Not even remotely. I'm over 65, no medical problems, and Medicare plus D plus G costs about $9K per year for the two of us. There are some deductibles.anyways, my point was that in the US it’s similar for people over 65.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Coronavirus

- Thread starter Wenche

- Start date

KSilver2000

Active Member

I apologize. It was my understanding that. Canada pays all medical but not all drugs and that a lot of people get private insurance for drugs either through work or on their own.

I stand corrected.

Please just stop.

You have no idea how Medicaid and Medicare works.

cusetownusa

2022 LR5 MSM/Bl | 19"

Please just stop.

You have no idea how Medicaid and Medicare works.

Ok. My apologies

cusetownusa

2022 LR5 MSM/Bl | 19"

Not even remotely. I'm over 65, no medical problems, and Medicare plus D plus G costs about $9K per year for the two of us. There are some deductibles.

yikes. That’s a lot.

@aubreymcfato2 weeks ago Italy had 20 cases.

Mar-6 : Lombardy's welfare minister: "every day we get 200 new people to the ER in critical conditions, which means every day we need to find 200 more hospital beds. […] the virus is spreading at an exceptional speed, faster than our predictions and than the data we got from China."

How is it working as a doctor in Italy now ? Warning : Its hard to read.

Testimony of a surgeon working in Bergamo, in the heart of Italy's coronavirus outbreak [translation in comments] : Coronavirus

can you confirm the authenticity of this post. Is it based in this?

Medico Humanitas su Facebook: «Situazione drammatica, altro che normale influenza»

Last edited:

