Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

dhanson865

Well-Known Member

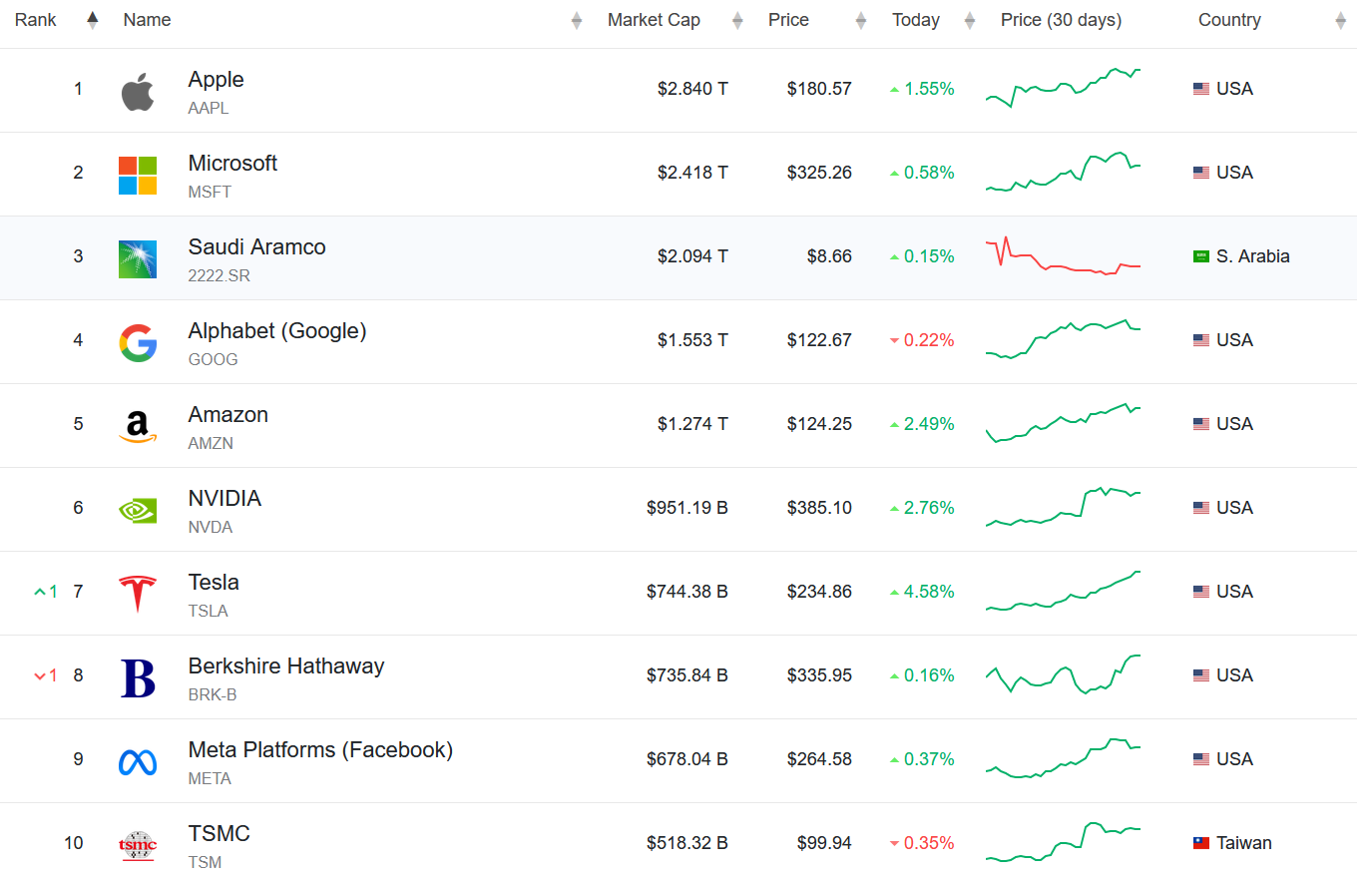

It takes TSLA around $400 a share to pass AMZN but NVDA might get passed along the way (assuming they can't pass AMZN.)

