Right. The first versions of my contract separated out those items and included an estimate for the amount eligible for the tax credit. But the last two or three versions did not and the tax credit estimate changed to 26% of the total. So that must represent some change of legal opinion within Tesla, but we who would claim the credit are still on our own (or with legal opinions from our tax advisors).On my 2020 solar roof contract, Tesla did have separate line items for PV tiles and for non-PV tiles.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Master Thread: Energy products and Tax discussions

- Thread starter jjrandorin

- Start date

-

- Tags

- tax tax credit

Right. The first versions of my contract separated out those items and included an estimate for the amount eligible for the tax credit. But the last two or three versions did not and the tax credit estimate changed to 26% of the total. So that must represent some change of legal opinion within Tesla, but we who would claim the credit are still on our own (or with legal opinions from our tax advisors).

I wonder if this is why Tesla wanted to charge more for the solar roof a few months ago.

If a buyer can confidently include the whole solar roof as eligible for the ITC, their net pricing goes down compared to the buyer that is trying to only claim a portion of the roof under the ITC. And, the usual gambit is for sellers to try and get as much of the incentive for themselves by adjusting their gross pricing accordingly based on the available incentives.

sunwarriors

Member

Build Back Later Reboot from scratch:

pv-magazine-usa.com

pv-magazine-usa.com

Build back later

After multiple rounds of slashing the total cost of the Build Back Better bill, US senators remain locked in negotiations. Democratic Senator Joe Manchin (West Virginia) voted against an earlier proposal, shocking many, and has now said he will reopen negotiations “starting from scratch.”

Mj23lebron6

Member

Hello Tesla Family,

I had a quick question on the tesla solar tax credit. My total roof was roughly 70k. When I signed up tesla stated my federal tax rebate would be 18,364. However, on my signed contract there’s a breakout for roof and solar roof.

Roof: 47k

Solar: 23k

My question is do I get the 18,364 tax credit? Or should it be for the 6,110 for the solar portion only? See screenshots below.

Thanks again for the help

I had a quick question on the tesla solar tax credit. My total roof was roughly 70k. When I signed up tesla stated my federal tax rebate would be 18,364. However, on my signed contract there’s a breakout for roof and solar roof.

Roof: 47k

Solar: 23k

My question is do I get the 18,364 tax credit? Or should it be for the 6,110 for the solar portion only? See screenshots below.

Thanks again for the help

Attachments

jrweiss98020

Tessa's Tesla

I am not a lawyer, but IMO, from your invoice, the $70K for the Solar Roof is eligible, but the $6700 for the roof deck is not. The $18K tax credit is about right. Talk with a CPA or tax attorney if you want a "legal" opinion.

trautmane2

Member

My opinion is that only the solar PV tiles ($23502 in your case) are deductible - others disagree.My question is do I get the 18,364 tax credit? Or should it be for the 6,110 for the solar portion only?

You can find more discussion about it here:

New Solar Roof owners - how much can we write off in taxes?

Hi, As we approach the end of the year it is time to think about tax planning for the SolarRoof we installed in 2020. In the initial documents, we received an estimate from Tesla based on the portion that is active tiles. However, I am seeing neighbors with non-Tesla systems writing off 26% of...

That being said, if you ever get a definitive IRS ruling that states the cost of all your tiles is deductible please post here.

I would love to amend my return to get the larger deduction.

jrweiss98020

Tessa's Tesla

From the IRS (Energy Incentives for Individuals: Residential Property Updated Questions and Answers | Internal Revenue Service):

==================

Tesla already explicitly separated out the non-qualifying decking on the invoice.

Q. Is a roof eligible for the residential energy efficient property tax credit?

A. In general, traditional roofing materials and structural components do not qualify for the credit. However, some solar roofing tiles and solar roofing shingles serve as solar electric collectors while also performing the function of traditional roofing, serving both the functions of solar electric generation and structural support and such items may qualify for the credit. Components such as a roof's decking or rafters that serve only a roofing or structural function do not qualify for the credit.==================

Tesla already explicitly separated out the non-qualifying decking on the invoice.

CrazyRabbit

Active Member

based on the 23502 portion of the roof, inverter, wiring and labor. Not the non active portion of the roof.Hello Tesla Family,

I had a quick question on the tesla solar tax credit. My total roof was roughly 70k. When I signed up tesla stated my federal tax rebate would be 18,364. However, on my signed contract there’s a breakout for roof and solar roof.

Roof: 47k

Solar: 23k

My question is do I get the 18,364 tax credit? Or should it be for the 6,110 for the solar portion only? See screenshots below.

Thanks again for the help

CrazyRabbit

Active Member

just like mining income, you have a choice. ordinary income (no write offs) and a lower tax rate; or llc with a higher tax rate but you get to write off equipment.I've got a fun tax topic to discuss: SREC income.

