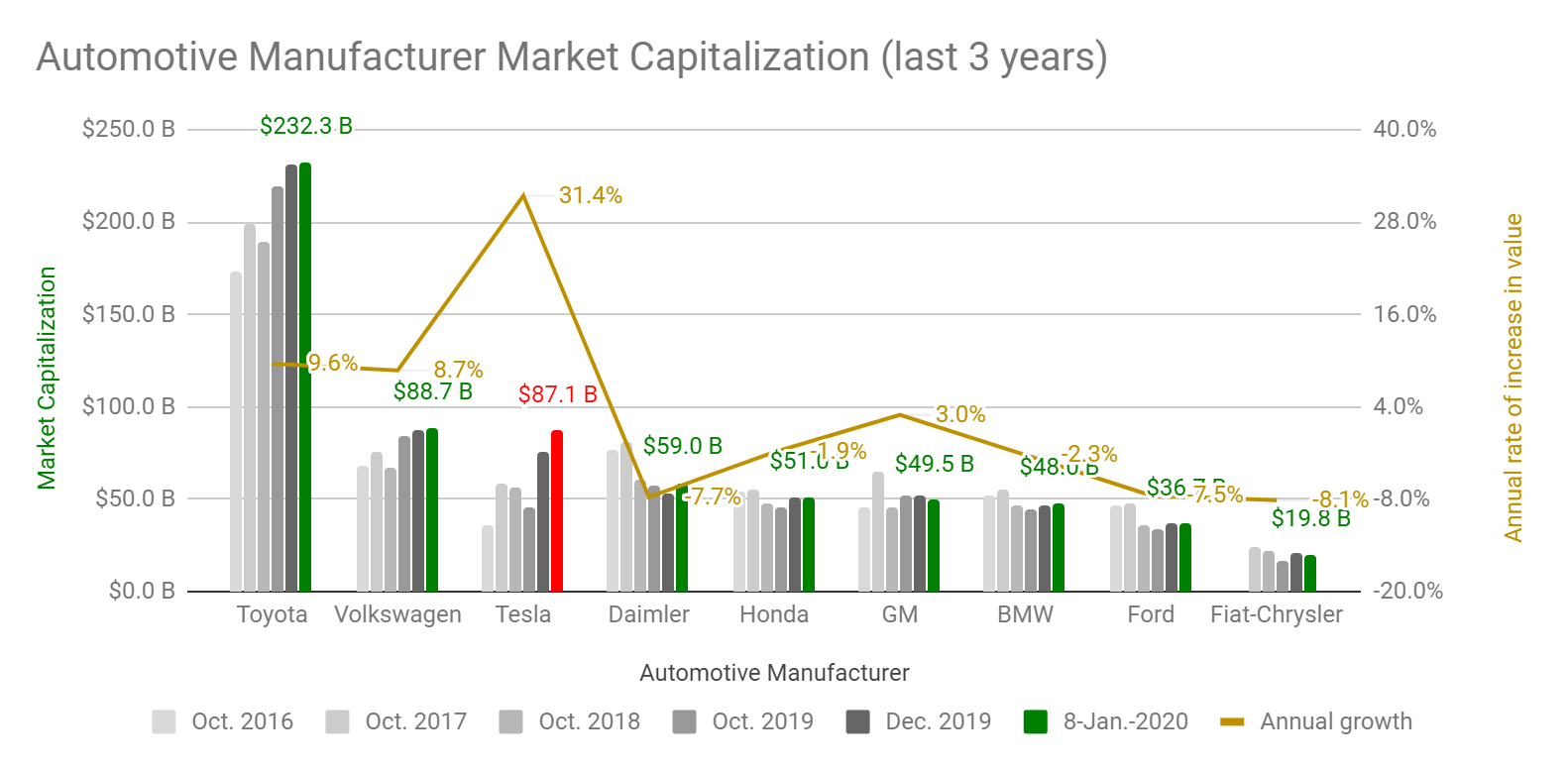

Tesla's marketcap just surpassed GM and Ford combined.

GM ($49.5 B) + Ford ($36.7 B) = $86.2 B

TSLA = $87.1 B

"Only" $1.6 B to surpass VW as the 2nd most valuable auto manufacturer in the world.

Tesla's marketcap just surpassed GM and Ford combined.

GM ($49.5 B) + Ford ($36.7 B) = $86.2 B

TSLA = $87.1 B

"Only" $1.6 B to surpass VW as the 2nd most valuable auto manufacturer in the world.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M