Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TSLA Technical Analysis

- Thread starter Robert.Boston

- Start date

-

- Tags

- elon is an ass TSLA

graphix25

-=electronboy=-

It’s a fair point to consider the size of your net worth as a key variable in determining diversification strategy. There is a big difference between 100k, 1m, 10m or 100m. I was responding to someone who was a casual new investor who it was safe to assume they don’t have a 5m net worth. Someone with a few 100k looking to beat the market, 10% single stock max is a good rule of thumb. I like the concept you mention betting on themes and is a core reason why I invest in Tesla at 20% of my net worth. Electrification of transportation, autonomy, solar energy and storage, network effect and big data. Tesla has all big theme elements I think will be disruptive, transformational and hopefully highly profitable all in one highly vertically integrated company.

The difference between betting and investing is not the size in dollars but the research and knowledge behind where you place your money. If I go into a casino and place 500k on black at the roulette table that is a bet. If I do my research, analyze the industry, and place 500k on a single company for the long term, that is a investment.

The difference between betting and investing is not the size in dollars but the research and knowledge behind where you place your money. If I go into a casino and place 500k on black at the roulette table that is a bet. If I do my research, analyze the industry, and place 500k on a single company for the long term, that is a investment.

Having been a licensed broker for many years and in the financial industry for 40, I don't think there's any reasonable licensed advisor who would recommend having as much as 10% in any one stock, especially one that gyrates around as violently as TSLA. If you are managing a $5M portfolio, having $500k in ANY 1 stock, be it Amazon, AT&T, Exxon, or any other name that you throw on the table is a huge bet. A bet, not an investment. Full disclosure -- I've traded TSLA, riding the violent gyrations..

neroden

Model S Owner and Frustrated Tesla Fan

Purely in terms of diversification, most of big caps today just follow indices. So, it’s no use going from a handful of stocks to index funds. For real diversification you need something that is not correlated with stock, but with decent returns over the long term.

