Tesla's Shanghai Gigafactory production sprint, with a daily production of 1,600 Model Y | Google Translate

021/9/26 16:44:21 Source: House of IT Author:

Q Zhou Editor:

Q boat

"IT Home News on September 26 According to the previous export rules, Tesla will export a large number of exports at the beginning of each quarter. For example, this situation was similar in April and July this year, and it is expected to be the same in October.

"The current production capacity of Tesla's Shanghai plant is mainly responsible for export business. Cars in Europe can only be exported by sea at the beginning of the season. This is the case in April, July, and it is estimated that it will be the same in October.

"According to Sina, with the end of the third quarter, Tesla's Shanghai Gigafactory began to enter the final production sprint stage.

"As can be seen from the pictures taken by them, there are already a large number of Tesla Model Y and Model 3 cars ready to go, which also shows that the demand in the third quarter is strong.

"According to sources, Tesla’s Shanghai Gigafactory now produces 1,600 Model Ys per day, a significant increase from the previous month. In contrast, Tesla's Shanghai plant produced 1,000 Model Y a day in August, which is far more than the average daily Model 3 number of 800.

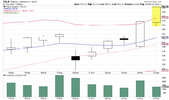

"IT Home learned that in August, Tesla China exported 31,379 vehicles from the Shanghai plant. In August, the domestic sales volume was 12,885 vehicles, and the wholesale sales volume reached 44,264 vehicles.

"As of August, Tesla China has exported 97,496 vehicles to more than 10 countries and regions including Europe, America, Australia, Japan, South Korea, and Singapore in 2021. According to a related person from Tesla, from the perspective of the development of the industrial chain, Tesla's Shanghai Super Factory continues to accelerate the localization process. As of the end of 2020, the localization rate of parts for Tesla's Shanghai Gigafactory has reached 86%."