I've already convinced myself that because I claimed the full cost of my solar system in the federal solar tax credit, money I collect from selling SRECs is taxable income (in theory, you can claim the SRECs are offsetting the initial investment in solar, but that would cause the basis to decrease over time, and might require an amended return for the solar tax credit every year, but that's another topic).

So the question I wanted to ask was: how is SREC income legally classified? TurboTax thinks because it was done with the intent to earn money and occurs every year, it's a form of self-employment that requires additional self-employment taxes. It's definitely not "employment," so I manually overrode the self-employment taxes. But will the IRS be happy with me just filing it as a 1099-MISC every year?

i would just do the ordinary income...

Xepa777

Banned

In the proposed Inflation Reduction Bill, I read about the subsidy for solar purchases at 30%. That’s more than today’s 26% right? Or are they two different things? That means I should wait until the bill passes to buy it, or will it be retroactive? Thanks!

EVRider-FL

Active Member

Not familiar with the energy credit change, but typically a bill would apply to purchases anytime during the year it gets enacted. However, you should read the text of the bill and wait for the vote before making any purchase decisions, since it’s not a done deal.

sunwarriors

Member

From my reading, it sounds like 2022 installs will be back up to 30% I think till the drop to 26% -> 22% in 10 years or something (didn't bother looking it up). Only folks like me who did installs in 2021 got shafted with 26%. I'm ok with it though. I was more worried about NEM3.0.

Redhill_qik

Active Member

You are in California, so getting your systems installed quickly and operating under NEM 2.0 before NEM 3.0 starts is a much bigger factor than the extra 4% credit.In the proposed Inflation Reduction Bill, I read about the subsidy for solar purchases at 30%. That’s more than today’s 26% right? Or are they two different things? That means I should wait until the bill passes to buy it, or will it be retroactive? Thanks!

jgleigh

Member

Last but not least, solar

The legislation revives a 30% tax credit for installing residential solar panels and extends the program until Dec. 31, 2034. The tax credit would decline to 26% for solar panels put into service after Dec. 31, 2032 and before Jan. 1, 2034. Homeowners who install solar battery systems with at least 3 kilowatt-hours of capacity would also qualify for the tax credit.From my reading, it sounds like 2022 installs will be back up to 30% I think till the drop to 26% -> 22% in 10 years or something (didn't bother looking it up). Only folks like me who did installs in 2021 got shafted with 26%. I'm ok with it though. I was more worried about NEM3.0.

Don’t worry, in almost all cases the business selling the product captures the value of these broadly available public subsidy incentives. If the ITC goes up, pricing goes up. The customer rarely sees a significant net benefit.

Stuff like the SGIP resiliency is different since it is a targeted incentive that not everyone can get.