How can you have capital gains *and* be HODLing? /sAs I was checking (just curious) my tax lots today after trading stopped, I was surprised and happy to see my original Tesla purchases from 2013 are now up 7,330% !!! Capital gains last year were a bitch, but thank dog they were long-term.

Damn glad to be a HODLer!

Upkeep is a high priority. Tesla requires its technicians to be at a non working Supercharger within 10 hours of it being reported as non working. It may be very helpful to be the simplest design, but it doesn't stay working just because of magic fairy dust. A dedicated team of Tesla employees keep it running at maxJust wanted to mention this. As a relatively long-time observer of Tesla and Musk, the company (and Musk) have repetitively stated that, "The Supercharger network is not a profit center."

The money received, then, apparently goes into:

1. Paying for electricity

2. Paying for upkeep and repairs

3. Paying for more superchargers

And not into making $$$ for Tesla.

The idea: Make the cost of charging the car as small as possible.. so people can buy more cars.

So: Based upon this, when Ford and GM join the fun, they won't be making tons of money on Superchargers, either: But they will be selling more cars. And that's the point.

dhanson865

Well-Known Member

At roughly 2M vehicles a year TSLA passes Mercedes in production (that shouldn't take long)

At roughly 3M vehicles a year TSLA passes BMW (well within sights after Mercedes, and beating BMW puts tesla in the Top 10 by production quantity)

At roughly 4M vehicles a year TSLA passes Nissan, Honda, Ford (harder to judge, these might split up and go at different times)

At roughly 5M vehicles a year TSLA passes GM, Stellantis (beating one or both of these puts Tesla in the Top 5)

At roughly 6M vehicles a year TSLA passes Hyundai Kia (putting Tesla in the Top 3)

Shortly after the last 2 fall, VW and Toyota. Hard to say at what level, they are both playing in the 8M - 10M range. But if they hold out as leaders longer than Hundai Kia, I'd still expect them to shrink a chunk by then.

rough numbers from peeking at Top 15 Automakers in the World | Car Sales Rank Worldwide and knowing that the others will shrink or hold as TSLA expands.

At roughly 3M vehicles a year TSLA passes BMW (well within sights after Mercedes, and beating BMW puts tesla in the Top 10 by production quantity)

At roughly 4M vehicles a year TSLA passes Nissan, Honda, Ford (harder to judge, these might split up and go at different times)

At roughly 5M vehicles a year TSLA passes GM, Stellantis (beating one or both of these puts Tesla in the Top 5)

At roughly 6M vehicles a year TSLA passes Hyundai Kia (putting Tesla in the Top 3)

Shortly after the last 2 fall, VW and Toyota. Hard to say at what level, they are both playing in the 8M - 10M range. But if they hold out as leaders longer than Hundai Kia, I'd still expect them to shrink a chunk by then.

rough numbers from peeking at Top 15 Automakers in the World | Car Sales Rank Worldwide and knowing that the others will shrink or hold as TSLA expands.

Last edited:

It wasn't by choice mate...How can you have capital gains *and* be HODLing? /s

TN Mtn Man

Member

So, how long before Toyota gets on board the NACS train? Given their lack of significant EV volume it won't cost them much to switch...

FSDtester#1

Craves Electrolytes

Sure that's what happened. You meant to say you were test driving Highland and one of your buddies caught you on their phone....I saw Model 3 Highland on I-280 earlier today. Luckly pictures came out well as I was driving 80 mph w/o Autopilot.

At roughly 2M vehicles a year TSLA passes Mercedes in production (that shouldn't take long)

At roughly 3M vehicles a year TSLA passes BMW (well within sights after Mercedes, and beating BMW puts tesla in the Top 10 by production quantity)

At roughly 4M vehicles a year TSLA passes Nissan, Honda, Ford (harder to judge, these might split up and go at different times)

At roughly 5M vehicles a year TSLA passes GM, Stellantis (beating one or both of these puts Tesla in the Top 5)

At roughly 6M vehicles a year TSLA passes Hyundai Kia (putting Tesla in the Top 3)

Shortly after the last 2 fall, VW and Toyota. Hard to say at what level, they are both playing in the 8M - 10M range. But if they hold out as leaders longer than Hundai Kia, I'd still expect them to shrink a chunk by then.

rough numbers from peeking at Top 15 Automakers in the World | Car Sales Rank Worldwide and knowing that the others will shrink or hold as TSLA expands.