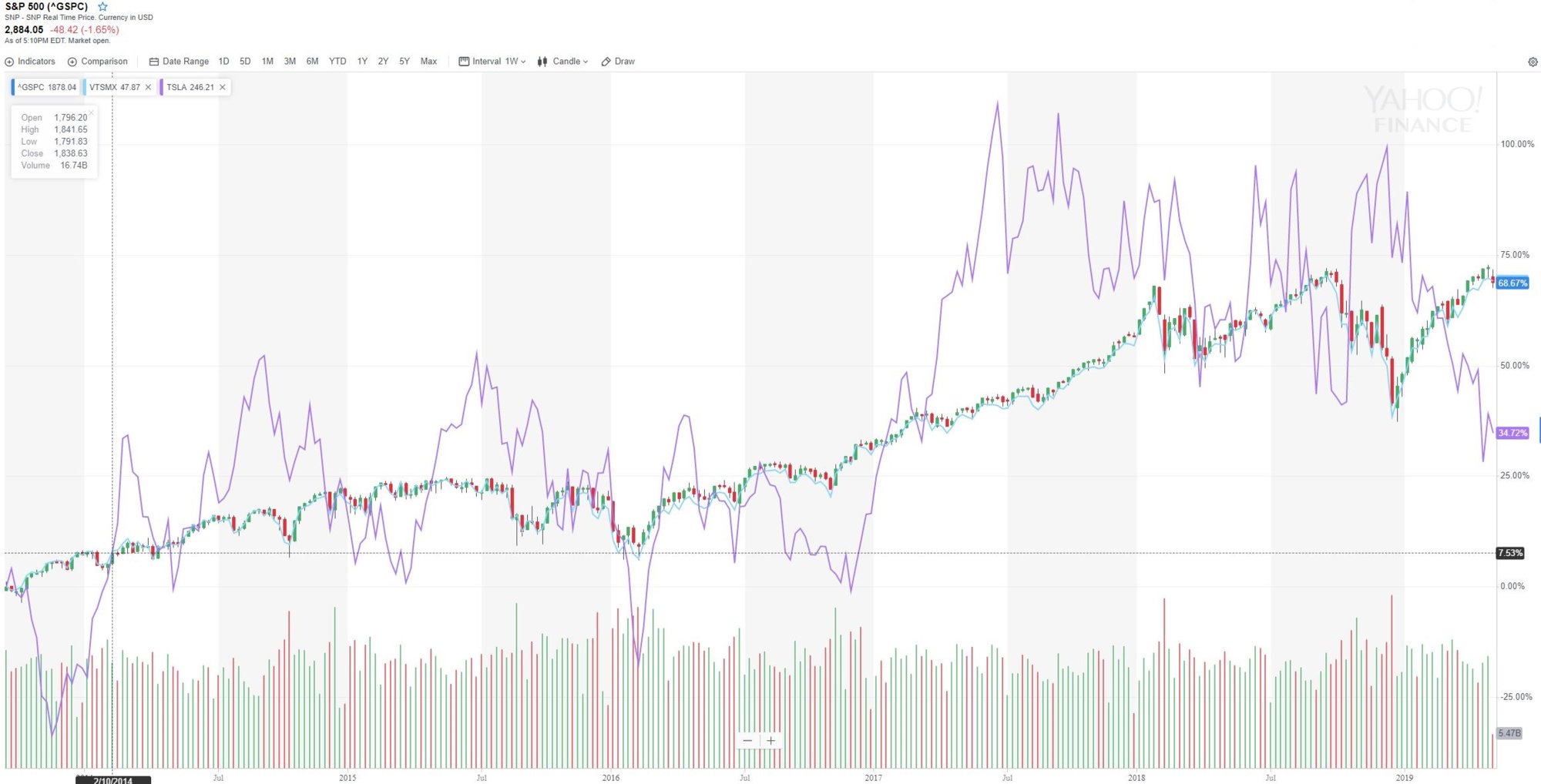

Interestingly, Tesla isn't correlated with any broad stock index.

*ba-dum-ching*

graphix25

-=electronboy=-

Amazing the coloration between the Vanguard Total Market Index (3615 Us stocks) and the S&P500 which basically mirrors the the top 50 stocks in the index. RIP John C. Bogle.

Diversification for me is either in the market, cash or bonds. It's been my experience when things go south in a big way only cash and/or bonds can protect you from downside risk. I also diversify by owning a home. Out of all the investments I have ever made the best one from a capital growth perspective by far was my education. Getting a BS in CompSci and a MBA has paid of maybe 50 fold in 20 years of earnings.

I don't know TSLA kinda rhymes with the general market if you squint at the charts.

Diversification for me is either in the market, cash or bonds. It's been my experience when things go south in a big way only cash and/or bonds can protect you from downside risk. I also diversify by owning a home. Out of all the investments I have ever made the best one from a capital growth perspective by far was my education. Getting a BS in CompSci and a MBA has paid of maybe 50 fold in 20 years of earnings.

I don't know TSLA kinda rhymes with the general market if you squint at the charts.

Interestingly, Tesla isn't correlated with any broad stock index.

*ba-dum-ching*

Attachments

EVNow

Well-Known Member

But the long term returns are low (compared to stock).Diversification for me is either in the market, cash or bonds.

anthonyj

Stonks

Zhelko Dimic

Careful bull

That Chaikin oscillator just doesn't want to go below zero, eh?

I find that slightly encouraging...

I find that slightly encouraging...

That Chaikin oscillator just doesn't want to go below zero, eh?

I find that slightly encouraging...

View attachment 408139

Plus a bullish divergence.

TSLA is coiling in a symmetrical pattern. Big movement is likely coming:

It doesn't really look good to me, as the support has already been tested 3 times and we could see macro pressure after 2 strong day in the market.

The daily chart shows the same thing, with an "inside day" too.

Bigger trading range soon.

It doesn't really look good to me, as the support has already been tested 3 times and we could see macro pressure after 2 strong day in the market.

The daily chart shows the same thing, with an "inside day" too.

Bigger trading range soon.

Attachments

Last edited:

Breakdown already during premarket trading.TSLA is coiling in a symmetrical pattern. Big movement is likely coming:

It doesn't really look good to me, as the support has already been tested 3 times and we could see macro pressure after 2 strong day in the market.

The daily chart shows the same thing, with an "inside day" too.

Bigger trading range soon.

Zhelko Dimic

Careful bull

Even Chaikin surrenderedThat Chaikin oscillator just doesn't want to go below zero, eh?