Vuski's ride

Member

Hello all,

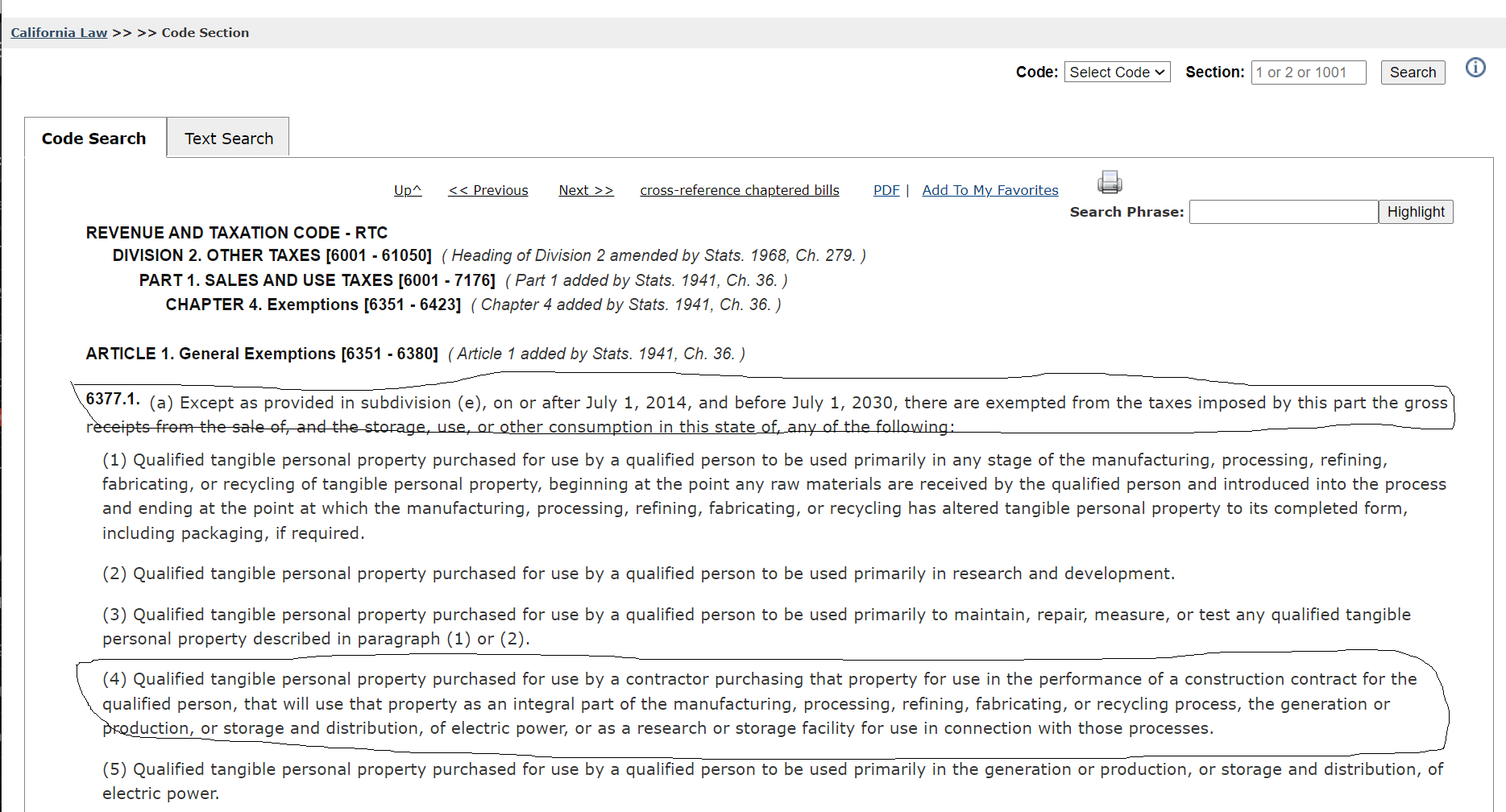

SoCal resident here. So i read in the Cali Revenue & Taxation Code, CA RTC that all solar related products are currently excluded from sales tax until July 1, 2030. This is under Art. 1, Code 6377.1, subsection (a)4. See attached screen shot. I asked the Project Advisor and he said, yeah we still gonna charge sales tax on some of the products, don't really care what Ca tax code says. Has anyone experienced this issue? I'm about to sign up for a 4.8kWh system and was wondering if anyone is aware of this sales tax exclusion for CA.

Here's the link to the tax code: Codes Display Text.

SoCal resident here. So i read in the Cali Revenue & Taxation Code, CA RTC that all solar related products are currently excluded from sales tax until July 1, 2030. This is under Art. 1, Code 6377.1, subsection (a)4. See attached screen shot. I asked the Project Advisor and he said, yeah we still gonna charge sales tax on some of the products, don't really care what Ca tax code says. Has anyone experienced this issue? I'm about to sign up for a 4.8kWh system and was wondering if anyone is aware of this sales tax exclusion for CA.

Here's the link to the tax code: Codes Display Text.

Based on this article battery storage might qualify for the 30% tax credit if the batteries are charged via renewable energies.So, what is the status on getting a itc writeoff if one adds batteries?

If installed in 2022 does one get a 30% writeoff?

Can You Use The Investment Tax Credit (ITC) For Battery Storage? (IRA UPDATE)

The Inflation Reduction Act answered the question of whether the Investment Tax Credit (ITC) can be used for storage: Yes it can.

I didn't verify anything in the article. So take it for what it is.

TheTalkingMule

Distributed Energy Enthusiast

Don’t worry, in almost all cases the business selling the product captures the value of these broadly available public subsidy incentives. If the ITC goes up, pricing goes up. The customer rarely sees a significant net benefit.

This is generally true. When incentives go up, especially state incentives, all the marketing operators and sales teams flock to that region and cost go up. Sales cost tends to absorb most of the incentive and homeowners see next to nothing.

Tesla does something similar, but any increase from them likely just goes to the bottom line since there are no sales teams for Tesla. Could be a very good thing for scaling solar both at Tesla and market-wide.

I checked an Illinois address for standard solar panels, a state with massive subsidies, and Tesla was quoting $2.47/Watt. PA has no subsidies and is quoting $2.31/Watt.

I'm fine with this since the variance isn't due to an increase in sales effort or cost. When sales effort goes up trying to capture these incentives, all it does is create more noise and homeowner confusion.

Sales cost in residential solar is a $2.5B business annually. Just sales. That's why no solar installers actually make any money. With Tesla, any incremental price hike goes to the bottom line, not sales teams.

silverstar336

New Member

Hi, I am in the process of having a 12kW solar system + 4 PWs installed at the beginning of December, with all required inspections completed by Dec 20th but PTO will most likely be done in January. Can I claim the 30% Solar tax credit for tax year 2022? Thanks!

Similar threads

- Sticky

- Replies

- 387

- Views

- 21K

- Replies

- 3

- Views

- 414