He lost his head! Must have overheated watching the ATH(s)!24-hour update. And, once again, On Topic:

View attachment 500046

Alas, poor ICE. I knew him, Horatio.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StealthP3D

Well-Known Member

I am in a state of disbelief - since Gerber claims to administrate funds of 840M $.

Do you have a source for this ?

He posted it on Twitter yesterday:

Ross Gerber on Twitter

I believe what Ross means is that he has only 200 TSLa shares left from his $30 entry point but he has purchased more along the way.

He has more than 200 shares today but at a higher cost basis.

This I can understand. About a year ago the Tesla SP went through huge daily swings, easily MMDs of several percent. So I thought it should be possible to reduce my average buying price, while adding shares, by timing some trading with these swings. I did one sell-buyback cycle with maybe 10% of my shares, suffered from major FOMO while having the cash on hand and ended buying back at a profit that turned out to be lousy especially when transaction cost was taken into account.

Luckily some TMC posters here gave generally useful advice that convinced me of the futility of this risky and time consuming exercise.

Bankwupt! The Ponzi fraud and drug selling and copper theft and dangerous slaughter pilot all caught up to us!Accounts on the website appear to be down right now:

View attachment 500047

Wonder if they're making modifications?

Same. I decided a while back to not chase small dips because I might miss out on big rises. i.e. this past month. Plenty of people were saying they intended to sell at 400 and buy back in in the 300s. This I can understand. About a year ago the Tesla SP went through huge daily swings, easily MMDs of several percent. So I thought it should be possible to reduce my average buying price, while adding shares, by timing some trading with these swings. I did one sell-buyback cycle with maybe 10% of my shares, suffered from major FOMO while having the cash on hand and ended buying back at a profit that turned out to be lousy especially when transaction cost was taken into account.

Luckily some TMC posters here gave generally useful advice that convinced me of the futility of this risky and time consuming exercise.

willow_hiller

Well-Known Member

OT: Car and Driver turns to Reddit to look for a Raven Performance S. Redditors are angry at C&D for their Model 3 review, especially since they borrowed a community member's car for it and didn't treat it well.

Benzinga - 9 minutes ago: Tesla Option Alert: Jan, 2021 $640 Calls at the Ask: 500 @ $61.8 vs 182 OI; Earnings 1/29 After Close [est] Ref=$533.0

The fact that the trade took place at the "ask" price implies that that the buyer was more anxious than the seller/writer. The call price paid implies the buyer's expectation that TSLA shares will be at least $701.80 by 2021 JAN 15.

The fact that the trade took place at the "ask" price implies that that the buyer was more anxious than the seller/writer. The call price paid implies the buyer's expectation that TSLA shares will be at least $701.80 by 2021 JAN 15.

Last edited:

mejojo

Active Member

The stock has to rise much higher and faster to get rid of the shorts.

Looks like they are still not in panic and instead doubling down:

View attachment 500045

At this point, the shorts are outfielders who cannot tell if that ball is a pop fly or a home run. They're running in assuming it's a can of corn.

Am I hearing correctly that Ark raised their SP target even higher, above 6k?

What did smeagol say? Even my burner/tslaq account is blocked from that guy.

" Just another typical 30 million-share day for a $540 story-stock, lol."

Attachments

Today marks the 5 year anniversary of my first stock purchase ever. 5 shares of TSLA at $194.12

That purchase was largely influenced by the investor threads here on TMC so I just wanted to mark this date by sending out a big THANK YOU to all the posters that contribute meaningful information to this board. It is much appreciated (just like TSLA since then ).

).

My initial investment thesis of putting a few grand into the stock with a hope to upgrade a few options on a future Model E slowly evolved into a much larger stake as I continually learned about the company and the many buying opportunities the stock market allowed. Today I am lucky enough to have a Model 3 partly bought from TSLA profits but also continue to hold a good chunk (to me) of shares as I remain a strong believer in the mission of the company.

Cheers to all the longs as we sit here at 2.76x of my initial purchase.

That purchase was largely influenced by the investor threads here on TMC so I just wanted to mark this date by sending out a big THANK YOU to all the posters that contribute meaningful information to this board. It is much appreciated (just like TSLA since then

My initial investment thesis of putting a few grand into the stock with a hope to upgrade a few options on a future Model E slowly evolved into a much larger stake as I continually learned about the company and the many buying opportunities the stock market allowed. Today I am lucky enough to have a Model 3 partly bought from TSLA profits but also continue to hold a good chunk (to me) of shares as I remain a strong believer in the mission of the company.

Cheers to all the longs as we sit here at 2.76x of my initial purchase.

Last edited:

Just caught last 30 seconds of Woods’ CNBC visit.

Can someone please recap her interview?

I didn't take notes.

5 yr projection is $6k/shr as of their 2nd model. They had this on the screen.

3rd model is coming in less than 2 months available on github and will be an update.

VW is likely to be the one other than Tesla to watch because they are vertically integrating.

Tesla share of EV total market looks to be holding which is a positive surprise.

Tesla should have the Tesla Network appearing about end of 2021 and could see margins in the 80% (I think I got this right) vs 30% in EV manufacturing. Regulatory friction is an issue and they have added a year to make some allowance for this unknown. But see regulators noting a reduction in all types of accidents with autonomy from Tesla's data. Sees this generating a lot of cash.

Market has trouble valuing Tesla because there has never been a company business model like this with mobility as a service based on big data NN AI and autonomy. Uber is not the model. She sometimes said SW as a service and sometimes mobility as a service.

