A 'kind of advertising': Tesla Model 3 picked for 'The Price is Right’s' iconic Dream Car Week giveaway

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

EVNow

Well-Known Member

How many of the 180M are not held by long term investors ?"3/4 of shares are sold short right now" - where did you get that number? my estimate is around 40 million shares short, total number of shares is close to 180 million.

It's not boxing were you avoid a strong opponent.If multiple players get to the robotaxi stage around the same time, we may see them introduce the service in different cities until competing headon becomes necessary. All this will take years to play out.

If Tesla has California, be sure someone will be happy to ride on their success and undercut Tesla (which should be easy) for ride costs. At first Tesla will not have whole lot of vehicles, others may get a nice fleet going very quickly. No need to stick to one luxury brand. Just make as many brands and models join the fleet, even convert existing cars.

Link to the official Weibo account:Tesla teases an image on Weibo site in China about an announcement for the Chinese market. I will not post a link as I could not find one other than the FredL one and I refuse to give him 'clicks'.

微博

(weirdly I couldn't figure out how to link to an individual weibo...)

Tesla China already have Model Y, Roadster, and M3 SR+, but it seems they don't have Raven S & X yet, so this announcement could be for that, please correct me if I'm wrong.

Huskyf

Member

Link to the official Weibo account:

微博

(weirdly I couldn't figure out how to link to an individual weibo...)

Tesla China already have Model Y, Roadster, and M3 SR+, but it seems they don't have Raven S & X yet, so this announcement could be for that, please correct me if I'm wrong.

Sorry what is "Raven" ?

Sorry what is "Raven" ?

The name given for this latest S/X drivetrain/charging upgrades.

Here is an idea that someone should tweet out to Elon or Zach.

Tesla should very seriously consider cross listing it's shares in Hong Kong. This has been done in the past by a handful of firms, but I'll get to this further below. The basic idea is once listed in HK, the shares become accessible to mainland Chinese investors.

This plan has many advantages. China is a huge market and is shaping up to be the manufacturing base of Tesla for potentially all of Asia if not more. The government did a huge favor by letting Tesla own 100% of their factory. It's only fair that mainland investors get to put their $s or RMBs in this opportunity. So this will:

Tesla would not be the first company to do it. Coach, the handbag maker did this to much fanfare about 8 years ago.

- Let Tesla widen it's shareholder base. Having concentrated ownership is not healthy. Just look at how TRP and fidelity dumped their shares, because a new manager didn't like the story

- Greater Chinese ownership will immunize Tesla from trade wars. China wants to end it's oil dependence and clean up air. So the government already loves Tesla. This will reduce any further reason for China to tilt the scales in favor of Chinese competitors like the Germans are doing

- China will also be a huge R&D base for Tesla with a lot of white-collar workers who like to get stock based compensation. This opens up an opportunity to do that

Coach eyes dual listing in Hong Kong - Reuters

Then they ran into, well, nowhere. They had very little liquidity, because they did not do a HK IPO and simply listed their shares in HK. Without a wide base, the liquidity eroded. I don't think this will be a problem for Tesla, as other tech listings have gone on to do well. Especially if they did an IPO in HK. Something tells me Tesla will not be a dull low volume stock.

In any case, if Tesla is going to produce in the order of a few million cars in the next 3-5 years, I see very few ways of doing this with organic cash generation. I think it's a no brainier for them to do an HK IPO later this year or early next year after a couple of good quarters paint a better picture of what they can do.

The more I think about it, the more it feels like they should have done it last year.

Ok, I tweeted this at Elon and copied Cathie and Tasha from ARK. Please give it some love and retweet if you think a second listing in Hong Kong is a good idea.

Generalenthu on Twitter

Last edited:

EVNow

Well-Known Member

Depends on what they need for FSD.It's not boxing were you avoid a strong opponent.

If Tesla has California, be sure someone will be happy to ride on their success and undercut Tesla (which should be easy) for ride costs. At first Tesla will not have whole lot of vehicles, others may get a nice fleet going very quickly. No need to stick to one luxury brand. Just make as many brands and models join the fleet, even convert existing cars.

