Tslynk67

Well-Known Member

Thank <insert deity of choice> she closed that cupboard...

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Market macros ugly. Please take that into consideration. Although it does look like a rotation to a degree. Almost all my solars are positive.

They know, but as long as Tesla doesn't pay the ransom, CNBC will put out every negative thing they find. (The analysts either know nothing or have an anti-Tesla agenda).CNBC keeps on leading with “analysts” that were telling people to sell years ago...

...and then the stock went 10x.

Why are they still going to these people for opinions on Tesla?

It’s obvious they *still* no nothing.

Not very relevant, but in my case they're 160 strike for next month that I might roll again or convert back to stock if there's a large-ish pop to ATH. Or double down if we see further weakness. Who knows.what calls are you getting?

Getting super close to triggering uptick rule.

Edit: just crossed it.

I've been meaning to thank you for giving us part of the feed from what looks like your Bloomberg terminal.News cross the wire before there's a link to post.

In the interest of speed I post important news as I see them rather than wait for a link to an article.

I'll stop doing that if people prefer the non-actionable articles over novelty.

Well, that's pretty safe (politically), they'll be gone long before then.CALIFORNIA TO BAN SALES OF NEW AUTOS WITH INTERNAL COMBUSTION ENGINES BEGINNING IN 2035

This is unbelievable! 9% down on such great news. It just boggles the mind! I don’t get it at all.

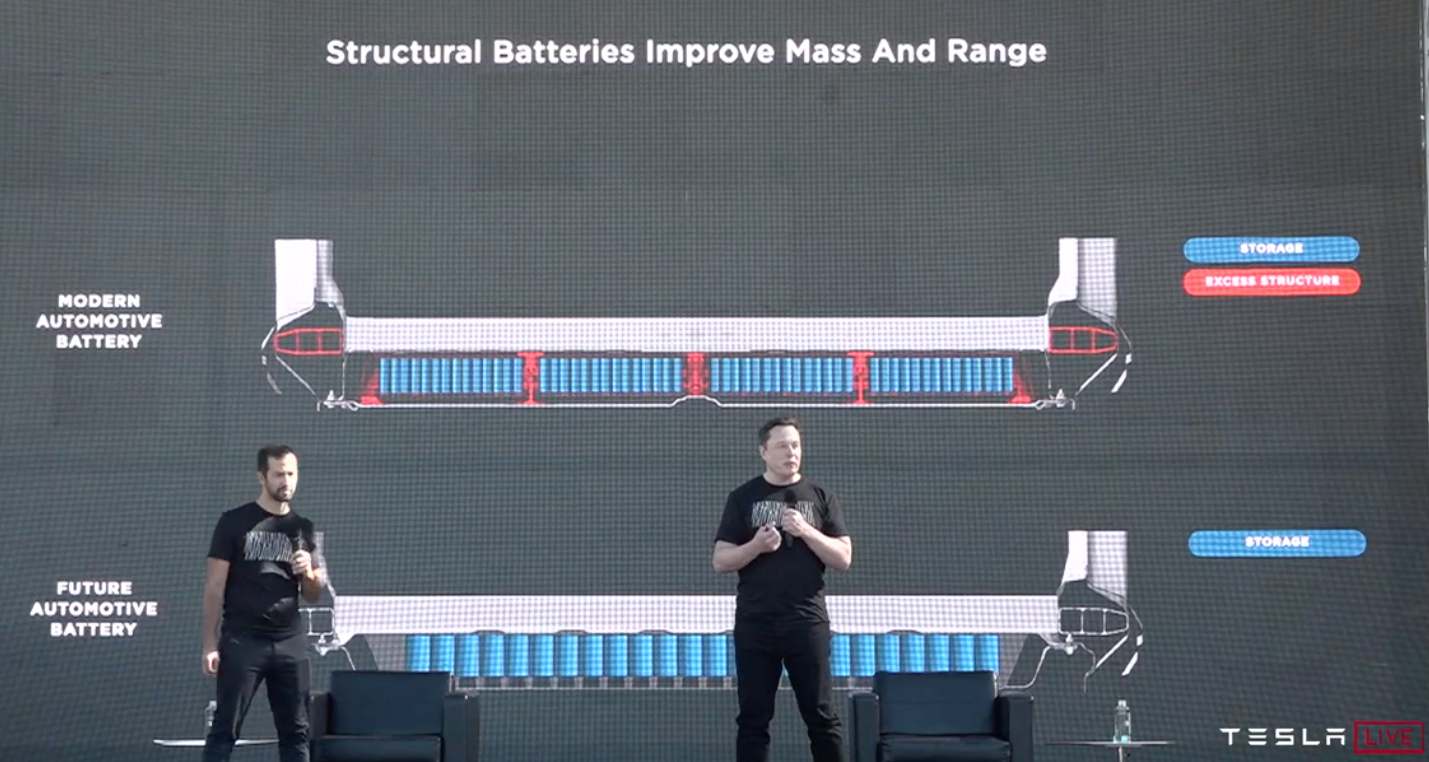

Anyone else speculate the batteries running down the edge of the car? In the top screenshot there is red on the outside edge that is labeled as "excess structure", but on the bottom picture that same location is still there but grey. It looks like one of the new battery cells would fit pretty well in that space and giving a 5-10% increase in capacity. Maybe I am just getting a bit crazy over here as the stock hits $380 and I am searching my couch cushions for some more dry powder.

What a good day to convert stock to deep in the money calls and add more deltas for almost no premium.

God bless the IRAs.

What other stocks are there?I expect market macro's to bottom in mid Oct, anywhere from 5-10% lower than they currently are. Even with declining macro's, I still think Q3 numbers will push the stock back up into 400's and by the 3rd week of October, the FOMO of S&P inclusion will restart again because everyone will know Tesla will post a profit without credits based on Q3 P/D numbers.

So I feel my window for pulling the trigger on using margin is this week. I thought the sell off would continue throughout the rest of this week, but the uptick rule was just triggered so I'm a bit worried any further sell off chances are now diminished. So decision decisions

Edit: A bummer that to get Fidelity's lowest margin rates of 4.25%, I would have to do a margin loan of 500k. Anything less and the interest rates jump to 6.5% and higher for smaller and smaller loan amounts. 500k wouldn't leverage me to the point where I would have to worry about a margin call, but still......not sure I want to be that ballsy

Edit #2: There are a couple other stocks I'd like to buy too. So not like all 500k would go into Tesla. Hmmm

Can't be right....too lowI tried to put that 3TWh battery production for 2030 in my 32 bit Excel but the cell ran out of integers.

Seriously, I‘m eagerly awaiting the usuals suspect with far deeper knowledge than me to update future valuations and price targets. Something about my 18k usd/ share by 2030 surely can‘t be right. Right?!