I’m still interested in trying to crunch some of the numbers involved with the FCA/Tesla pooling deal. I’ve found most of the info I was looking for in this post:

Tesla, TSLA & the Investment World: the 2019 Investors' Roundtable

Reference 1 had:

The

FCA 2017 fleet total vehicles = 727,201 (p. 13)

The

FCA 2017 fleet average CO2 emissions = 120 g/km (Table 3-1)

The

FCA CO2 emission targets (2020/2021) = 91 g/km (Table 3-1)

(Reference 1 already combined all the Fiat components that I listed separately in the linked post.)

The one obvious missing piece is the calculation for the pool average CO2 emission. The post I linked to above assumed it was a “vehicle weighted” average, and I still think that would be right. In fact, Reference 2 specifies the information that pool members are allowed to share and it’s the exact above parameters (Article 7 Paragraph 5). There’s not much more you can do with those than “vehicle weighted”.

Reference 2 (Article 9 Paragraph 2b) gives the post-2018 penalty (“premium”) for missing the emission target:

95 € per g/km per new vehicle. Paragraph 4 states that that

penalty goes into the “general budget” of the EU. (!!)

Given that data and assumptions, if FCA pools with a ZEV provider we can compute the pool average emissions given the number of ZEVs, or conversely the number of ZEVs needed to reach a certain emission limit. The equations are given below.

Interesting results:

First the easy one. How much trouble is FCA in? Their 2017 numbers are 29 g/km out of compliance with the 2020/21 limits (120-91).

(29 g/km)( 95 € per g/km per vehicle)(727,201 vehicles) =

€2.00 B penalty. Per year.

Ouch, but that’s the number we’ve been hearing. So far, so good.

Second, how many ZEVs would it take to get an FCA/ZEV Pool into complete compliance (91 g/cc)? Plug the numbers into Equation 2 below:

(120)(727,201)/(91)-727,201 =

231,745 ZEVs. Per year.

Ouch again. Obviously, Tesla is not going to get FCA into compliance and eliminate the whole penalty. It can only reduce the pain.

OK,

what if Tesla supplies 70,000 ZEVs to the pool every year? How much help is that? From Equation 1:

(120)(727,201)/(727,201+70,000)=109.5 g/km. That’s a reduction of 10.5 g/km which is equivalent to a penalty

reduction of (10.5)(95)(727,201) = €725 M.

So how much is that worth to FCA?

Suppose they give Tesla a 50% “bounty” (half of the yearly penalty reduction) to join the pool. That’s:

(0.5)( €725 M) = €362.5 M. Per year. Not out of line with “low 100’s of millions of euros” and each ZEV is worth about €5,200 additional profit to Tesla.

In this scenario,

FCA would pay the EU €1.275 B penalty, pay Tesla €362.5 M bounty and save €362.5 M over not pooling. Per year. Still really bad, but realistically probably the best scenario they’ve got. All they can do is negotiate the bounty.

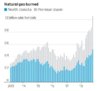

Does FCA have any other options? Well, they could try to lower their darn emissions, but Reference 1 Figure 3.8 shows they have made essentially zero progress since 2011. But suppose miraculously they got half way to their target (105 g/km). Then their best option would only pay the EU €648.5 M, but would

still pay Tesla €318.5 M bounty for the 70,000 ZEVs (€4550 additional Tesla profit per ZEV)

.

Those that understand the pooling logic better than me, feel free to correct. I’m still not clear on the 2019 pooling vs. the 2020/2021 targets. It seems like the 2019 numbers are subject to the 2020/2021 targets in some way.

References:

1)

https://www.theicct.org/sites/default/files/publications/ICCT_Pocketbook_2018_Final_20181205.pdf

2)

https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2009:140:0001:0015:EN:PDF

View attachment 394958