Causalien

Prime 8 ball Oracle

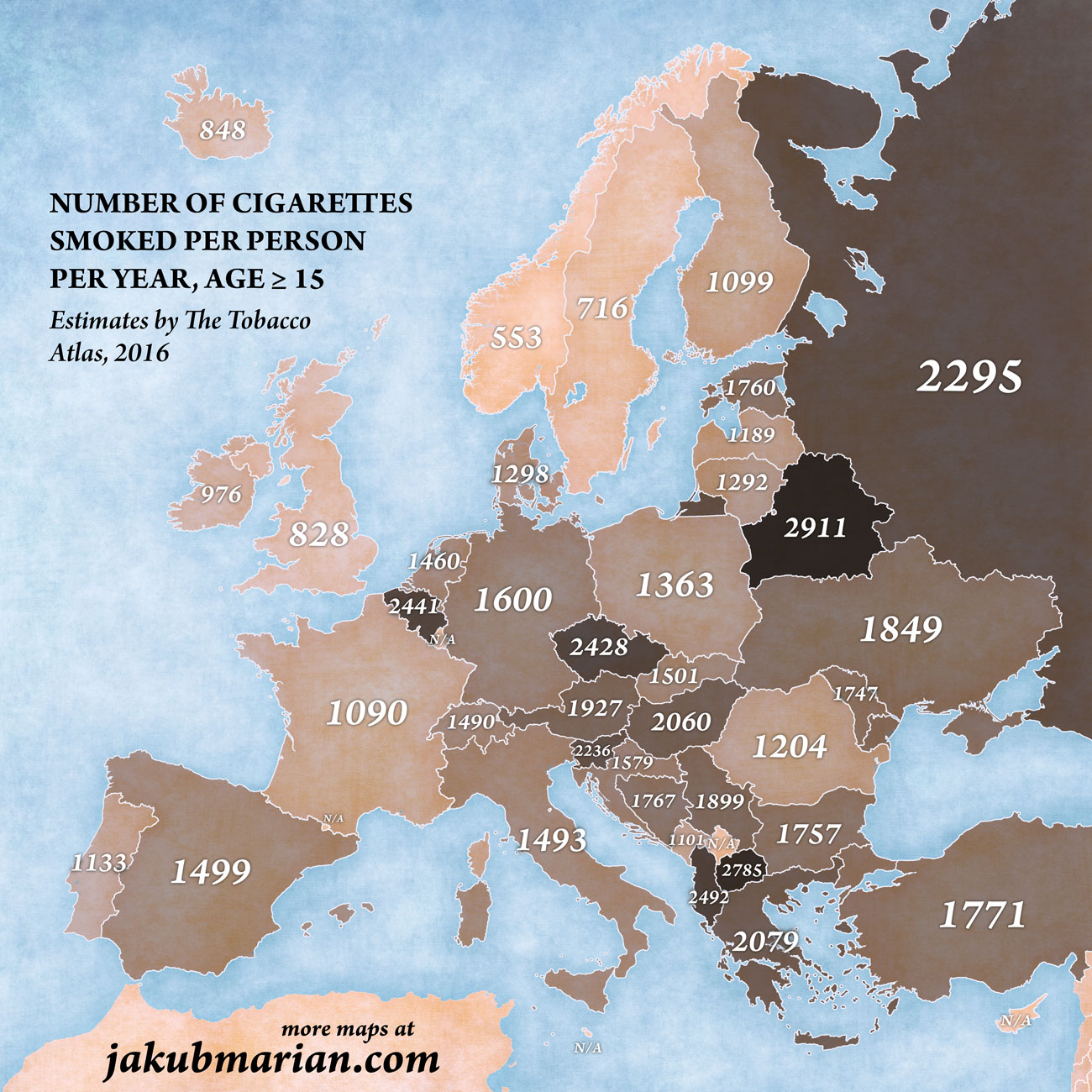

This made me curious. It appears there two ways to measure this - percentage of adults who smoke, and average consumption of cigarettes per capita. Germany lands lower than France and Spain on the former metric, but higher on the latter metric. Here's a graphic of the latter.

That could explain it. Yet smoking more should lead to higher death, but we are not seeing that.

From my own travelling experience, I vividly remembered being annoyed by cigarette smoke everywhere in Germany, not so in France and spain. And some tales of german girls who cannot find a german guy that doesn't smoke.

@aubreymcfato

can you confirm the authenticity of this post. Is it based in this?

Medico Humanitas su Facebook: «Situazione drammatica, altro che normale influenza»

Yes, I can confirm it is a good translation of the article from Il Corriere.

Thank you, and apparently it is also confirmed that the original FB poster is a real person, who works as a doctor in the local hospital?Yes, I can confirm it is a good translation of the article from Il Corriere.

Thank you, and apparently it is also confirmed that the original FB poster is a real person, who works as a doctor in the local hospital?

Yes, that is the case. He is a surgeon there.

Of course, the situation may not be as dramatic in other hospitals. It is difficult to get clear information from the Italian context. But clearly the health system is under significant stress in some areas of the Country.

First of all, I’m disappointed in Musks ignorance on the topic and tweeting about it. Here’s a great thread explaining the potential of the situation Jeremy WASH YOUR DAMN HANDS Konyndyk on Twitter

KSilver2000

Active Member

In that memo from the Italian doctor, he mentions what is common among the hospitalized: bilateral interstitial pneumonia. I will add that it is generally consolidated to the lower lobes with this virus.

Recent studies from Chinese doctors show that follow up CT scans could be helpful to track progression even in patients with pneumonia who made a full recovery.

So, if you acquire Cov-pneumonia, you’ll either end up dead or with scarring in lungs.

Recent studies from Chinese doctors show that follow up CT scans could be helpful to track progression even in patients with pneumonia who made a full recovery.

So, if you acquire Cov-pneumonia, you’ll either end up dead or with scarring in lungs.

UnknownSoldier

Unknown Member

Gov. Inslee says ‘mandatory measures’ under consideration to combat coronavirus in Washington

Where are all the people who keep trying to tell us the virus is nothing and just media incited panic? Who's going to demand to see my private user profile now to try and counter this news today my area is considering a quarantine?

Where are all the people who keep trying to tell us the virus is nothing and just media incited panic? Who's going to demand to see my private user profile now to try and counter this news today my area is considering a quarantine?

adiggs

Well-Known Member

Short version: I'm looking for different points of view and opinions on a portfolio shift I'm contemplating; namely to move all the money in market tracking funds into cash for (guess of the day) 3-9 months until I see evidence that the US response is focused on the medical crisis, rather than the potential political and/or economic crisis.

I plan to hold Tesla through what's coming - I think there's a non-zero chance that Tesla becomes one of the few safe havens during the crash, or it's one of the first to recover after the crash, and I don't want to try and time or miss that.