For eg., if they need full redundancy it will be difficult to convert existing cars. They would most probably get cars directly from the manufacturer and convert slowly. I doubt they can convert 5k/wk.

Yes, they can get a manufacturer to mass produce a lot of FSD cars - but they will take atleast couple of years from design to production, at least.

Lets say Tesla and couple of others get to FSD in year 2023. Tesla will be producing 20k / wk - with an existing fleet of 3 Million cars. Others will be at various stages of getting their FSD cars produced and not at 20k/wk unless they started designs etc in 2020. Besides, if they need Lidar, they will wait till inexpensive solid state Lidars are available before trying to mass produce them.

ps : It does look like the California Gold Rush, all over again.

Navin

Active Member

Don’t underestimate the importance of this Friday’s announcement in China. It’s a surprise as suggested but it’s going to be epic IMO.

Pras

Member

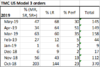

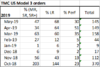

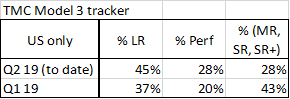

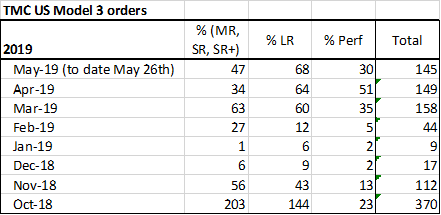

A few observations from TMC Model 3 tracker, US data only. Read the disclaimers about the TMC tracker data at the end of this post.

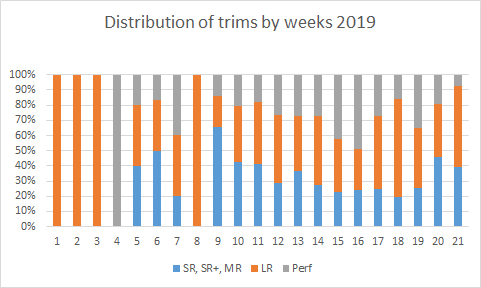

1) The mix of LR and Performance version remains healthy (Table 1, and chart 1), suggesting a good steady Model 3 demand in the US (and not related to any pent up demand), which is not just driven by newly introduced lower variant. Note that the real mix may be biased towards SR variant but the QoQ trend seems that the mix seems to hold up.

2) More and more the demand slowdown in Q1 is looking like a duo effect of seasonal dip and Q4 tax pull. See table 2, the # of cars on TMC tracker are back to stronger/steady number and it is not just driven by SR variant but all variants. Although there was net reduction in prices and AWD variant became much cheaper, it would be hard to suggest that this resulted in the dramatic recovery of demand.

Table 1:

If you see the Q2-19 till date US orders reflected on the tracker, the trim mix remain consistent (rather improved) toward higher price variants. The table shows aggregate numbers and the chart shows weekly trend. This aligns with Zach's comment that LR remains in good demand. Interestingly the Performance version remains very popular too.

Chart 1 (SR and SR+ was introduced in week 9)

Table 2

Disclaimer: this is US only data from the TMC tracker which may not represent the real data. The Canada mix is expected to be heavily in favor of SR+ variant. TMC tracker data is a very small representation and may have biases.

1) The mix of LR and Performance version remains healthy (Table 1, and chart 1), suggesting a good steady Model 3 demand in the US (and not related to any pent up demand), which is not just driven by newly introduced lower variant. Note that the real mix may be biased towards SR variant but the QoQ trend seems that the mix seems to hold up.

2) More and more the demand slowdown in Q1 is looking like a duo effect of seasonal dip and Q4 tax pull. See table 2, the # of cars on TMC tracker are back to stronger/steady number and it is not just driven by SR variant but all variants. Although there was net reduction in prices and AWD variant became much cheaper, it would be hard to suggest that this resulted in the dramatic recovery of demand.

Table 1:

If you see the Q2-19 till date US orders reflected on the tracker, the trim mix remain consistent (rather improved) toward higher price variants. The table shows aggregate numbers and the chart shows weekly trend. This aligns with Zach's comment that LR remains in good demand. Interestingly the Performance version remains very popular too.