My estimates for dates are as follows:

2M vehicles/yr is either end of 2023 or early 2024.

3M is early 2025.

4M is late 2025.

5M is 2026. (Compact enters volume production)

6M is also 2026.

10M is 2028.

17M is 2030. (I think Tesla will miss their goal of 20M for 2030)

The next couple years will be very telling as to how the trend will play out.

This news implies to me that Tesla will now be a tier 1 automotive supplier to both F and GM, which must have pretty significant financial implications, would you not agree? Tesla “DNA” will be in every F and GM vehicle that uses the Supercharger network—that seems to me to be a pretty big financial deal. Tesla will invoice both companies for the time, engineering and resources it takes to get its charging software and hardware integrated into F and GM vehicles (not to mention the work Tesla is already doing for F on FSD and OTA updates). Additionally, Tesla will have access to some intellectual property rights, as well as be able to harvest huge loads of data from these vehicles long into the future (data has value, both financial and strategic). The fact that Tesla tech will be found in its biggest competitors has to be quite profound, I’d think.Lots of cheering, but what does this deal imply? I'm missing some analysis of the financial implications.

- How often will the average Ford/GM EV driver supercharge per year? Most charging is done at home, because it's more convenient and cheaper. I'd estimate 10 times.

- How much does the average charge cost? I'd say 70 kWh. At $0.30 that makes about $20.

- What is the profit margin on this? 60% perhaps? $12 in profit then. So we get to $120 of profit per EV per year.

- How many EVs will be driving around in the US in, say, 10 years? One hundred million, including Teslas?

Assuming all other brands also sign up that's $12 billion in profit (of which 2/3 was not yet accounted for, the Teslas were). Capital costs and maintenance will take that down to maybe $10 billion. Assuming there's a P/E of 20 for that part of the business that makes for $200 billion in market cap. That's 60 points. A lot, but I suppose not enough to get us to an ATH.

Other implications: Tesla loses a very big moot. But Tesla also becomes a household name for EV drivers who visit the Superchargers and that may lure people to the brand.

And ok, you’re right, most wealthy people with EVs RIGHT NOW charge at home, but that will change in the future as lower-income apartment-dwellers start getting second- and third-hand EVs. Superchargers will be more heavily utilized then, and Tesla will be to EV charging what Exxon and Chevron fueling stations are today with ICE vehicles. And then think of all the government contracts Tesla will score for fleshing out not just long-distance charging infrastructure, but city/neighborhood infrastructure; government contracts will decrease upfront capital costs, and maintaining the chargers will be built into the cost the consumer pays, like any other service.

I don’t believe Tesla is losing its moat—I think it’s expanding it. Tesla will continue to be the leader in fastest charging, most reliable EVs for quite some time because they’ve been playing the game for so long. F and GM are just now seriously getting their feet wet. They’re far from being profitable in their EV segments, and just because they can make EVs that roll down the road doesn’t mean they won’t have their share of growing pains like Tesla did as they continue to scale.

Tesla is going to be the transportation/energy juggernaut of the future, the financial implications seem quite staggering, IMHO.

Buckminster

Well-Known Member

Threads of the day:

FSD discussion V11.4.3 with employees and could roll out to first users this weekend

Project Highland (Investor impact etc.) Hatchback? Seems unlikely to me.

Supercharger Revenue Who knew this would be the breakout catalyst?

V2G in a robotaxi world Supercharger deals plus V2G = Standard Oil

FSD discussion V11.4.3 with employees and could roll out to first users this weekend

Project Highland (Investor impact etc.) Hatchback? Seems unlikely to me.

Supercharger Revenue Who knew this would be the breakout catalyst?

V2G in a robotaxi world Supercharger deals plus V2G = Standard Oil

jkirkwood001

Active Member

Because adding the connector to your car was open-source, but being able to charge at Tesla's 12,000 (?) North American Superchargers was not. Ford and GM bought rights for their vehicles to charge at Tesla Superchargers using integrated account and payment.Thought I remembered something like that. So why does everyone think Ford and GM payed anything then?