Longer version.

I've been thinking about some changes to my family savings / retirement portfolio, and I would like to get some other points of view. Anybody with an opinion, please speak up (I will make my own decisions, and be responsible for them ).

).

I find myself increasingly of the opinion that whether the virus is going to be a big deal medically or not, the next 3-6 months (maybe more, maybe a bit less) are going to be disastrous for the market. Both stock and bond markets, as companies in many sectors see demand postponed, and some cases lost permanently. At the center of this is the observation that the US government is so far approaching this medical problem as fundamentally a political problem (gotta keep the economy strong to get Trump reelected), and as a result they are creating just about as bad of a response to the medical problem as is possible. (Which will also, ultimately, make for as bad of an economic and political result as possible too, but I don't think they see it that way yet).

To the point that given any particular problem that arises and any particular set of reactions, I'm growing increasingly confident that the US government will choose the one that will create maximum longer term pain, but that might create the illusion short term that things are ok / getting better.

(The latter two paragraphs are my opinion of what I am observing of the US response thus far, and thus the basis for the investment approach that comes next).

Since I'm now expecting at least a recession, with much better odds for being worse (depression, or worse) than not (missing the recession), and with uneven effects on companies (some will be little affected, while others will be going bankrupt and wiping out their shareholders), my thinking is to exit the stock and bond market with a lot of our portfolio and move into cash. The strategy here is that I'm strongly disinterested in trying to short the market (in order to make money on the way down) - mostly because I've got no experience with that and I don't want to try and learn on the fly.

So I'm not going to short.

I figure in cash, there are three possible futures over the next 3-9 months (with ongoing evaluation as we go).

The market goes up, and we miss out on that move up because we're out of the market.

The market goes sideways, and we end up where we would have been anyway (most of this piece of the portfolio is an SP 500 index fund - just tracking the market).

The market goes down (and I have visions of it being a very BIG down move as possibilities from the virus turns into reality), and we stay flat by being in cash. (And I plan to go all the way into cash - some sort of stable value fund where I sort of expect to see it's interest rate go to 0%). As a result of being in cash, we stay flat while the market crumbles, and at some point in the future, we might even get back in and wind up owning more than we do now. The primary goal though is just to avoid the big down turn I expect to happen.

The apparent "don't test, don't tell" virus response strategy in the US looks like a good way to see a very large body count in a month or two. And to see other countries in the world close their borders to travelers from the US.

Additional conversation with somebody else has helped me clarify what I'm trying to do, and the triggers. I am fundamentally a very long term buy and hold investor. I held INTC and market tracking funds through '99/'00 without even a thought of rearranging the deck chairs. I held through the '08 crash, again with no thought of making changes. That I am even contemplating not holding through what I see coming is itself noteworthy.

In my case, the objective isn't to time the market - sell the market high, and buy it again lower. The objective is to mostly exit the market ahead of what I see coming in the US - a breakdown in social trust, cohesion, and even our bedrock belief in the country. So far, I see the response as "do whatever needs to be done to project 'all is well' and keep people happy in the short term, even if that creates long term pain". Keep the economy healthy now, and later will take care of itself.

So my thinking is that going most all cash (portfolio would end up being some real estate, TSLA, and the rest cash) now while I see the US response being botched. Later when I see the response is getting real and appropriate to the problem (no longer on track to break social trush / cohesion), then I will reenter the market and ride it up or down from there. I'm not thinking I'll wait for this to pass - I'm waiting for evidence that the country is done with managing perception, and is focused on managing a medical crisis. And I am definitely not trying to time a bottom to the market (my perception and timing on such things is an excellent negative indicator).

I might get back in at the bottom of the market, it might be flat with the market today - it might even be with the market higher than today, but I consider the 3rd possibility to be vanishingly small. It's the first possibility, and visions of this being Great Depression scale (90% drop in the stock market from peak to valley - S&P 500 at 2500 instead of 25000 anybody?) that has me thinking this way.

A strongly related question - anything better than cash you can think of to shift into?

I plan to hold Tesla through what's coming - I think there's a non-zero chance that Tesla becomes one of the few safe havens during the crash, or it's one of the first to recover after the crash, and I don't want to try and time or miss that.

Longer version.