Chart 1 (SR and SR+ was introduced in week 9)

Table 2

Disclaimer: this is US only data from the TMC tracker which may not represent the real data. The Canada mix is expected to be heavily in favor of SR+ variant. TMC tracker data is a very small representation and may have biases.

Attachments

Last edited:

At such production rates the market for ride sharing could be satisfied rather quickly. Especially if not the whole world is on board allowing a car to make a driver with a job redundant. A simple little law that every vehicle needs a licenced designated driver will ruin RoboTaxi and all competing initiatives.

All they do is try and replace one or more jobs per commercial vehicle on the road. Sure there are costs to be saved, but to use such a business model (pushing millions of low wage workers into unemployment, as would Tesla's production accomplish) to market the very pinnacle in automotive tech...seems a waste. And for now, it's actually a stretch.

When there are multiple FSD operations live, it will be a good time to still have a market of people who will actually drive their next car. Tesla seems ready to alienate all customers away from them.

All they do is try and replace one or more jobs per commercial vehicle on the road. Sure there are costs to be saved, but to use such a business model (pushing millions of low wage workers into unemployment, as would Tesla's production accomplish) to market the very pinnacle in automotive tech...seems a waste. And for now, it's actually a stretch.

When there are multiple FSD operations live, it will be a good time to still have a market of people who will actually drive their next car. Tesla seems ready to alienate all customers away from them.

Sorry I have to pour some cold water on this “30k per week at Giga 3” idea. I watch Giga 3 pretty closely but have never heard of anything about that 1.5 million per year number. The official figure is 500K per year.

“

上海超级工厂将为中国市场生产 Model 3 电动车和未来的新车型。工厂建成后,计划在初始阶段每周生产约3,000辆 Model 3 电动车,在完全投入运营后年产量将攀升至500,000辆纯电动整车(注:这一计划受包括监管部门审批以及供应链情况等当地因素的影响)。

”

I also remember Elon saying they were planning a max 500k capacity.

I think anything over that number is pure speculation, and likely not helpful. Unless I see any real sources of info.

SimplyThis

Member

Can someone please explain the difference between total amount of outstanding shares and the float?How many of the 180M are not held by long term investors ?

I get it that Elon doesn't want to sell his shares, so his shares are not part of the float.

But neither do I, and I presume that my shares are part of the float.

What makes my shares different from his?

When are shares not part of the float?

Thanks!

TradingInvest

Active Member

What's your reasoning that it's going to be epic? I'm not aware of anything in the pipeline. Usually if there is something surprising, people would be discussing about it months before hand.Don’t underestimate the importance of this Friday’s announcement in China. It’s a surprise as suggested but it’s going to be epic IMO.

Aww man... looks like it was a classic Countach too.Gas stations are dangerous. Time to short the oil companies. VIDEO: Lamborghini and SUV go up in flames at NC Walmart gas station

I'm going to guess it's just something to announce the exterior structure of GF3 is complete.What's your reasoning that it's going to be epic? I'm not aware of anything in the pipeline. Usually if there is something surprising, people would be discussing about it months before hand.

JohnDinger

Member

The 80% limit on superchargers is quite frustrating. Can't Tesla have a more elegant solution?

For example, if there are 8 stalls and only 5 cars nearby, just remove the limit.

For example, if there are 8 stalls and only 5 cars nearby, just remove the limit.

I'm going to guess it's just something to announce the exterior structure of GF3 is complete.

That's what I was thinking.

frequencydip

Sig 100 - #52

Shares that are not part of the float can’t easily be traded they are generally restricted, owned by the company as part of employee compensation plans, owned by insiders etc. your shares are part of the float because technically you can sell the shares at any point without delay when the market is open. It does not matter what your intent is just if you can.Can someone please explain the difference between total amount of outstanding shares and the float?

I get it that Elon doesn't want to sell his shares, so his shares are not part of the float.

But neither do I, and I presume that my shares are part of the float.

What makes my shares different from his?

When are shares not part of the float?

Thanks!

Yes, happened to me yesterday. I was at the Manhattan Beach supercharger, got the message that charging stopped at 80%. But I wanted a full charge, I was going to drive my family around before putting them on a plane back to Oz and then driving home to San Diego. So I just adjusted the limit to 100% and it started again.That's what I was thinking.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M