Agree, I said same when I first posted about Ford signing ( see below). All the talk is about fee-per-use paid by the driver. But I'm sure Tesla will be compensated for every Ford (and now, GM) sold as it's a value-added feature that contributes to the car's sale. So the OEM pays Tesla up-front, and owners pay on use. Again, I trust Zach to have inked a beneficial deal. Tesla's leverage only grows per OEM. What will Hyundai do? VW? Nissan? Rivian?? They have no leverage to avoid looking like an also-ran provider.There is also a potential license/royalty fee that GM/Ford needs to pay Tesla for each car they build that uses NACS.

Jim Farley: "In 2024, Ford customers will have access to Tesla Superchargers... a huge move for our customers... later (Tesla's) NACS interface will be added to our next generation vehicles."

Live on Twitter spaces now.

Edit 1: Elon: "A Ford driver will be able to use a Tesla SuperCharger using the Ford app."

Edit 2: Lots of love being shared between Elon and Jim. This is a huge cross-roads IMHO, and probably the relationship Diess was working towards. What will VW do now??

The best part is no part…something, something.It’ll go the way of Tesla’s battery swap service. RIP

even more exciting when you run those forecasts for revenue and profits!My estimates for dates are as follows:

2M vehicles/yr is either end of 2023 or early 2024.

3M is early 2025.

4M is late 2025.

5M is 2026. (Compact enters volume production)

6M is also 2026.

10M is 2028.

17M is 2030. (I think Tesla will miss their goal of 20M for 2030)

The next couple years will be very telling as to how the trend will play out.

But Elon said they are selling at cost:This news implies to me that Tesla will now be a tier 1 automotive supplier to both F and GM, which must have pretty significant financial implications, would you not agree? Tesla “DNA” will be in every F and GM vehicle that uses the Supercharger network—that seems to me to be a pretty big financial deal.

insaneoctane

Well-Known Member

None of us know any of the specifics of either Ford's or GMs deals. They might get free access just for adopting NACS. They might have paid upfront. They might pay monthly. Or yearly. Or per car. Or? The point is WE don't know. I don't suspect Tesla will share details with us anytime soon. I suspect they didn't collect compensation anywhere near what they could of, because...the mission. I would be interested is some wild wags of how much the 12,000 superchargers have cost Tesla (and, thus, the shareholders) to date. I wonder how many kWh a Supercharger has to deliver before it can start to make a small profit. How many months or years does it take? Maybe Ford and GM will start to pay for some percentage of future build out?

We don't know anything yet, other than these announcements have likely contributed to some SP increases. Maybe more profound.

We don't know anything yet, other than these announcements have likely contributed to some SP increases. Maybe more profound.

Wait, it says, "Chevron, The Human Energy Company"

Does this mean they're making energy out of humans?

What would Charlton Heston say about that?

And I thought it was dinosaurs

Electroman

Well-Known Member

We're at 240+ AH

ItsNotAboutTheMoney

Well-Known Member

I don’t believe Tesla is losing its moat—I think it’s expanding it. Tesla will continue to be the leader in fastest charging, most reliable EVs for quite some time because they’ve been playing the game for so long. F and GM are just now seriously getting their feet wet. They’re far from being profitable in their EV segments, and just because they can make EVs that roll down the road doesn’t mean they won’t have their share of growing pains like Tesla did as they continue to scale.

Tesla is going to be the transportation/energy juggernaut of the future, the financial implications seem quite staggering, IMHO.

Definitely losing a moat.

Hopefully they can take any money from this and make their service not suck.

MartinAustin

Active Member

I had to laugh at this... of all the people to bring on for commentary about GM+NACS, they bring on GoJo. But when they uploaded the interview to Youtube... they didn't include what he had to say

All Tesla Service Centers in Québec are overloaded with deliveries lately. So much that they asked our Club Tesla Québec to help them. I spent the last 2 days there guiding new owners with all the options in the cars and answering whatever questions they had. The new Model Y RWD is crazy popular, probably 2 MY for every M3 delivered. Quality is top notch, none of the new owners I talked with had any issue with the car. No panel gap, no paint chip, nothing. Giga Shanghai is really producing top level cars.

It was a very fun and enjoyable experience. Super nice to see all the new owners with such big smile

It was a very fun and enjoyable experience. Super nice to see all the new owners with such big smile

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M