I've been thinking about some changes to my family savings / retirement portfolio, and I would like to get some other points of view. Anybody with an opinion, please speak up (I will make my own decisions, and be responsible for them

I find myself increasingly of the opinion that whether the virus is going to be a big deal medically or not, the next 3-6 months (maybe more, maybe a bit less) are going to be disastrous for the market. Both stock and bond markets, as companies in many sectors see demand postponed, and some cases lost permanently. At the center of this is the observation that the US government is so far approaching this medical problem as fundamentally a political problem (gotta keep the economy strong to get Trump reelected), and as a result they are creating just about as bad of a response to the medical problem as is possible. (Which will also, ultimately, make for as bad of an economic and political result as possible too, but I don't think they see it that way yet).

To the point that given any particular problem that arises and any particular set of reactions, I'm growing increasingly confident that the US government will choose the one that will create maximum longer term pain, but that might create the illusion short term that things are ok / getting better.

(The latter two paragraphs are my opinion of what I am observing of the US response thus far, and thus the basis for the investment approach that comes next).

Since I'm now expecting at least a recession, with much better odds for being worse (depression, or worse) than not (missing the recession), and with uneven effects on companies (some will be little affected, while others will be going bankrupt and wiping out their shareholders), my thinking is to exit the stock and bond market with a lot of our portfolio and move into cash. The strategy here is that I'm strongly disinterested in trying to short the market (in order to make money on the way down) - mostly because I've got no experience with that and I don't want to try and learn on the fly.

So I'm not going to short.

I figure in cash, there are three possible futures over the next 3-9 months (with ongoing evaluation as we go).

The market goes up, and we miss out on that move up because we're out of the market.

The market goes sideways, and we end up where we would have been anyway (most of this piece of the portfolio is an SP 500 index fund - just tracking the market).

The market goes down (and I have visions of it being a very BIG down move as possibilities from the virus turns into reality), and we stay flat by being in cash. (And I plan to go all the way into cash - some sort of stable value fund where I sort of expect to see it's interest rate go to 0%). As a result of being in cash, we stay flat while the market crumbles, and at some point in the future, we might even get back in and wind up owning more than we do now. The primary goal though is just to avoid the big down turn I expect to happen.

The apparent "don't test, don't tell" virus response strategy in the US looks like a good way to see a very large body count in a month or two. And to see other countries in the world close their borders to travelers from the US.

Additional conversation with somebody else has helped me clarify what I'm trying to do, and the triggers. I am fundamentally a very long term buy and hold investor. I held INTC and market tracking funds through '99/'00 without even a thought of rearranging the deck chairs. I held through the '08 crash, again with no thought of making changes. That I am even contemplating not holding through what I see coming is itself noteworthy.

In my case, the objective isn't to time the market - sell the market high, and buy it again lower. The objective is to mostly exit the market ahead of what I see coming in the US - a breakdown in social trust, cohesion, and even our bedrock belief in the country. So far, I see the response as "do whatever needs to be done to project 'all is well' and keep people happy in the short term, even if that creates long term pain". Keep the economy healthy now, and later will take care of itself.

So my thinking is that going most all cash (portfolio would end up being some real estate, TSLA, and the rest cash) now while I see the US response being botched. Later when I see the response is getting real and appropriate to the problem (no longer on track to break social trush / cohesion), then I will reenter the market and ride it up or down from there. I'm not thinking I'll wait for this to pass - I'm waiting for evidence that the country is done with managing perception, and is focused on managing a medical crisis. And I am definitely not trying to time a bottom to the market (my perception and timing on such things is an excellent negative indicator).

I might get back in at the bottom of the market, it might be flat with the market today - it might even be with the market higher than today, but I consider the 3rd possibility to be vanishingly small. It's the first possibility, and visions of this being Great Depression scale (90% drop in the stock market from peak to valley - S&P 500 at 2500 instead of 25000 anybody?) that has me thinking this way.

A strongly related question - anything better than cash you can think of to shift into?

Causalien

Prime 8 ball Oracle

Gov. Inslee says ‘mandatory measures’ under consideration to combat coronavirus in Washington

Where are all the people who keep trying to tell us the virus is nothing and just media incited panic? Who's going to demand to see my private user profile now to try and counter this news today my area is considering a quarantine?