No mention of battery technology that I heard. Nor SuperCharger network, nor CT, nor new factories. It is really about the payoff for harvesting big data to feed the NN from their hundreds of thousands of vehicles traveling the roads.

That is what I got. Apologies for what I missed and others please correct or extend.

Krugerrand

Meow

Kathy made some great points. She’s banking on EV’s to have a third of market share in 5 years and their old model said Tesla would lose their market share down to 11% but now the new model shows no loss maintaining 17%.

She discussed autonomy and got pressed about regulations. Kathy tried to quote Elon and got cut off with “I didn’t ask what Elon thinks I asked what you think” then one dumbass said “well what about Porsche they enter the EV market this year and they had a good year?” Kathy thought that was funny and said watch out for VW because they are actually building a battery plant.

She was trying to tell them that analyst don’t know how value Tesla because they are use to old auto and Tesla’s software will be the difference

17% of the third? Or 17% of all - meaning approximately 50% of the third?

They made fun of her on that halftime report show. I hope someone clips that moment to replay laterAm I hearing correctly that Ark raised their SP target even higher, above 6k?

What did smeagol say? Even my burner/tslaq account is blocked from that guy.

17% of the third. So not only is the EV market growing, but Tesla is growing their share of it.17% of the third? Or 17% of all - meaning approximately 50% of the third?

Too many newly wealthy TSLA owners are wanting to buy Teslas now.Man! I knew I should've placed the order last night. Dang it!

Or....those people who stayed away out of bankruptcy fears are rushing to buy Teslas now that it's "cool" again.

Sorry I wrote that out a little fast.17% of the third? Or 17% of all - meaning approximately 50% of the third?

So I believe she has modeled for Tesla to have 11% of the EV market by 2025, however that was with the idea that Tesla would lose market share in the ev landscape. Now they are seeing that Tesla is not losing market share in the ev market and the new $6000 model suggest a 17% retention of the EV market in 5 years.

ARK is pricing in expected loss in market share as more ev players enter market

From what she’s said in past appearances, I believe she is referring to Tesla’s global EV market share, which stood at 17% one or two years ago. They expected that market share to fall as the EV market grew. So far, Tesla has maintained their EV market share. Actually I think it went up a smidge. The surprise to everyone was the weakness of the competition thus far.17% of the third? Or 17% of all - meaning approximately 50% of the third?

Bet TSLA

Active Member

You're worried that while you're making a gazillion bucks, somebody might steal a few nickels? Worry about something else.Right, if the SP is driven up very quickly due to shorts covering, then it can be expected to come down again quickly.

But what worries me is that during this short time, the SP will run through the order books at an insane rate, so the bid-ask spread can become huge, so some tier-N retail traders like myself will be far from getting timely updates to the bid-ask - so there is a risk that one's limit order will be filled right at or very close to the limit, although at that moment the bid-ask may look very different.

Think about it, if the SP goes up (or down) at say 100$ every minute (and 10 times that for options), the average retail trader will likely enter a far from optimal trading order - and some market makers may have someone on their desk who tries to (illegally) profit from that, on the thinking that with the extreme volatility and volume overload no one will notice.

So while it is an interesting thought that we momentarily reach ArkInvest's 4k $ SP some time this spring, that moment could also be a moment were the ill-informed and ill-equipped retail seller who tries to take some profit gets completely screwed over.

So a recurring pattern of a 1-2% daily gain for a few days followed by some minor correction actually seems better, to me at least.

JusRelax

Active Member

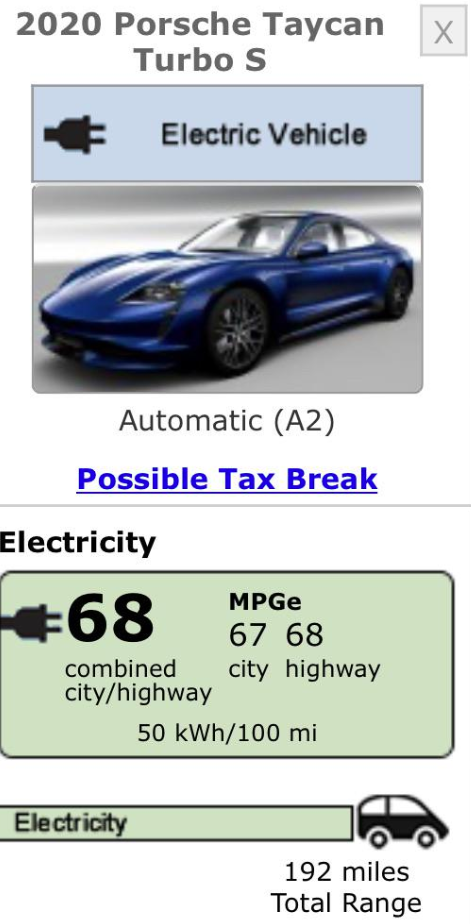

The Taycan Turbo S range dropped on fueleconomy.gov.... it's not even 200 miles:

TheTalkingMule

Distributed Energy Enthusiast

FUD pieces are absolutely flying all over the place......and bouncing off a brick wall of immunity to bullshit.

They're pushing rope.

They're pushing rope.

SageBrush

REJECT Fascism

It will compete vary favorably in the 'go the the store or work' segment, so long as one does not mind the price. The LEAF better watch out.The Taycan Turbo S range dropped on fueleconomy.gov.... it's not even 200 miles:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M