I find that slightly encouraging...

View attachment 408139

I got some TSLA this morning by converting FB into it, but not doing it anymore until we're at $180-$195.

At that point I may go back all in TSLA, though, not sure it's worth it.

Even that little slice of AMZN, FB, DIS, made my portfolio much less volatile, and a bit less stressful...

This would be a good time for Elon to borrow a billion or two and buy as much as possible in a day, before he has to report it that same evening. I see nothing else getting us out of the root until Q2, Q3 better results...

Causalien

Prime 8 ball Oracle

Causalien

Prime 8 ball Oracle

Looks like July 18th is the decision date of the current down channel. Just in time for Q2 earnings. Then a couple of weeks later (Maybe August) we will meet the dreaded $180 support and see if it represent a strong enough barrier.

What is worriesome is the breakdown from the channel in the last two days. This basically breaks TA. Could be a one off thing, or not. Maximum upside is $230 right now due to the upper bound of the downward channel.

If we do rebound up, the upper bound from the previous channel between 2013 to 2016 is ~$265. Which also coincide with the 50% fib retracement from alltime low to high.

IF Elon is going through with the promise of betting the company on FSD with all the surplus, then be prepared for 3~4 years of bouncing between 180 and 265.

On a brighter note. Option volatility for TSLA is extremely low for the kind of break down that is happening right now. Straddle is recommended as no matter what happens. It won't stay at this price.

anthonyj

Stonks

bdy0627

Active Member

It seems very unlikely to me that it will take another 2-3 months for the stock to test $180, if it is indeed going to do that. The current price action seems to be accelerating this downward movement. Just a guess, but I think we've probably got just a few weeks to the bottom at this point.Looks like July 18th is the decision date of the current down channel. Just in time for Q2 earnings. Then a couple of weeks later (Maybe August) we will meet the dreaded $180 support and see if it represent a strong enough barrier.

What is worriesome is the breakdown from the channel in the last two days. This basically breaks TA. Could be a one off thing, or not. Maximum upside is $230 right now due to the upper bound of the downward channel.

If we do rebound up, the upper bound from the previous channel between 2013 to 2016 is ~$265. Which also coincide with the 50% fib retracement from alltime low to high.

IF Elon is going through with the promise of betting the company on FSD with all the surplus, then be prepared for 3~4 years of bouncing between 180 and 265.

On a brighter note. Option volatility for TSLA is extremely low for the kind of break down that is happening right now. Straddle is recommended as no matter what happens. It won't stay at this price.

K_Dizzle

Member

Why is everyone convinced we’re going lower? The letter was hyped by the media but it’s fake news. Without any catalyst Monday could be green simply because people had time to digest what was said.It seems very unlikely to me that it will take another 2-3 months for the stock to test $180, if it is indeed going to do that. The current price action seems to be accelerating this downward movement. Just a guess, but I think we've probably got just a few weeks to the bottom at this point.

Navin

Active Member

Exactly.

Listen to Elon say it specifically.

Dropbox - Bank Call Capital Question.mp3 - Simplify your life

Listen to Elon say it specifically.

Dropbox - Bank Call Capital Question.mp3 - Simplify your life

anthonyj

Stonks

We are at a point where it's easy for Market Makers to manipulate the price lower to trigger stop losses and margin calls. It is actually better to shake out these "weak" holders now, because otherwise they will sell at a higher price when it climbs back anyway. In my opinion this is the fakeout before the breakout. Happens to a lot of stocks. We need a good Q2 to actually climb thoughWhy is everyone convinced we’re going lower? The letter was hyped by the media but it’s fake news. Without any catalyst Monday could be green simply because people had time to digest what was said.

K_Dizzle

Member

I get that but there’s gotta be a turning point, the same momentum we have on the Down side should happen on the upsideWe are at a point where it's easy for Market Makers to manipulate the price lower to trigger stop losses and margin calls. It is actually better to shake out these "weak" holders now, because otherwise they will sell at a higher price when it climbs back anyway. In my opinion this is the fakeout before the breakout. Happens to a lot of stocks. We need a good Q2 to actually climb though

Similar threads

- Replies

- 21

- Views

- 6K

- Replies

- 3

- Views

- 900

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 23

- Views

- 709