I personally think everyone who ever said "it's just a flu bro" should be banned for a month. But even our god Elon is implying that. So there goes my rage.

Dr. J

Active Member

I'll take a stab at that.Short version: I'm looking for different points of view and opinions on a portfolio shift I'm contemplating; namely to move all the money in market tracking funds into cash for (guess of the day) 3-9 months until I see evidence that the US response is focused on the medical crisis, rather than the potential political and/or economic crisis.

I largely agree with your analysis of the political response to the virus in the US. However, even though it looks like an impending train wreck of Olympian proportions, there seems a decent sized chance that we will get lucky in spite of ourselves. It's hard, perhaps impossible, for me to translate (my) political viewpoints into constructive investing strategies. My opinions get in the way.

AFAIK, the Great Depression is the only time period in the last 100 years where getting and staying out of risky assets (for more than say, 3-5 years) was the right move. It could happen again, but it's unlikely. Probably not the model to trade on.

I'm a committed buy-and-hold-forever investor, but eventually I'll have to liquidate (some) assets in retirement. My wife's risk tolerance is lower than mine, so last weekend we decided to do the following (which is not a recommendation/advice) to protect the value of the portfolio during this crisis:

Prior portfolio: 4% cash, 4% gold, 2% other (REITs, etc.), 45% bonds (including long term Treasuries, bond index funds, etc.), 45% stocks (roughly equal large-cap, mid-cap, small-cap, emerging markets). A small TSLA position is in the stock allocation, and I left it alone.

Change 6 days ago: Moved 1/3 of stock portfolio (primarily US small-cap and mid-cap index funds) to cash. So now it's 19% cash, 30% stocks, everything else the same.

Result: This past week, it worked like a charm. The long-term Treasuries gained nearly enough to offset stock losses, and bonds and gold were pretty favorable. Of course the problem now is Treasuries in particular appear extremely over-valued. But presumably if they (the safest haven except maybe gold) decline in value, it's probable stocks are increasing in value. Kind of washes out.

My goal is to preserve portfolio value and sleep better at night without giving up on being a long-term investor. We will see if it works.

Thekiwi

Active Member

I personally think everyone who ever said "it's just a flu bro" should be banned for a month. But even our god Elon is implying that. So there goes my rage.

Just waiting for Elon to announce he's going to build a nano-submarine to try and take on the coronavirus at the molecular level, fantastic voyage style.

linux-works

Active Member

What's with the toilet paper hoarding?

I go to Costco this morning and the clerk asked me "No toilet paper?"

just tell him "I'm all set; I have my sea shells; thanks for asking"

Causalien

Prime 8 ball Oracle

Just waiting for Elon to announce he's going to build a nano-submarine to try and take on the coronavirus at the molecular level, fantastic voyage style.

"Everybody thinks it's just a flu until they get coughed at in the mouth"

EVNow

Well-Known Member

This is a good read. The person got infected by community transmission and got tested only by enrolling in the UW flu study.

Beginning to feel the "outbreak in Seattle" is mainly because of Seattle flu study. If other cities had similar studies, we'd be finding more cases in them too.

Public Facebook Post from MS employee who was infected (name redacted) : CoronavirusWA

Beginning to feel the "outbreak in Seattle" is mainly because of Seattle flu study. If other cities had similar studies, we'd be finding more cases in them too.

Public Facebook Post from MS employee who was infected (name redacted) : CoronavirusWA

I am pretty sure I can pinpoint the day I became infected—Tuesday 2/25 I went to lunch with 7 people at a restaurant and by that Friday 4 of us had symptoms (fever, etc). There was no physical contact such as hand shaking or hugging, only sitting at a table together for an hour. Similarly I had a work meeting with 3 people on Thursday (the day before I showed symptoms) and 2 of them got mild fevers within days. Again, no physical contact, just sitting at a table together. This tells you how quickly it transmits. Some people develop only a mild fever and that’s it.

Similar threads

- Replies

- 81

- Views

- 5K

- Replies

- 2

- Views

- 925

- Replies

- 165

- Views

- 25K

- Replies

- 85

- Views

- 9K

- Replies

- 23

- Views

- 5K

B